ICICI Bank 2003 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F93

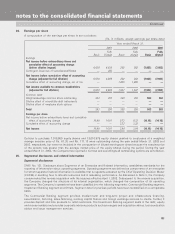

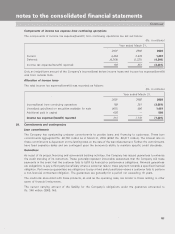

Components of income tax expense from continuing operations

The components of income tax expense/(benefit) from continuing operations are set out below:

(Rs. in millions)

Year ended March 31,

2001 2002 2003

Current 4,458 3,474 1,287

Deferred (4,269) (3,223) (4,348)

Income tax expense/(benefit) reported 189 251 (3,061)

Only an insignificant amount of the Company’s income/(loss) before income taxes and income tax expense/(benefit)

was from outside India.

Allocation of income taxes

The total income tax expense/(benefit) was recorded as follows:

(Rs. in millions)

Year ended March 31,

2001 2002 2003

Income/(loss) from continuing operations 189 251 (3,061)

Unrealized gain/(loss) on securities available for sale (481) 890 1,461

Additional paid in capital 605 — 599

Income tax expense/(benefit) reported 313 1,141 (1,001)

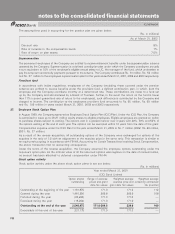

29. Commitments and contingencies

Loan commitments

The Company has outstanding undrawn commitments to provide loans and financing to customers. These loan

commitments aggregated Rs.48,759million as of March 31, 2003 (2002: Rs.68,217million). The interest rate on

these commitments is dependent on the lending rates on the date of the loan disbursement. Further, the commitments

have fixed expiration dates and are contingent upon the borrower’s ability to maintain specific credit standards.

Guarantees

As a part of its project financing and commercial banking activities, the Company has issued guarantees to enhance

the credit standing of its customers. These generally represent irrevocable assurances that the Company will make

payments in the event that the customer fails to fulfill its financial or performance obligations. Financial guarantees

are obligations to pay a third party beneficiary where a customer fails to make payment towards a specified financial

obligation. Performance guarantees are obligations to pay a third party beneficiary where a customer fails to perform

a non-financial contractual obligation. The guarantees are generally for a period not exceeding 10years.

The credit risk associated with these products, as well as the operating risks, are similar to those relating to other

types of financial instruments.

The current carrying amount of the liability for the Company’s obligations under the guarantee amounted to

Rs. 346 million (2002: Nil).

Continued

notes to the consolidated financial statements