ICICI Bank 2003 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F74

Continued

notes to the consolidated financial statements

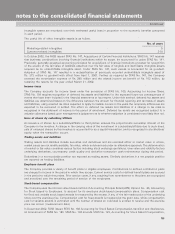

Project and corporate finance loans are generally secured by property, plant and equipment and other tangible

assets. Generally, the working capital loans are secured by a first lien on current assets, principally comprising

inventory and receivables. Additionally, in certain cases the Company may obtain additional security for working

capital loans through a first or second lien on property and equipment, pledge of financial assets like marketable

securities and corporate/personal guarantees.

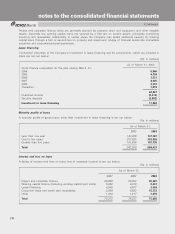

Lease financing

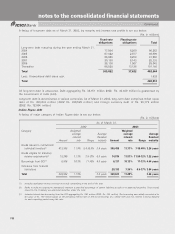

Contractual maturities of the Company’s investment in lease financing and its components, which are included in

loans are set out below:

(Rs. in millions)

As of March 31, 2003

Gross finance receivables for the year ending March31,

2004 5,900

2005 4,159

2006 3,531

2007 2,925

2008 2,793

Thereafter 7,619

26,927

Unearned income (6,213)

Security deposits (2,852)

Investment in lease financing 17,862

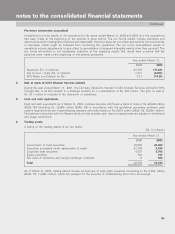

Maturity profile of loans

A maturity profile of gross loans, other than investment in lease financing is set out below:

(Rs. in millions)

As of March 31,

2002 2003

Less than one year 143,309 147,707

One to five years 237,025 328,692

Greater than five years 161,636 193,138

Total 541,970 669,537

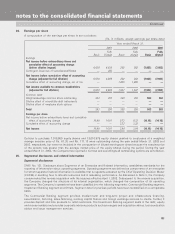

Interest and fees on loans

A listing of interest and fees on loans (net of unearned income) is set out below:

(Rs. in millions)

As of March 31,

2001 2002 2003

Project and corporate finance 60,900 56,032 45,307

Working capital finance (including working capital term loans) 5,892 6,418 8,241

Lease financing 4,948 4,977 2,484

Consumer loans and credit card receivables 2,088 6,593 15,372

Other 1,444 1,217 3,676

Total 75,272 75,237 75,080