ICICI Bank 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

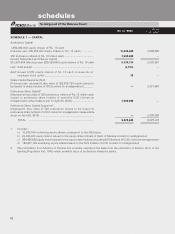

F6

forming part of the Balance Sheet

schedules

(Rs. in ‘000s) As on

31.03.2002

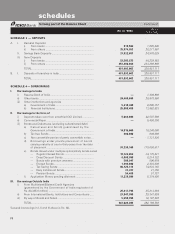

SCHEDULE 1 — CAPITAL

Authorised Capital

1,550,000,000 equity shares of Rs. 10 each

[Previous year 300,000,000 equity shares of Rs. 10 each] ................ 15,500,000 3,000,000

350 preference shares of Rs. 10 million each ........................................ 3,500,000 —

Issued, Subscribed and Paid-up Capital

613,031,404 [Previous year 220,358,680] equity shares of Rs. 10 each16,130,314 2,203,587

Less: Calls unpaid ................................................................................... (3,744) —

Add: Issued 3,000 equity shares of Rs. 10 each on exercise of

employee stock option .................................................................. 30 —

Share Capital Suspense [Net]

[Previous year: represents face value of 392,672,724 equity shares to

be issued to share holders of ICICI Limited on amalgamation] ............. —3,921,885

Preference Share Capital2

[Represents face value of 350 preference shares of Rs. 10 million each

issued to preference share holders of erstwhile ICICI Limited on

amalgamation redeemable at par on April 20, 2018] ............................. 3,500,000 —

Preference Share Capital Suspense2

[Represents face value of 350 preference shares to be issued to

preference share holders of ICICI Limited on amalgamation redeemable

at par on April 20, 2018] ......................................................................... —3,500,000

TOTAL ....................................................................................... 9,626,600 9,625,472

1. Includes :

a) 31,818,180 underlying equity shares consequent to the ADS issue

b) 23,539,800 equity shares issued to the equity share holders of Bank of Madura Limited on amalgamation

c) 264,465,582 equity shares issued to the equity share holders [excluding ADS holders] of ICICI Limited on amalgamation

d) 128,207,142 underlying equity shares issued to the ADS holders of ICICI Limited on amalgamation

2. The notification from Ministry of Finance has currently exempted the Bank from the restriction of Section 12 (1) of the

Banking Regulation Act, 1949, which prohibits issue of preference shares by banks.