ICICI Bank 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

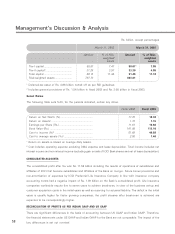

Management’s Discussion & Analysis

58

Rs. billion, except percentages

March 31, 2002 March 31, 2003

Amount % of Risk- Amount % of Risk-

weighted weighted

assets assets

Tier-I capital ...................................... 58.87 7.47 58.0717.05

Tier-II capital2.................................... 31.25 3.97 33.39 4.05

Total capital ...................................... 90.12 11.44 91.46 11.10

Risk-weighted assets ....................... 787.73 823.81

1 Deferred-tax asset of Rs. 4.88 billion netted off as per RBI guidelines.

2 Includes general provisions of Rs. 1.54 billion in fiscal 2002 and Rs. 3.08 billion in fiscal 2003.

Select Ratios

The following table sets forth, for the periods indicated, certain key ratios.

Fiscal 2002 Fiscal 2003

Return on Net Worth (%)............................................ 17.75 18.30

Return on Assets1........................................................ 1.10 1.15

Earnings per Share (Rs.) ............................................. 11.61 19.68

Book Value (Rs.) .......................................................... 101.88 113.10

Cost to income (%)2................................................... 51.69 49.88

Cost to average assets (%)2....................................... 2.55 1.46

1 Return on assets is based on average daily assets.

2 Cost includes operating expense excluding DMA expense and lease depreciation. Total income includes net

interest income and non-interest income (excluding gain on sale of ICICI Bank shares and net of lease depreciation).

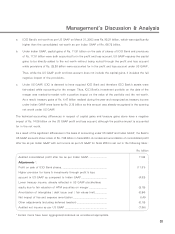

CONSOLIDATED ACCOUNTS

The consolidated profit after tax was Rs. 11.52 billion including the results of operations of subsidiaries and

affiliates of ICICI that became subsidiaries and affiliates of the Bank on merger. Future bonus provisions and

non-amortisation of expenses by ICICI Prudential Life Insurance Company in line with insurance company

accounting norms had a negative impact of Rs. 1.09 billion on the Bank’s consolidated profit. Life insurance

companies worldwide require five to seven years to achieve break-even, in view of the business set-up and

customer acquisition costs in the initial years as well as reserving for actuarial liability. The deficit in the initial

years is usually higher for faster growing companies; the profit streams after break-even is achieved are

expected to be correspondingly higher.

RECONCILIATION OF PROFITS AS PER INDIAN GAAP AND US GAAP

There are significant differences in the basis of accounting between US GAAP and Indian GAAP. Therefore,

the financial statements under US GAAP and Indian GAAP for the Bank are not comparable. The impact of the

key differences is set out overleaf: