ICICI Bank 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Directors’ Report

Queries relating to the operational and financial performance of ICICI Bank may be addressed to:

Rakesh Jha / Anindya Banerjee

ICICI Bank Limited

ICICI Bank Towers, Bandra-Kurla Complex, Mumbai 400 051

Information on Shareholding

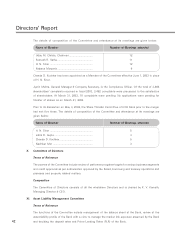

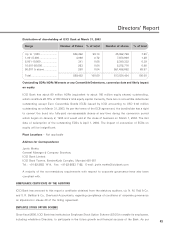

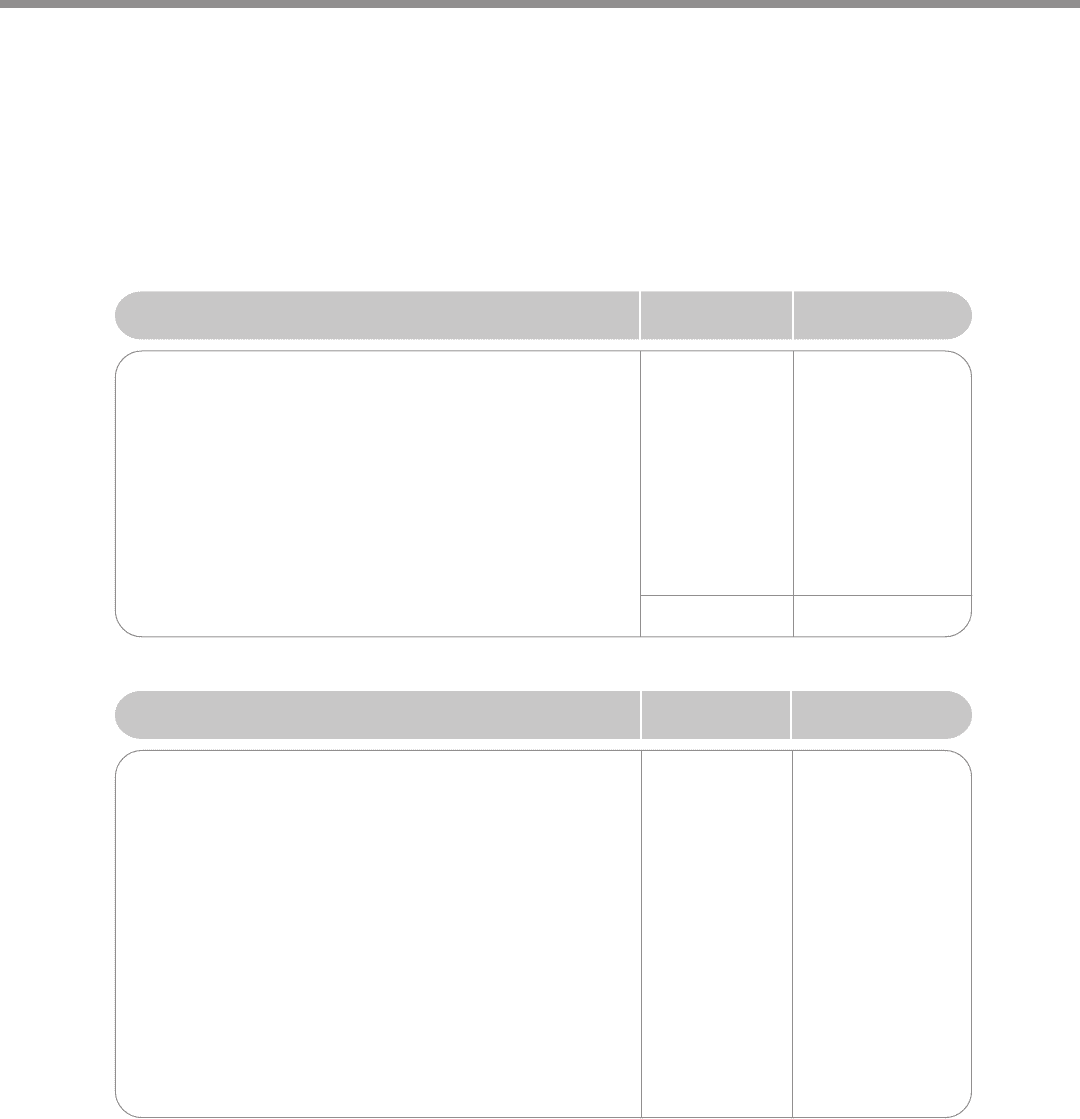

Shareholding pattern of ICICI Bank at March 31, 2003

Shareholder Category Shares % holding

Deutsche Bank Trust Company Americas

(as Depositary for ADR holders) .................................. 160,022,118 26.10

FIIs and NRIs ................................................................. 236,644,243 38.60

Insurance Companies .................................................... 94,714,564 15.45

Bodies Corporate ........................................................... 30,258,750 4.94

Unit Trust of India – I & II ............................................. 20,341,225 3.32

Banks and Financial Institutions ................................... 6,579,125 1.07

Mutual Funds ................................................................. 8,720,080 1.42

Individuals ...................................................................... 55,754,299 9.10

Total ................................................................................ 613,034,404 100.00

Shareholders of ICICI Bank with more than one per cent holding at March 31, 2003

Name of the Shareholder Number of % to Total

Shares Number of Shares

Deutsche Bank Trust Company Americas

(as Depositary for ADR holders) ................................. 160,022,118 26.10

Life Insurance Corporation of India ............................. 50,948,413 8.31

Orcasia Limited ............................................................. 46,231,626 7.54

Government of Singapore* .......................................... 42,478,330 6.93

Bajaj Auto Limited ........................................................ 21,519,880 3.51

Unit Trust of India – I & II ............................................ 20,341,225 3.32

M and G Investment Management Limited ............... 18,980,477 3.10

The New India Assurance Company Limited ............. 17,276,695 2.82

Emerging Markets Growth Fund Inc. .......................... 13,193,690 2.15

General Insurance Corporation of India ...................... 9,881,295 1.61

National Insurance Company Limited ......................... 8,425,659 1.37

Templeton Inv. Counsel LLC A/c Templeton foreign equity series 6,433,958 1.05

Emerging markets management LLC A/c EMSAF Mauritius 6,181,821 1.01

* Government of Singapore comprises:

Government of Singapore ............................................ 26,373,458 4.30

Monetary Authority of Singapore-J ............................. 7,417,350 1.21

Monetary Authority of Singapore ................................ 4,790,568 0.78

Monetary Authority of Singapore-B ............................. 3,057,566 0.50

Government of Singapore Investment Corporation A/c

Government of Singapore-E ......................................... 839,388 0.14