ICICI Bank 2003 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F94

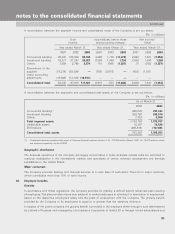

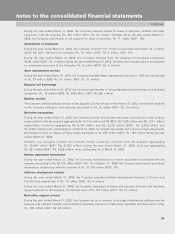

Details of guarantees outstanding are set out below:

(Rs. in millions)

Nature of guarantee Maximum potential amount of future payments under guarantee

Less than 1 year 1-3 years 3-5 years Over 5 years Total

Financial guarantees 5,755 4,598 118 17,753 28,224

Performance guarantees 3,260 2,111 786 10,462 16,619

Total 9,015 6,709 904 28,215 44,843

Capital commitments

The Company is obligated under a number of capital contracts. Capital contracts are job orders of a capital nature

which have been committed. As of the balance sheet date, work had not been completed to this extent. Estimated

amounts of contracts remaining to be executed on capital account aggregated Rs. 264million as of March 31, 2003

(2002: Rs. 756million).

Tax contingencies

Various tax-related legal proceedings are pending against the Company. Potential liabilities, if any, have been adequately

provided for, and the Company does not estimate any incremental liability in respect of these proceedings.

Litigation

Various litigation and claims against the Company and its subsidiaries are in process and pending. Based upon a

review of open matters with legal counsel, management believes that the outcome of such matters will not have

a material effect upon the Company’s consolidated financial position, results of operations or cashflows.

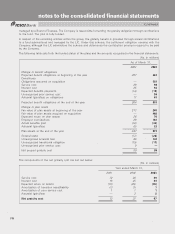

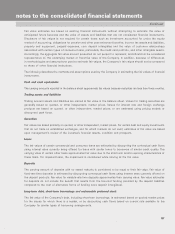

Operating lease commitments

The Company has commitments under long-term operating leases principally for premises and automated teller

machines. The following is a summary of future minimum lease rental commitments as of March 31, 2003, for

non-cancelable leases:

(Rs. in millions)

Lease rental commitments for the year ending March 31,

2004 237

2005 231

2006 223

2007 208

2008 174

Thereafter 320

Total minimum lease commitments 1,393

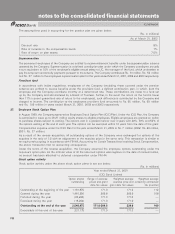

30. Related party transactions

The Company has transactions with its affiliates and directors/employees. The following represent the significant

transactions between the Company and such related parties:

Insurance services

During the year ended March 31, 2003 the Company paid insurance premium to Lombard amounting to

Rs. 224 million (2002: Rs. 26 million, 2001: Nil).

Lease of premises and facilities

During the year ended March 31, 2003, the Company received for lease of premises, facilities and other administrative

costs from Prulife, Rs. 84 million (2002: Rs. 54 million. 2001: Rs. 22million), from Pru-ICICI, Rs. 6 million

(2002: Rs. 5 million, 2001: Rs. 3million) and from Lombard, Rs. 82 million (2002: Rs. 50 million, 2001: Nil).

Continued

notes to the consolidated financial statements