ICICI Bank 2003 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F75

Continued

notes to the consolidated financial statements

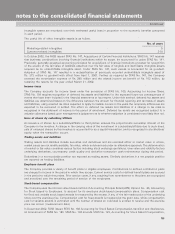

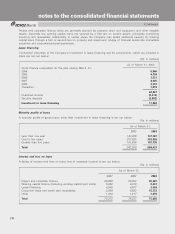

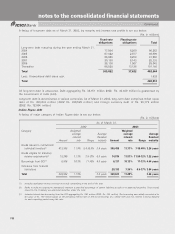

Restructured loans

The Company classifies a loan as a restructured loan where it has made concessionary modifications, that it would

not otherwise consider, to the contractual terms of a loan to a borrower experiencing financial difficulties. As of

March31, 2003, the Company had committed to lend Rs.2,822million (2002: Rs. 18,616million), to borrowers

who are parties to troubled debt restructurings.

Impaired loans, including restructured loans

A listing of restructured loans is set out below:

(Rs. in millions)

As of March 31,

2002 2003

Project and corporate finance 84,048 135,421

Working capital finance (including working capital term loans) 5,283 11,084

Other 5,757 886

Restructured loans 95,088 147,391

Allowance for loan losses (17,722) (24,732)

Restructured loans, net 77,366 1,22,659

Restructured loans:

With a valuation allowance 95,088 147,391

Without a valuation allowance ——

Restructured loans 95,088 1,47,391

A listing of other impaired loans is set out below:

(Rs. in millions)

As of March 31,

2002 2003

Project and corporate finance 48,093 67,906

Working capital finance (including working capital term loans) 1,699 11,907

Lease financing 731 1,550

Consumer loans and credit card receivables 190 1,752

Other 41 41

Other impaired loans 50,754 83,156

Allowance for loan losses (17,567) (27,837)

Other impaired loans, net 33,187 55,319

Other impaired loans:

With a valuation allowance 50,754 83,087

Without a valuation allowance —69

Other impaired loans 50,754 83,156

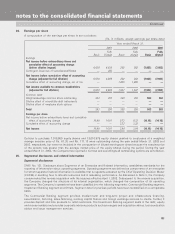

During the year ended March 31, 2003, interest income of Rs.2,358million (2002:Rs. 3,257million, 2001:

Rs. 1,989million) was recognized on impaired loans on a cash basis. Gross impaired loans (including restructured

loans) averaged Rs. 188,195million during the year ended March 31, 2003 (2002: Rs. 115,543million).

Concentration of credit risk

Concentration of credit risk exists when changes in economic, industry or geographic factors similarly affect groups of

counterparties whose aggregate credit exposure is material in relation to Company’s total credit exposure. The Company’s

portfolio of financial instruments is broadly diversified along industry, product and geographic lines within India.