ICICI Bank 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

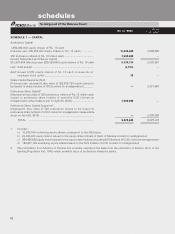

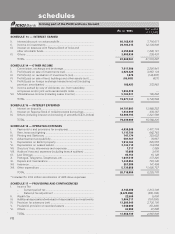

F5

for the year ended March 31, 2003

profit and loss account

Schedule (Rs. in ‘000s) Year ended

31.03.2002

I. INCOME

Interest earned .................................................................. 13 93,680,561 21,519,297

Other income ..................................................................... 14 19,677,741 5,746,598

Profit on sale of shares of ICICI Bank Limited

held by erstwhile ICICI Limited ......................................... 11,910,517 —

TOTAL ................................................................................ 125,268,819 27,265,895

II. EXPENDITURE

Interest expended.............................................................. 15 79,439,989 15,589,235

Operating expenses .......................................................... 16 20,116,900 6,225,770

Provisions and contingencies ............................................ 17 13,650,139 2,867,900

TOTAL ................................................................................ 113,207,028 24,682,905

III. PROFIT/LOSS

Net profit for the year ........................................................ 12,061,791 2,582,990

Profit brought forward ....................................................... 195,614 8,294

TOTAL ....................................................................... 12,257,405 2,591,284

IV. APPROPRIATIONS/TRANSFERS

Statutory Reserve .............................................................. 3,020,000 650,000

Transfer from Debenture Redemption Reserve ................ (100,000) —

Capital Reserves ................................................................ 2,000,000 —

Investment Fluctuation Reserve ........................................ 1,000,000 160,000

Special Reserve ................................................................. 500,000 140,000

Revenue and other Reserves ............................................ 600,000 960,000

Proposed equity share Dividend ....................................... 4,597,758 —

Proposed preference share Dividend ................................ 35 —

Interim dividend paid ......................................................... —440,717

Corporate dividend tax ...................................................... 589,092 44,953

Balance carried over to Balance Sheet ............................. 50,520 195,614

TOTAL ....................................................................... 12,257,405 2,591,284

Significant Accounting Policies and Notes to Accounts ............ 18

Cash Flow Statement ................................................................. 19

Earning per Share (Refer Note B. 9 )

Basic (Rs.) .......................................................................... 19.68 11.61

Diluted (Rs.) ....................................................................... 19.65 11.61

The Schedules referred to above form an integral part of the Profit and Loss Account.

As per our Report of even date For and on behalf of the Board of Directors

For N.M. RAIJI & CO. N. VAGHUL K. V. KAMATH

Chartered Accountants Chairman Managing Director & CEO

JAYESH M. GANDHI LALITA D. GUPTE KALPANA MORPARIA

Partner Joint Managing Director Executive Director

For S.R. BATLIBOI & CO. NACHIKET MOR CHANDA D. KOCHHAR

Chartered Accountants Executive Director Executive Director

per VIREN H. MEHTA S. MUKHERJI BALAJI SWAMINATHAN

a Partner Executive Director Senior General Manager

JYOTIN MEHTA N.S. KANNAN G. VENKATAKRISHNAN

Place : Mumbai General Manager & Chief Financial Officer & General Manager -

Date : April 25, 2003 Company Secretary Treasurer Accounting & Taxation Group