ICICI Bank 2003 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F47

schedules

forming part of the Consolidated Accounts Continued

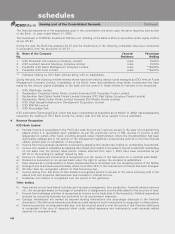

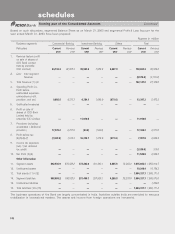

10.2 Assets under finance lease

The future lease rentals are given in the table below :

Rupees in million

Period March 31, 2003

Total of future minimum lease payments ...................................................................... 1,161.0

Present value of lease payments .................................................................................... 818.1

Unmatured finance charges ............................................................................................ 342.9

Maturity profile of total of future minimum lease payments

Not later than one year ................................................................................................... 166.0

Later than one year and not later than five years ........................................................ 831.9

Later than five years ........................................................................................................ 163.1

Total .................................................................................................................................. 1,161.0

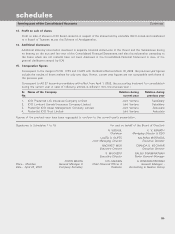

11. Other

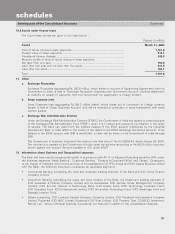

a. Exchange Fluctuation

Exchange Fluctuation aggregating Rs. 923.6 million, which arises on account of Rupee-tying Agreements with the

Government of India, is held in “Exchange Fluctuation Suspense with Government Account” pending adjustment

at maturity on receipt of payments from the Government for repayments to foreign lenders.

b. Swap suspense (net)

Swap Suspense (net) aggregating Rs.128.7 million (debit), which arises out of conversion of foreign currency

swaps, is held in “Swap Suspense Account” and will be reversed at conclusion of swap transactions with swap

counter parties.

c. Exchange Risk Administration Scheme

Under the Exchange Risk Administration Scheme (‘ERAS’), the Government of India has agreed to extend support

to the Exchange Risk Administration Fund (‘ERAF’), when it is in deficit and recoup its contribution in the event

of surplus. The Bank can claim from the positive balance in the ERAF account maintained by the Industrial

Development Bank of India (IDBI) to the extent of the deficit in the ERAS Exchange Fluctuation Account. If the

balance in the ERAF account with IDBI is insufficient, a claim will be made on the Government of India through

IDBI.

The Government of India has foreclosed the scheme vide their letter F. No.6 (3)/2002-IF.1 dated January 28, 2003.

The total amount payable to the Government of India under the scheme amounting to Rs.493.6 million has been

shown against the account “Amount payable to GOI under ERAS”.

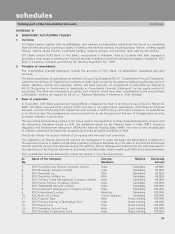

12. Information about Business and Geographical segments

The Bank had been reporting segmental results, in accordance with AS 17 on Segment Reporting issued by ICAI, under

the business segments ‘Retail Banking’, ‘Corporate Banking’, ‘Treasury & Corporate Office’ and ‘Others’. Consequent

to the merger of erstwhile ICICI Limited and two of its subsidiaries ICICI PFS Limited and ICICI Capital Services Limited

with the Bank, the following have been considered as reportable segments :

• Commercial Banking comprising the retail and corporate banking business of the Bank and ICICI Home Finance

Company Limited.

• Investment Banking comprising the rupee and forex treasury of the Bank, the investment banking business of

ICICI Securities & Finance Company Limited and its subsidiaries ICICI Venture Funds Management Company

Limited, ICICI Eco-net Internet & Technology Fund, ICICI Equity Fund, ICICI Technology Incubator Fund,

ICICI Emerging Fund, ICICI International Limited, ICICI Information Technology Fund, ICICI Advantage Fund and

Strategic Investor Fund.

• Others comprising, ICICI Lombard General Insurance Company Limited, ICICI Prudential Life Insurance Company

Limited, Prudential ICICI AMC Limited, Prudential ICICI Trust Limited, ICICI Property Trust, TCW/ICICI Investment

Partner LLC., whose individual business is presently not material in relation to the consolidated financials.