ICICI Bank 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Directors’ Report

To the members,

Your Directors have pleasure in presenting the Ninth Annual Report of ICICI Bank Limited with the audited

statement of accounts for the year ended March 31, 2003.

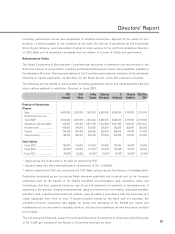

FINANCIAL HIGHLIGHTS

As the Appointed Date of the merger of erstwhile ICICI Limited (ICICI), ICICI Personal Financial Services Limited

(ICICI PFS) and ICICI Capital Services Limited (ICICI Capital) with the Bank was March 30, 2002, the

profit & loss account for fiscal 2002 included the results of the operations of ICICI, ICICI PFS and ICICI Capital

for March 30 and 31, 2002 i.e. two days only. The results for fiscal 2003 are, therefore, not comparable with

the results for fiscal 2002. The financial performance for fiscal 2003 is summarised below:

Rs. billion

Fiscal 2003 Fiscal 2002

Net interest income and other income,

excluding extraordinary items ........................................................ 33.91 11.67

Operating profit ............................................................................ 13.80 5.45

Provisions & contingencies .......................................................... 17.91 2.87

Profit on sale of ICICI Bank shares ............................................. 11.91 —

Profit after tax ............................................................................... 12.06 2.58

Consolidated profit after tax ........................................................ 11.52 2.58

APPROPRIATIONS

The profit & loss account shows a profit after taxation of Rs. 12.06 billion after write-offs and provisions of

Rs. 17.91 billion and after taking into account all expenses. The disposable profit is Rs. 12.25 billion, taking into

account the balance of Rs. 0.19 billion brought forward from the previous year. Your Directors have recommended

a dividend rate of 75% (Rs. 7.50 per equity share of Rs. 10) for the year and have appropriated the disposable

profit as follows:

Rs. billion

Fiscal 2003 Fiscal 2002

To Statutory Reserve, making in all Rs. 5.51 billion ................... 3.02 0.65

To Investment Fluctuation Reserve,

making in all Rs. 1.27 billion ........................................................ 1.00 0.16

To Special Reserve created and maintained in terms

of Section 36(1)(viii) of the Income-tax Act, 1961,

making in all Rs. 11.44 billion ...................................................... 0.50 0.14

To Revenue and other Reserves making in all

Rs. 36.91 billion1........................................................................... 2.50 0.96