ICICI Bank 2003 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F71

Continued

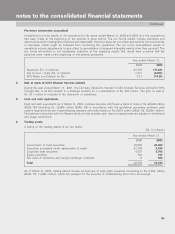

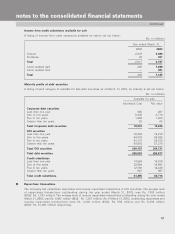

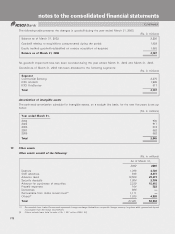

Income from credit substitutes available for sale

A listing of income from credit substitutes available for sale is set out below:

(Rs. in millions)

Year ended March 31,

2002 2003

Interest 2,872 8,406

Dividends 45 381

Total 2,917 8,787

Gross realized gain 282 1,200

Gross realized loss —(75)

Total 282 1,125

Maturity profile of debt securities

A listing of each category of available for sale debt securities as of March31, 2003, by maturity is set out below:

(Rs. in millions)

Available for sale

Amortized Cost Fair value

Corporate debt securities

Less than one year 285 267

One to five years 8,436 8,719

Five to ten years 1,862 1,900

Greater than ten years 53 60

Total Corporate debt securities 10,636 10,946

GOI securities

Less than one year 76,238 76,216

One to five years 54,976 55,922

Five to ten years 54,170 54,614

Greater than ten years 54,803 57,379

Total GOI securities 240,187 244,131

Total debt securities 250,893 255,077

Credit substitutes

Less than one year 14,584 14,618

One to five years 32,984 34,683

Five to ten years 12,760 12,448

Greater than ten years 967 967

Total credit substitutes 61,295 62,716

8.8.

8.8.

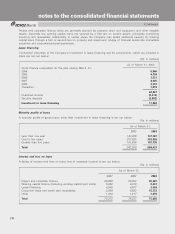

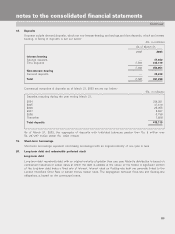

8. Repurchase transactions

The Company has undertaken repurchase and reverse repurchase transactions in GOI securities. The average level

of repurchase transactions outstanding during the year ended March 31, 2003, was Rs. 7002million

(2002: Rs. 1,743million). The average level of reverse repurchase transactions outstanding during the year ended

March 31, 2003, was Rs. 4,483million (2002:Rs. 1,347million). As of March 31, 2003, outstanding repurchase and

reverse repurchase transactions were Rs. 3,000 million (2002: Rs. 595 million) and Rs. 5,399 million

(2002: Rs. 21,399million) respectively.

notes to the consolidated financial statements