ICICI Bank 2003 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F92

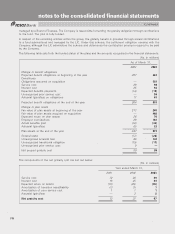

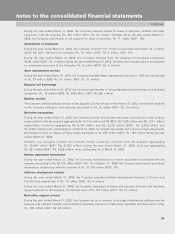

The Company had a valuation allowance of Rs. 97 million as at April 1, 2001. The net change in the total valuation

allowance for the years ended March 31, 2002 and March 31, 2003 was an increase of Rs. 129 and Rs. 298 million

respectively. The majority of the valuation allowance as of March 31, 2002 related to business loss carried forward

and capital loss carried forward. As at March 31, 2003, included in the above, the Company has recorded a valuation

allowance of Rs. 280 million pertaining to an excess of the amount for financial reporting over the tax basis carried

forward pertaining to investment in equity affiliates.

As at March 31, 2003, the Company has business loss carry forward of Rs. 505 million, with expiration dates as

follows: March 31, 2009 – Rs. 108 million, March 31, 2010 – Rs. 43 million. Further, business loss carry forward

pertaining to the Company’s US subsidiary was Rs. 321million which expires in 2022 and Australian subsidiary was

Rs. 33 million which has no expiration date. The Company’s capital loss carried forward of Rs. 110 million expires

in March 31, 2006.

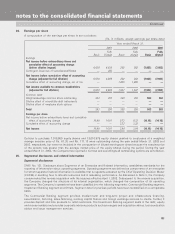

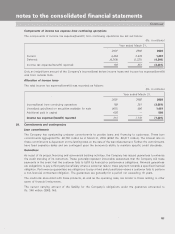

Reconciliation of tax rates

The Indian statutory tax rate is 35% plus a surcharge. During each of the years presented, legislation was enacted

in the first few months of the fiscal year that changed the amount of the surcharge for that fiscal year and future

years. The surcharge was changed to 13%, 2% and 5% during the years ended March 31, 2001, 2002 and 2003,

respectively, and resulted in a total statutory tax rate of 39.55%, 35.70% and 36.75% for the years ended March 31,

2001, 2002 and 2003, respectively.

The following is the reconciliation of expected income taxes at statutory income tax rate to income tax expense/

benefit as reported:

(Rs. in millions)

Year ended March 31,

2001 2002 2003

Income/(loss) before income taxes 6,819 533 (11,044)

Statutory tax rate 39.55% 35.70% 36.75%

Income tax expense/(benefit) at the statutory tax rate 2,697 190 (4,059)

Increases/(reductions) in taxes on account of:

Special tax deductions available to financial institutions (542) (333) (38)

Exempt interest and dividend income (525) (800) (558)

Income charged at rates other than statutory tax rate (927) 280 916

Changes in the statutory tax rate (192) 360 (109)

Expenses disallowed for tax purposes 179 109 486

Tax on undistributed earnings of subsidiary 227 234 62

Change in valuation allowance 97 129 298

Tax adjustments in respect of prior year tax assessments — 175 (31)

Tax adjustment on account of change in tax status of subsidiary ——(97)

Other (825) (93) 69

Income tax expense/(benefit) reported 189 251 (3,061)

Continued

notes to the consolidated financial statements