ICICI Bank 2003 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F38

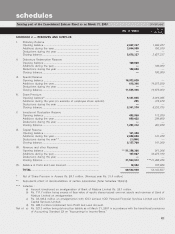

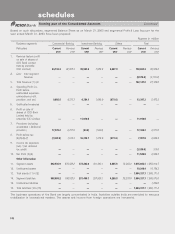

schedules

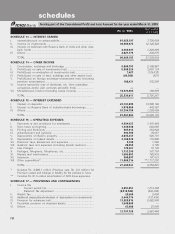

forming part of the Consolidated Profit and Loss Account for the year ended March 31, 2003

SCHEDULE 13 — INTEREST EARNED

I. Interest/discount on advances/bills .............................................. 61,628,197 7,725,058

II. Income on investments ................................................................ 30,889,875 12,349,422

III. Interest on balances with Reserve Bank of India and other inter-

bank funds .................................................................................... 2,368,947 1,226,299

IV. Others ............................................................................................ 2,021,176 238,275

TOTAL ............................................................................................ 96,908,195 21,539,054

SCHEDULE 14 — OTHER INCOME

I. Commission, exchange and brokerage ....................................... 8,660,753 2,308,887

II. Profit/(Loss) on sale of investments (net) ................................... 5,866,324 3,057,134

III. Profit/(Loss) on revaluation of investments (net) ........................ 1,487 (126,432)

IV. Profit/(Loss) on sale of land, buildings and other assets (net) .. (66,586) (627)

V. Profit/(Loss) on foreign exchange transactions (net) (including

premium amortisation) .................................................................. 102,431 372,200

VI. Income earned by way of dividends, etc. from subsidiary

companies and/or joint ventures abroad/in India ....................... ——

VII. Miscellaneous Income (Including Lease Income) ....................... 10,674,602 180,099

TOTAL ............................................................................................ 25,239,011 5,791,261

SCHEDULE 15 — INTEREST EXPENDED

I. Interest on deposits ...................................................................... 24,797,095 13,896,190

II. Interest on Reserve Bank of India/inter-bank borrowings .......... 3,076,050 478,387

III. Others ............................................................................................ 53,394,759 1,228,599

TOTAL ............................................................................................ 81,267,904 15,603,176

SCHEDULE 16 — OPERATING EXPENSES

I. Payments to and provisions for employees ............................... 4,894,633 1,475,464

II. Rent, taxes and lighting ............................................................... 1,439,530 664,685

III. Printing and Stationery ................................................................. 807,914 353,022

IV. Advertisement and publicity ......................................................... 892,789 79,657

V. Depreciation on Bank’s property ................................................. 2,035,237 526,791

VI. Depreciation on leased assets ..................................................... 3,166,538 115,000

VII. Directors’ fees, allowances and expenses .................................. 2,199 1,569

VIII. Auditors’ fees and expenses (including branch auditors) .......... 20,252 3,105

IX. Law Charges ................................................................................. 178,387 15,149

X. Postages, Telegrams, Telephones, etc. ....................................... 1,133,398 377,703

XI. Repairs and maintenance ............................................................. 1,555,653 783,916

XII. Insurance ....................................................................................... 269,697 141,533

XIII. Other expenditure* ....................................................................... 11,086,314 **1,717,207

TOTAL ............................................................................................ 27,482,541 6,254,801

* Includes Rs. 2,588.1 million (Previous year Rs. 0.9 million) for

Premium ceded and Change in liability for life policies in force.

** Includes Rs. 91.5 million amortisation of ADS issue expenses.

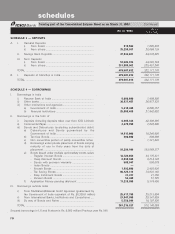

SCHEDULE 17 — PROVISIONS AND CONTINGENCIES

I. Income Tax

– Current period tax ................................................................ 2,957,051 1,213,300

– Deferred Tax adjustment ..................................................... (6,518,520) (903,300)

II. Wealth Tax ..................................................................................... 22,500 5,000

III. Additional depreciation/(write-back of depreciation) on investments . 2,444,174 (137,436)

IV. Provision for advances (net) ......................................................... 13,282,615 2,682,900

V. Prudential provision on standard assets ..................................... 1,540,000 —

VI. Others ............................................................................................ 63,900 27,000

13,791,720 2,887,464

(Rs. in ‘000s) Year ended

31.03.2002