ICICI Bank 2003 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F66

notes to the consolidated financial statements

Continued

to provide alternative methods of transition for a voluntary change to the fair value based method of accounting for

stock-based employee compensation. In addition, SFAS No. 148 amends the disclosure requirements of

SFAS No. 123 to require prominent disclosures in both annual and interim financial statements about the method

of accounting for stock based employee compensation and the effect of the method used on reported results. The

disclosure provisions of SFAS No. 148 are applicable for fiscal periods beginning after December 15, 2002.

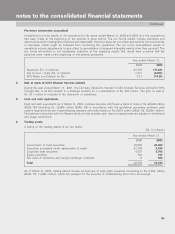

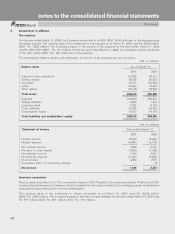

Had compensation cost been determined in a manner consistent with the fair value approach described in

SFAS No. 123, the Company’s net income and earnings per share as reported would have changed to the amounts

indicated below:

Year ended March 31,

2001(1) 2002(2) 2003

Net income/(loss) (in Rs. millions) Rs. Rs. Rs.

As reported 6,630 1,547 (7,983)

Add: Stock based employee compensation

expense included in reported net income,

net of tax effects 37 26 7

Less: Stock based employee compensation

expense determined under fair value based

method, net of tax effects (128) (58) (358)

Pro forma net income / (loss) 6,539 1,515 (8,334)

Earnings / (loss) per share: Basic (in Rs.)

As reported 16.88 3.94 (14.18)

Pro forma 16.65 3.86 (14.80)

Earnings / (loss) per share: Diluted (in Rs.)

As reported 16.81 3.94 (14.18)

Pro forma 16.59 3.86 (14.80)

(1) Restated for reverse acquisition.

(2) Restated for reverse acquisition and adoption of SFAS No. 147.

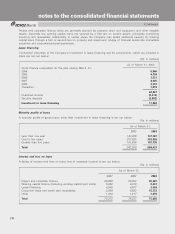

The fair value of the options is estimated on the date of the grant using the Black- Scholes options pricing model,

with the following assumptions:

2001 2002 2003

Dividend yield 5.9% 5.5% 1.7%

Expected life 10 years 10 years 10 years

Risk free interest rate 10.4% 7.4% 8.9%

Volatility 30% 55% 54%

Dividends

Dividends on common stock and the related dividend tax are recognized on approval by the Board of Directors.

Earnings / (Loss) per share

Basic earnings / (loss) per share is computed by dividing net income / (loss) by the weighted average number of

common stock outstanding during the period. Diluted earnings / (loss) per share reflects the potential dilution that

could occur if securities or other contracts to issue equity shares were exercised or converted.

Reclassifications

Certain other reclassifications have been made in the financial statements of prior years to conform to classifications

used in the current year. These changes had no impact on previously reported results of operations or stockholders’

equity.