ICICI Bank 2003 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

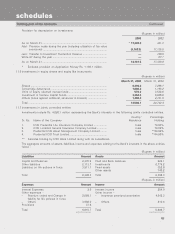

F25

forming part of the Accounts Continued

schedules

b. Exchange Fluctuation

Exchange Fluctuation aggregating Rs. 923.6 million, which arises on account of Rupee-tying Agreements with the

Government of India, is held in “Exchange Fluctuation Suspense with Government Account” pending adjustment

at maturity on receipt of payments from the Government for repayments to foreign lenders.

c. Swap suspense (net)

Swap Suspense (net) aggregating Rs. 128.7 million (debit), which arises out of conversion of foreign currency

swaps, is held in “Swap Suspense Account” and will be reversed at conclusion of swap transactions with swap

counter parties.

d. Exchange Risk Administration Scheme

Under the Exchange Risk Administration Scheme (“ERAS”), the Government of India has agreed to extend support

to the Exchange Risk Administration Fund (“ERAF”), when it is in deficit and recoup its contribution in the event

of surplus. The Bank can claim from the positive balance in the ERAF account maintained by the Industrial

Development Bank of India (IDBI) to the extent of the deficit in the ERAS Exchange Fluctuation Account. If the

balance in the ERAF account with IDBI is insufficient, a claim will be made on the Government of India through

IDBI.

The Government of India has foreclosed the scheme vide their letter F. N. 6 (3)/2002-IF.1 dated January 28, 2003.

The total amount payable to the Government of India under the scheme amounting to Rs. 493.6 million has been

included in Other Liabilities.

e. Profit on sale of shares in ICICI Bank Limited is in respect of the shares held by erstwhile ICICI Limited and

transferred to a Board of Trustees as per the scheme of amalgamation.

13. Comparative figures

Consequent on the merger of ICICI, I PFS and I CAPS with the Bank effective March 30, 2002, current year figures

are not comparable with those of the previous year. Figures of the previous year have been regrouped to conform to

the current year’s presentation.

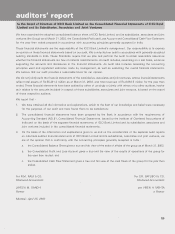

Signatures to Schedules 1 to 19

For and on behalf of the Board of Directors

N. VAGHUL K. V. KAMATH

Chairman Managing Director & CEO

LALITA D. GUPTE KALPANA MORPARIA

Joint Managing Director Executive Director

NACHIKET MOR CHANDA D. KOCHHAR

Executive Director Executive Director

S. MUKHERJI BALAJI SWAMINATHAN

Executive Director Senior General Manager

JYOTIN MEHTA N. S. KANNAN G. VENKATAKRISHNAN

Place : Mumbai General Manager & Chief Financial Officer & General Manager -

Date : April 25, 2003 Company Secretary Treasurer Accounting & Taxation Group