ICICI Bank 2003 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F96

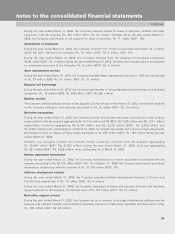

During the year ended March 31, 2002, the Company provided telephone banking call-centre services and transaction

processing services for the credit card operations of the acquiree, and earned fees of Rs.149million (2001: Rs. 99 million).

Transfer of financial assets

During the year ended March 31, 2002, the Company transferred loans in pass-through securitization transactions,

where the beneficial interests were purchased by the acquiree, of Rs. 11,152 million (2001:Rs. 438million). Gains

of Rs. 98 million (2001: Rs. 50million) was recorded on the sale. Subsequently, due to a change in the status of

the qualifying special purpose entity used in the transactions, the Company regained control of the assets sold. As

at March 31, 2002, obligations of Rs. 3,526 million (2001: Nil) relating to such repurchases are reflected as a

component of the other borrowings.

Share transfer activities

During the year ended March31, 2002. the Company provided share transfer services and dematerialization services

to the acquiree and earned fees of Rs. 3million (2001:Rs. 8 million).

Other transactions

During the year ended March 31, 2002, the Company undertook a corporate brand advertising campaign, out of

which an amount of Rs. 29million (2001: Rs. 15 million) has been recovered from the acquiree.

Employee loans

The Company has advanced housing, vehicle and general purpose loans to employees, bearing interest ranging from

2.5% to 6%. The tenure of these loans range from 5 years to 25 years. The loans are generally secured by the assets

acquired by the employees. Employee loan balances outstanding as of March 31, 2003, of Rs. 2,273million

(2002: Rs. 949million) are included in other assets.

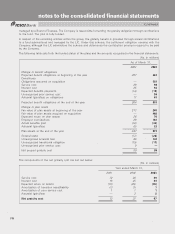

Related party balances

The following balances payable to/receivable from related parties are included in the balance sheet:

(Rs. in millions)

As of March 31,

2002 2003

Cash and cash equivalents 4,360 —

Loans 209 22

Other assets 1,269 2,549

Deposits —440

Other liabilities 24 3

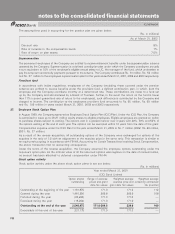

31. Estimated fair value of financial instruments

The Company’s financial instruments include financial assets and liabilities recorded on the balance sheet, as well

as off-balance sheet instruments such as foreign exchange and derivative contracts.

Fair value estimates are generally subjective in nature, and are made as of a specific point in time based on the

characteristics of the financial instruments and relevant market information. Where available, quoted market prices

are used. In other cases, fair values are based on estimates using present value or other valuation techniques. These

techniques involve uncertainties and are significantly affected by the assumptions used and judgments made regarding

risk characteristics of various financial instruments, discount rates, estimates of future cash flows, future expected

loss experience and other factors. Changes in assumptions could significantly affect these estimates and the

resulting fair values. Derived fair value estimates cannot necessarily be substantiated by comparison to independent

markets and, in many cases, could not be realized in an immediate sale of the instruments.

Continued

notes to the consolidated financial statements