ICICI Bank 2003 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F26

cash flow statement

for the year ended March 31, 2003

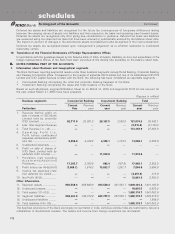

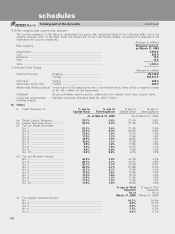

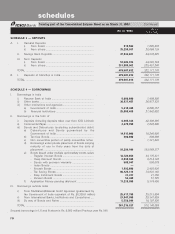

SCHEDULE 19 (Rs. in ‘000)

Particulars 2002-2003 2001-2002

CASH FLOW FROM OPERATING ACTIVITIES

Net profit before taxes ........................................................................................ 7,803,872 2,897,990

Adjustment for :

Depreciation on fixed assets .............................................................................. 5,059,415 640,913

Net (appreciation)/depreciation on investments ................................................. 3,094,311 (157,000)

Provision in respect of non-performing assets (including prudential provision

on standard assets) ............................................................................................. 14,749,848 2,682,900

Provision for contingencies & others .................................................................. 63,900 27,000

Loss on sale of fixed assets ............................................................................... 65,038 627

30,836,384 6,092,430

Adjustments for :

(Increase) / Decrease in Investments ................................................................. 1,193,485 (153,127,918)

(Increase) / Decrease in Advances ..................................................................... (74,578,831) 23,033,299

Increase / (Decrease) in Borrowings .................................................................. (149,162,389) (14,704,085)

Increase / (Decrease) in Deposits ....................................................................... 160,841,952 157,069,033

(Increase) / Decrease in Other assets ................................................................ (24,500,144) (5,070,756)

Increase / (Decrease) in Other liabilities and provisions ................................... 3,266,612 10,395,316

(82,939,315) 17,594,889

Payment of taxes (net) ........................................................................................ (6,438,190) (1,275,280)

Net cash generated from operating activities ................................................ (A) (58,541,121) 22,412,039

CASH FLOW FROM INVESTING ACTIVITIES

Purchase of fixed assets ..................................................................................... (4,516,874) (244,184)

Proceeds from sale of fixed assets ................................................................... 102,090 7,307

Net cash generated from investing activities ................................................. (B) (4,414,784) (236,877)

CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from issue of share capital ................................................................ 315

Repayment of subordinated debt ....................................................................... (17,882) 2,285,354

Dividend and dividend tax paid .......................................................................... —(971,340)

Net cash generated from financing activities ................................................. (C) (17,567) 1,314,014

Cash and cash equivalents on amalgamation ................................................ (D) — 68,437,439

Net increase/(decrease) in cash and cash equivalents ................................. (A)+(B)+(C)+(D) (62,973,472) 91,926,615

Cash and cash equivalents as at April 1st ..................................................... 127,863,499 35,936,884

Cash and cash equivalents as at March 31st ................................................ 64,890,027 127,863,499

Cash and Cash equivalents represent ‘Cash and balance with Reserve Bank of India’ and ‘Balances with banks and money at call and short notice’

For and on behalf of the Board of Directors

N. VAGHUL K. V. KAMATH

Chairman Managing Director & CEO

LALITA D. GUPTE KALPANA MORPARIA

Joint Managing Director Executive Director

NACHIKET MOR CHANDA D. KOCHHAR

Executive Director Executive Director

S. MUKHERJI BALAJI SWAMINATHAN

Executive Director Senior General Manager

JYOTIN MEHTA N.S. KANNAN G. VENKATAKRISHNAN

Place : Mumbai General Manager & Chief Financial Officer & General Manager -

Date : April 25, 2003 Company Secretary Treasurer Accounting & Taxation Group

AUDITORS’ CERTIFICATE

We have verified the attached cash flow statement of ICICI BANK LIMITED which has been compiled from and is based on the audited

financial statements for the years ended March 31, 2003 and March 31, 2002. To the best of our knowledge and belief and according

to the information and explanations given to us, it has been prepared pursuant to the requirements of Listing Agreements entered

into by ICICI Bank with stock exchanges.

For N. M. RAIJI & CO. For S.R. BATLIBOI & CO.

Chartered Accountants Chartered Accountants

JAYESH M. GANDHI per VIREN H. MEHTA

Partner a Partner

Place : Mumbai

Date : April 25, 2003