ICICI Bank 2003 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F83

Continued

notes to the consolidated financial statements

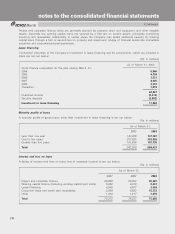

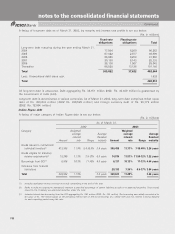

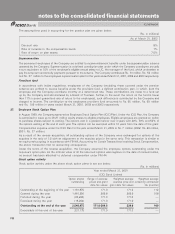

24. Earnings per share

A computation of the earnings per share is set out below:

(Rs. in millions, except earnings per share data)

Year ended March 31,

2001 2002 2003

Fully Fully Fully

Basic Diluted Basic diluted Basic diluted

Earnings

Net income before extraordinary items and

cumulative effect of accounting change

(before dilutive impact) 6,630 6,630 282 282 (7,983) (7,983)

Contingent issuances of subsidiaries/affiliates — (25) — — ——

Net income before cumulative effect of accounting

change (adjusted for full dilution) 6,630 6,605 282 282 (7,983) (7,983)

Cumulative effect of accounting change, net of tax — 1,265 1,265 ——

Net income available to common stockholders

(adjusted for full dilution) 6,630 6,605 1,547 1,547 (7,983) (7,983)

Common stock

Weighted-average common stock outstanding 393 393 393 393 563 563

Dilutive effect of convertible debt instruments ——— — ——

Dilutive effect of employee stock options ——— — ——

Total 393 393 393 393 563 563

Earnings per share

Net income before extraordinary items and cumulative

effect of accounting change 16.88 16.81 0.72 0.72 (14.18) (14.18)

Cumulative effect of accounting change — — 3.22 3.22 ——

Net income 16.88 16.81 3.94 3.94 (14.18) (14.18)

Options to purchase 7,015,800 equity shares and 12,610,975 equity shares granted to employees at a weighted

average exercise price of Rs.81.30and Rs.171.10 were outstanding during the year ended March31, 2002 and

2003, respectively, but were not included in the computation of diluted earnings per share because the exercise price

of the options was greater than the average market price of the equity shares during the period. During the year

ended March 31, 2003, the Company has reported a net loss and accordingly all outstanding options are anti-dilutive.

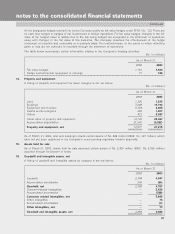

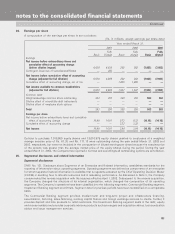

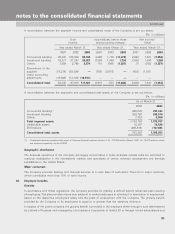

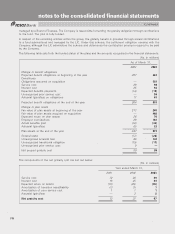

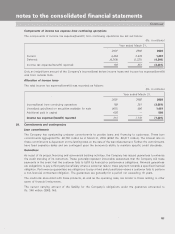

25. Segmental disclosures and related information

Segmental disclosures

SFASNo. 131, Disclosure about Segments of an Enterprise and Related Information, establishes standards for the

reporting of information about operating segments. Operating segments are defined as components of an enterprise

for which separate financial information is available that is regularly evaluated by the Chief Operating Decision Maker

(CODM) in deciding how to allocate resources and in assessing performance. As discussed in Note 3, the Company

consummated the reverse acquisition with the acquiree effective April 1, 2002. Subsequent to the reverse acquisition,

the Company changed the structure of its internal organisation, which changed the composition of its operating

segments. The Company’s operations have been classified into the following segments: Commercial Banking segment,

Investment Banking segment and Others. Segment data for previous periods have been reclassified on a comparable

basis.

The Commercial Banking segment provides medium-term and long-term project and infrastructure financing,

securitization, factoring, lease financing, working capital finance and foreign exchange services to clients. Further, it

provides deposit and loan products to retail customers. The Investment Banking segment deals in the debt, equity

and money markets and provides corporate advisory products such as mergers and acquisition advice, loan syndication

advice and issue management services.