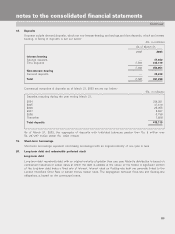

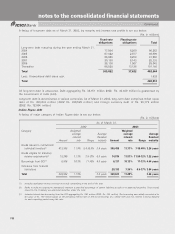

ICICI Bank 2003 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F77

Continued

notes to the consolidated financial statements

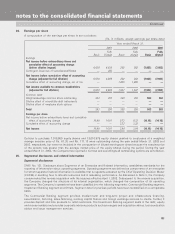

All the designated hedges entered into by the Company qualify as fair value hedges under SFASNo.133. There are

no cash flow hedges or hedges of net investments in foreign operations. For fair value hedges, changes in the fair

value of the hedged asset or liability due to the risk being hedged are recognized in the statement of operations

along with changes in the fair value of the derivative. The Company assesses the effectiveness of the hedge

instrument at inception and continually on a quarterly basis. The ineffectiveness, to the extent to which offsetting

gains or loss are not achieved, is recorded through the statement of operations.

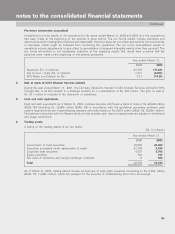

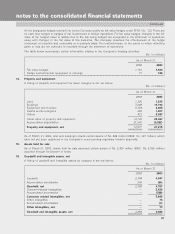

The table below summarizes certain information relating to the Company’s hedging activities:

(Rs. in millions)

As of March 31,

2002 2003

Fair value hedges 1,161 1,836

Hedge ineffectiveness recognized in earnings 77 128

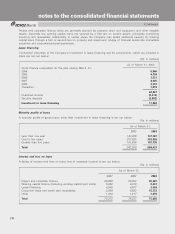

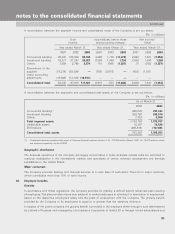

14. Property and equipment

A listing of property and equipment by asset category is set out below:

(Rs. in millions)

As of March 31,

2002 2003

Land 1,336 1,535

Buildings 7,208 11,194

Equipment and furniture 5,304 4,068

Capital work-in-progress 469 1,077

Others 423 8,593

Gross value of property and equipment 14,740 26,467

Accumulated depreciation (2,163) (5,252)

Property and equipment, net 12,577 21,215

As of March 31, 2003, land and buildings include certain assets of Rs. 622million (2002:Rs. 397 million), which

have not yet been registered in the Company’s name pending regulatory transfer approvals.

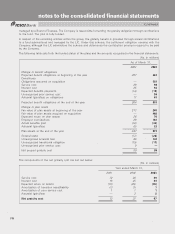

15. Assets held for sale

As of March 31, 2003, assets held for sale represent certain assets of Rs. 2,306million (2002:Rs. 2,029million)

acquired through foreclosure of loans.

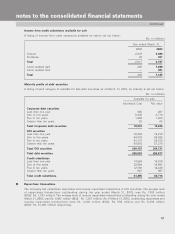

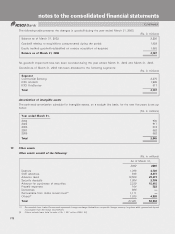

16. Goodwill and intangible assets, net

A listing of goodwill and intangible assets by category is set out below:

(Rs. in millions)

As of March 31,

2002 2003

Goodwill 2,304 4,841

Accumulated amortization (54) (54)

Goodwill, net 2,250 4,787

Customer-related intangibles —5,635

Accumulated amortization —(590)

Customer related intangibles, net 5,045

Other intangibles —76

Accumulated amortization —(3)

Other intangibles, net —73

Goodwill and intangible assets, net 2,250 9,905