ICICI Bank 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis

56

ICICI Bank has adopted a conservative general provisioning policy for its standard asset portfolio. The Bank

had already created fair valuation provisions against the corporate and project finance portfolio acquired from

ICICI in the merger. While Reserve Bank of India guidelines require only a 0.25% general provision against

standard assets, ICICI Bank makes additional general provisions against standard assets having regard to

overall portfolio quality, asset growth, economic conditions and other risk factors. During the year, ICICI Bank

also made additional/accelerated provisions against loans and other assets, primarily relating to ICICI’s portfolio.

ICICI Bank made aggregate provisions and write-offs of Rs. 17.91 billion, net of write-backs, in fiscal 2003.

Income-Tax Expense

On account of deferred tax asset arising out of provisions made in fiscal 2003 and utilisation of fair value

provisions against ICICI’s portfolio created at the time of the merger and after taking into account the tax charge

for the period, there was a net credit of Rs. 4.26 billion on account of Income tax. Deferred-tax asset has been

accounted for in accordance with the provisions of Accounting Standard 22 issued by the Institute of Chartered

Accountants of India, which requires recognition of deferred-tax assets and liabilities for the expected future

tax consequences of the events that have been included in the financial statements or tax returns. Charge to

profit for tax expense in fiscal 2002 was Rs. 0.32 billion after deferred-tax credit of Rs. 0.90 billion.

FINANCIAL CONDITION

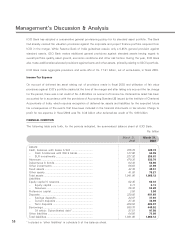

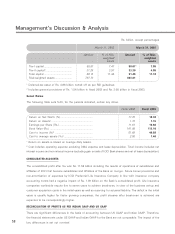

The following table sets forth, for the periods indicated, the summarised balance sheet of ICICI Bank.

Rs. billion

March 31, March 31,

2002 2003

Assets:

Cash, balances with banks & SLR ............................. 355.78 320.72

– Cash & balances with RBI & banks .................... 127.86 64.89

– SLR investments .................................................. 227.92 255.83

Advances ...................................................................... 470.35 532.79

Debentures & bonds .................................................... 64.36 56.90

Other investments ....................................................... 66.63 41.89

Fixed assets ................................................................. 42.39 40.61

Other assets ................................................................ 41.55 75.21

Total assets .................................................................. 1,041.06 1,068.12

Liabilities:

Equity capital & reserves ............................................. 62.45 69.33

– Equity capital ....................................................... 6.13 6.13

– Reserves ............................................................... 56.32 63.20

Preference capital ........................................................ 3.50 3.50

Deposits ....................................................................... 320.85 481.69

– Savings deposits .................................................. 24.97 37.93

– Current deposits .................................................. 27.36 36.89

– Term deposits ...................................................... 268.52 406.87

Borrowings ................................................................... 589.70 440.52

Of which: Subordinated debt1............................ 97.51 97.50

Other liabilities ............................................................. 64.56 73.08

Total liabilities ............................................................... 1,041.06 1,068.12

1 Included in ‘other liabilities’ in schedule 5 of the balance sheet.