ICICI Bank 2003 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

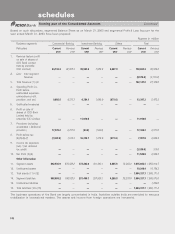

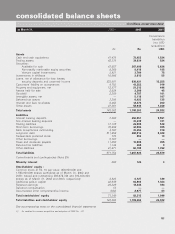

F53

at March 31,

2002

(1)

2003 2003

Convenience

translation

into USD

(unaudited)

Rs. Rs. USD

Assets

Cash and cash equivalents 41,476 72,453 1,524

Trading assets 42,376 39,634 834

Securities:

Available for sale 47,857 267,499 5,626

Non-readily marketable equity securities 8,268 9,418 198

Venture capital investments 3,921 3,704 78

Investments in affiliates 10,086 2,615 55

Loans, net of allowance for loan losses,

security deposits and unearned income 523,601 630,421 13,258

Customers’ liability on acceptances 4,783 43,252 910

Property and equipment, net 12,577 21,215 446

Assets held for sale 2,029 2,306 48

Goodwill 2,250 4,787 101

Intangible assets, net —5,118 107

Deferred tax assets 7,295 6,423 135

Interest and fees receivable 9,482 12,472 262

Other assets 27,361 58,946 1,240

Total assets 743,362 1,180,263 24,822

Liabilities

Interest bearing deposits 7,380 456,051 9,591

Non-interest bearing deposits —35,239 741

Trading liabilities 17,105 26,086 549

Short-term borrowings 70,804 42,095 885

Bank acceptances outstanding 4,783 43,252 910

Long-term debt 511,458 400,812 8,429

Redeemable preferred stock 772 853 18

Other borrowings 5,787 ——

Taxes and dividends payable 11,050 16,880 355

Deferred tax liabilities 1,144 460 9

Other liabilities 41,471 66,198 1,392

Total liabilities 671,754 1,087,926 22,879

Commitments and contingencies (Note 29)

Minority interest 260 124 3

Stockholders’ equity :

Common stock at Rs. 10 par value: 800,000,000 and

1,550,000,000 shares authorized as of March31, 2002 and

2003; Issued and outstanding 392,672,724 and 613,034,404

shares as of March31, 2002 and 2003, respectively 3,922 6,127 129

Additional paid-in capital 42,036 64,863 1,364

Retained earnings 26,229 18,246 384

Deferred compensation (7) ——

Accumulated other comprehensive income (832) 2,977 63

Total stockholders’ equity 71,348 92,213 1,940

Total liabilities and stockholders’ equity 743,362 1,180,263 24,822

See accompanying notes to the consolidated financial statements.

(1) As restated for reverse acquisition and adoption of SFAS No. 147

(in millions, except share data)

consolidated balance sheets