ICICI Bank 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis

60

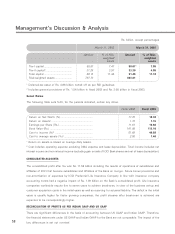

ASSET QUALITY AND COMPOSITION

Loan Portfolio

ICICI Bank follows a strategy of building a diversified and de-risked asset portfolio and limiting or correcting

concentrations in particular sectors.

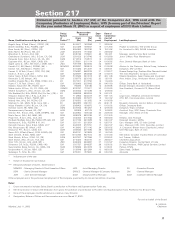

ICICI Bank limits its exposure to any particular industry to 15.0% of its total exposure. The following table sets

forth ICICI Bank’s industry-wise exposure at March 31, 2002 and at March 31, 2003.

Rs. billion, except percentages

March 31, March 31,

2002 2003

Industry % of total % of total Exposure1

Retail .................................................................. 7.9 22.8 191.32

Power ................................................................ 11.2 10.1 85.01

Iron & steel ........................................................ 11.1 9.6 80.42

Services ............................................................. 9.3 8.5 71.61

Telecommunications ......................................... 5.1 5.2 44.03

Textiles ............................................................... 6.2 4.9 41.06

Crude petroleum & refining .............................. 5.4 4.1 34.11

Engineering ....................................................... 3.5 3.4 28.93

Electronics ......................................................... 2.9 2.7 22.41

Metal & metal products ................................... 2.5 2.4 20.04

Cement .............................................................. 2.8 2.3 19.31

Petrochemicals .................................................. 1.2 2.1 17.83

Roads, ports & railways ................................... 1.4 1.9 16.28

Chemicals .......................................................... 2.5 1.7 13.96

Automobiles ...................................................... 2.3 1.6 13.50

Fertilisers ........................................................... 1.3 1.6 13.08

Paper & paper products ................................... 2.2 1.5 12.56

Food processing ............................................... 1.4 1.4 11.83

Man-made fibres ............................................... 1.5 1.4 11.52

Hotels ................................................................ 1.6 1.2 10.10

Sugar ................................................................. 1.1 1.0 8.60

Plastics .............................................................. 1.4 1.0 8.57

Shipping ............................................................ 1.0 0.8 6.98

Non-banking finance companies ..................... 1.3 0.7 5.92

Drugs & pharmaceuticals ................................. 1.2 0.7 5.53

Rubber & rubber products ............................... 0.5 0.3 2.91

Mining ............................................................... 1.1 0.3 2.62

Other infrastructure .......................................... 0.3 0.2 1.87

Miscellaneous ................................................... 8.8 4.6 38.68

Total ................................................................... 100.0 100.0 840.59

1 Includes principal outstanding, charges and non-fund-based exposures at 50%.