ICICI Bank 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

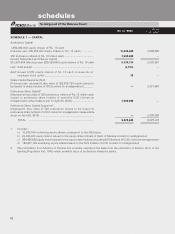

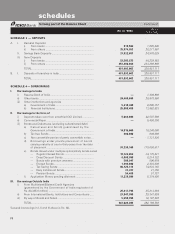

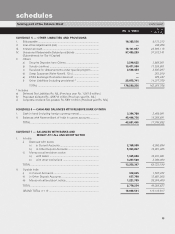

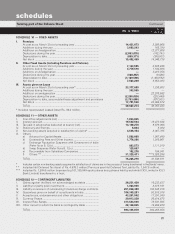

F13

forming part of the Accounts Continued

schedules

SCHEDULE 18

SIGNIFICANT ACCOUNTING POLICIES AND NOTES TO ACCOUNTS

Overview

ICICI Bank Limited (“ICICI Bank” or “the Bank”), incorporated in Vadodara, India is a publicly held bank engaged in providing

a wide range of banking and financial services including commercial banking and treasury operations. ICICI Bank is a

banking company governed by the Banking Regulation Act, 1949.

Basis of preparation

In fiscal 2001, ICICI Bank acquired and merged Bank of Madura into itself in an all-stock deal. Effective March 30, 2002,

ICICI Bank acquired ICICI Limited (“ICICI”) and two of its retail finance subsidiaries, ICICI Personal Financial Services Limited

(“I PFS”) and ICICI Capital Services Limited (“I CAPS”) along with ICICI’s interest in its subsidiaries in an all-stock deal. The

amalgamation was accounted for as per the approved Scheme of Amalgamation and the purchase method of accounting.

The accounting and reporting policies of ICICI Bank used in the preparation of these financial statements conform with

Generally Accepted Accounting Principles (“GAAP”) in India, the guidelines issued by the Reserve Bank of India (“RBI”) from

time to time and practices generally prevailing within the banking industry in India. The Bank follows the accrual method

of accounting and historical cost convention.

The preparation of financial statements requires the management to make estimates and assumptions considered in the

reported amounts of assets and liabilities (including contingent liabilities) as of the date of the financial statements and the

reported income and expenses during the reporting period. Management believes that the estimates used in the preparation

of the financial statements are prudent and reasonable. Future results could differ from these estimates.

A. SIGNIFICANT ACCOUNTING POLICIES

1. Revenue Recognition

a) Interest income is recognised in the Profit and Loss Account as it accrues except in the case of non-performing

assets where it is recognised upon realization as per the prudential norms of the Reserve Bank of India. Accrual

of income is also suspended on certain other loans, including projects under implementation where the

implementation has been significantly delayed and in the opinion of the management significant uncertainties

exist as to the final financial closure and/or date of completion of the project.

b) Income from hire purchase operations is accrued by applying the interest rate implicit on outstanding investments.

c) Income from leases is calculated by applying the interest rate implicit in the lease to the net investment outstanding

on the lease over the primary lease period. Leases effected from April 1, 2001 have been accounted as per

Accounting Standard 19 on “Accounting for leases” issued by the Institute of Chartered Accountants of India

(‘ICAI’).

d) Income on discounted instruments is recognised over the tenure of the instrument on a constant yield basis.

e) Dividend is accounted on an accrual basis when the right to receive the dividend is established.

f) Fees received as a compensation of future interest sacrifice is amortised over the remaining period of the facility.

g) Arranger’s fee is accrued proportionately where more than 75% of the total amount of finance has been arranged.

h) All other fees are recognised upfront on their becoming due.

i) Income arising from sell down of loan assets is recognised upfront in excess of the future servicing cost of the

assets sold and projected delinquencies and included in Interest income.

j) Guarantee commission is recognised over the period of the guarantee.

2. Investments

Investments are valued in accordance with the extant RBI guidelines on investment classification and valuation as

under :

a) All investments are categorised into ‘Held to Maturity‘, ’Available for sale’ and ‘Trading‘. Reclassifications, if any,

in any category are accounted for as per the RBI guidelines. Under each category the investments are further

classified under (a) Government Securities (b) other approved securities (c)shares (d) bonds and debentures

(e) subsidiaries and joint ventures and (f)others.

b) ‘Held to Maturity’ securities are carried at their acquisition cost or at amortised cost if acquired at a premium over

the face value. A provision is made for other than temporary diminution.