ICICI Bank 2003 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F67

notes to the consolidated financial statements

Continued

2. Dilution of ownership interest in the acquiree

Until March 2000, the Company held a 74.2% controlling interest in the acquiree. In March2000, the acquiree issued

15.9 million American Depository Shares (ADS) to third parties. As a result of the issuance, the proportionate

ownership interest of the Company in the acquiree reduced from 74.2% to 62.2%.

The offering price per share exceeded the Company’s carrying amount per share in the acquiree, resulting in an

increase in the carrying value of the Company’s investment in the acquiree by Rs. 4,114million. This change in the

carrying value was recognized in the statement of stockholders’ equity as a capital transaction.

In March2001, the acquiree acquired Bank of Madura Limited, a banking company, through issuance of stock. The

acquisition was recorded by the purchase method. As a result of the issuance, the ownership interest of the

Company in the acquiree was reduced from 62.2% to 55.6%. The issuance price exceeded the Company’s carrying

amount per share in the acquiree resulting in an increase in the carrying value of the Company’s investment in the

acquiree by Rs. 1,242million. This change in the carrying value, net of the related tax effect of Rs. 140million, has

been recognized in the statement of stockholders’ equity as a capital transaction.

Subsequently, during March2001, the Company sold a 9.2% interest in the acquiree to institutional investors for a

consideration of Rs. 3,499 million. The gain on sale of Rs. 1,996million is included in the statement of income. This

reduced the Company’s interest in the acquiree to 46.4%.

In view of the Company’s ownership interest in the acquiree having been reduced to below majority level, the

Company determined that consolidation of the acquiree was not appropriate and accounted for its ownership interest

under the equity method beginning April 1, 2000, the beginning of the fiscal year in which the ownership interest was

less than majority.

During the year ended March 31, 2002, the Company further reduced its ownership interest to 46%. This resulted

in a gain of Rs. 57 million, which is included in the statement of income.

3. Acquisitions

Reverse acquisition

Effective April 1, 2002, the acquiree and the Company consummated a transaction whereby shareholders of the

Company were issued shares of the acquiree in the ratio of 1:2. The transaction has been treated as a reverse

acquisition, with the acquiree as the surviving legal entity but the Company as the accounting acquirer.

On the acquisition date, the Company held a 46% ownership interest in the acquiree. Accordingly, the acquisition

of the balance 54% ownership interest has been accounted for as a step-acquisition. The operations of the acquiree

have been consolidated in the Company’s financial statements effective April 1, 2002.

As a result of the acquisition, the Company became a universal banking company offering the entire spectrum of

financial services. The acquisition is expected to reduce the cost of funds for the Company through access to the

extensive branch network and deposit base of the acquiree. Further, the acquisition is expected to benefit the

Company through greater opportunities to generate fee-based income, participation in the payment networks and

ability to provide transaction banking services. Subsequent to the acquisition, the operations of the Company will

be governed by the Banking Regulation Act, 1949.

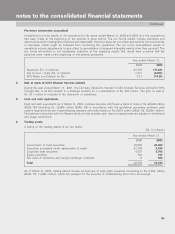

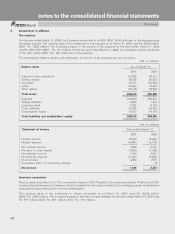

The components of the purchase price and allocation are as follows:

(Rs. in millions)

Fair value of common stock issued on reverse acquisition 12,028

Direct acquisition costs 1,627

Fair value of stock options assumed on reverse acquisition 409

Total 14,064

The fair value of common stock issued on reverse acquisition was based on the average prices of the equity shares

for the two trading days before and after October 25, 2002, the date, the terms of the acquisition were agreed to

and announced.

The total purchase price has been allocated to the acquired assets and assumed liabilities as of the date of

acquisition based on management’s estimates and independent appraisals as follows: