ICICI Bank 2003 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

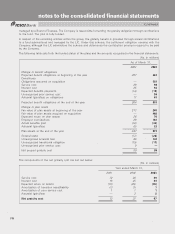

F84

Continued

notes to the consolidated financial statements

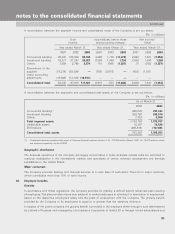

Others consist of various operating segments that do not meet the requirements to be reported as on individual

reportable segment as defined in SFAS No. 131.

The CODM evaluates the Company’s performance and allocates resources based on performance indicators

(components of profit and loss) of each of the segments. Further, the CODM specifically reviews assets of the

personal financial services division, which is a part of commercial banking segment.

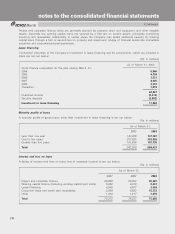

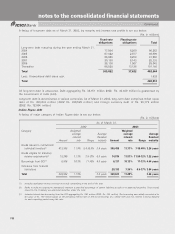

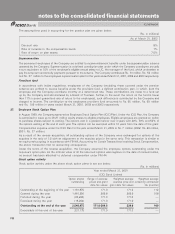

The profit and loss of reportable segments is set out below:

(Rs. in millions)

Commercial Banking Investment Banking

Year ended March 31, Year ended March 31,

2001 2002 2003 2001 2002 2003

Income from external customers

Interest income 85,169 91,445 76,498 7,328 8,239 21,595

Non - interest income 8,401 9,747 4,771 1,824 1,826 6,792

Income from other operating segments

Interest income 1,413 3,796 8,533 8,823 11,007 189

Non - interest income 658 1,040 384 236 219 251

Total income 95,641 106,028 90,186 18,211 21,291 28,827

Interest expense 72,111 81,867 69,462 14,327 17,454 23,916

Depreciation 948 1,244 2,008 67 89 231

Provision for loan losses 10,962 11,458 19,645 13 8 4

Other expenses 6,731 10,321 10,343 1,240 1,781 2,921

Income/(loss) before taxes 4,889 1,138 (11,272) 2,564 1,959 1,755

Income tax (expense)/benefit (347) (728) 3,420 24 (659) (529)

Cumulative effect of accounting changes, net of tax — 1,281 ————

Net income/(loss) 4,542 1,691 (7,852) 2,588 1,300 1,226

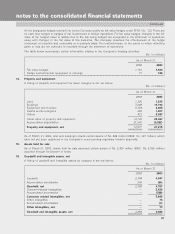

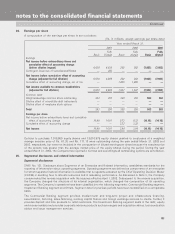

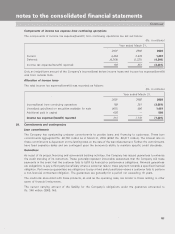

A listing of certain assets of reportable segments is set out below:

(Rs. in millions)

Commercial Investment Eliminations

Banking Banking Others of the acquiree Total

As of March 31, 2002 2003 2002 2003 2002 2003 2002 2003 2002 2003

Property and

equipment 13,157 16,048 2,152 2,754 2,099 2,413 (4,831) —12,577 21,215

Investment in

equity affiliates 15 ——252 1,867 2,363 ——1,882 2,615

Inter segment transactions are generally based on transfer pricing measures as determined by management. Income,

expenses, assets and liabilities are either specifically identifiable with individual segments or have been allocated to

segments on a systematic basis. Corporate overheads and assets have also been allocated to segments on a

systematic basis.