ICICI Bank 2003 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F87

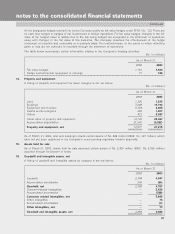

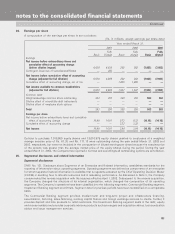

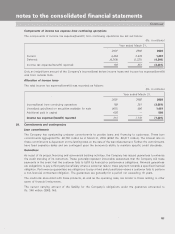

The actuarial assumptions used in accounting for the gratuity plan are given below:

As of March 31,

2002 2003

Discount rate 10% 8%

Rate of increase in the compensation levels 9% 7%

Rate of return on plan assets 9.5% 7.5%

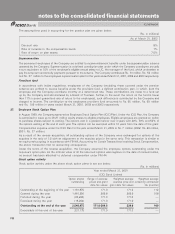

As of March31, 2003, of the total plan assets, Rs. 46million (2002: Rs. 3million) has been invested in debt

securities of the Company.

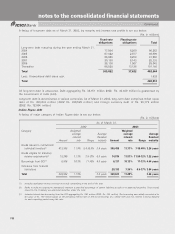

Pension

The Company provides for pension, a deferred retirement plan covering certain employees. The plan provides for a

pension payment on a monthly basis to these employees on their retirement based on the respective employee’s

salary and years of employment with the Company. Employees covered by the pension plan are not eligible for

benefits under the provident fund plan, a defined contribution plan. The pension plan is the continuation of the

acquiree’s plan and hence there are no comparatives for the current year.

The pension plan is funded through periodic contributions to a fund set-up by the Company and administrated by

a Board of Trustees. Such contributions are actuarially determined.

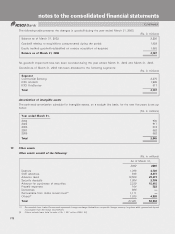

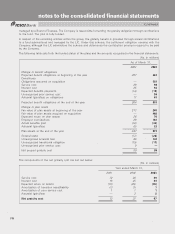

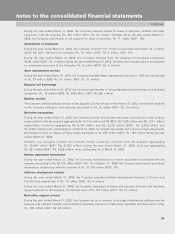

The following table sets forth the funded status of the plan and the amounts recognized in the financial statements.

(Rs. in millions)

As of March 31, 2003

Change in benefit obligations

Projected benefit obligations at beginning of the year 913

Service cost 22

Interest cost 89

Expected benefits payments (42)

Actuarial (gain)/loss on obligations (129)

Projected benefit obligations at the end of the year. 853

Change in plan assets

Fair value of plan assets at beginning of the year 914

Expected return on plan assets 86

Employer contributions 16

(Gain)/loss on plan assets 166

Benefits paid (26)

Plan assets at the end of the year 1,156

Net prepaid benefit 303

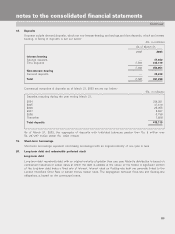

The components of the net pension cost are set out below:

(Rs. in millions)

Year ended March 31, 2003

Service cost 22

Interest cost 89

Expected return on assets (86)

Actuarial (gain)/loss —

Net pension cost 25

Continued

notes to the consolidated financial statements