ICICI Bank 2003 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F40

schedules

forming part of the Consolidated Accounts Continued

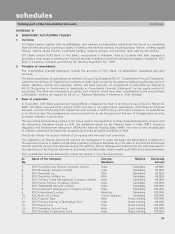

The financial statements of the subsidiaries used in the consolidation are drawn upto the same reporting date as that

of the Bank, i.e. year ended March 31, 2003.

The investment in TCW/ICICI Investment Partners LLC. (holding of the Bank is 50%) is accounted under equity method

as per AS 23.

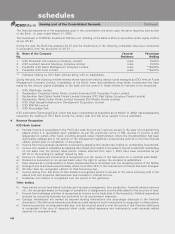

During the year, the Bank has adopted AS 27 and the investments in the following companies have been accounted

in accordance with the provisions of AS 27 :-

Sr. Name of the Company Country/ Percentage

No. Residence Holding

1. ICICI Prudential Life Insurance Company Limited India 74.00%

2. ICICI Lombard General Insurance Company Limited India 74.00%

3. Prudential ICICI Asset Management Company Limited India **44.99%

4. Prudential ICICI Trust Limited India **44.80%

** Indicates holding by ICICI Bank Limited along with its subsidiaries.

During the year, the following entities (whose shares have been held by various funds managed by ICICI Venture Funds

Management Company Limited, a subsidiary of the Bank), were deconsolidated since these investments had been

made by the venture capital subsidiary of the Bank and the control in these entities is intended to be temporary:

1. ICICI Web-Trade Limited

2. Reclamation Properties (India) Private Limited (formerly ICICI Properties Private Limited)

3. Reclamation Real Estate (India) Private Limited (formerly ICICI Real Estate Company Private Limited)

4. Reclamation Realty (India) Private Limited (formerly ICICI Realty Private Limited)

5. ICICI West Bengal Infrastructure Development Corporation Limited

6. ICICI KINFRA Limited

7. ICICI Knowledge Park

ICICI Information Technology Fund, which had been consolidated as subsidiary as on March 31, 2002, has subsequently

redeemed the holding of ICICI Bank during the current year and has since ceased to be a subsidiary.

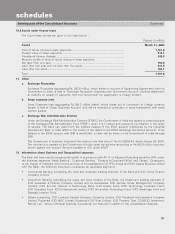

4. Revenue Recognition

ICICI Bank Limited

a) Interest income is recognised in the Profit and Loss Account as it accrues except in the case of non-performing

assets where it is recognised upon realisation as per the prudential norms of RBI. Accrual of income is also

suspended on certain other loans, including projects under implementation where the implementation has been

significantly delayed and in the opinion of the management significant uncertainties exist as to the final financial

closure and/or date of completion of the project.

b) Income from hire purchase operations is accrued by applying the interest rate implicit on outstanding investments.

c) Income from leases is calculated by applying the interest rate implicit in the lease to the net investment outstanding

on the lease over the primary lease period. Leases effected from April 1, 2001 have been accounted as per

AS 19 on “Accounting for Leases” issued by ICAI.

d) Income on discounted instruments is recognised over the tenure of the instrument on a constant yield basis.

e) Dividend is accounted on an accrual basis when the right to receive the dividend is established.

f) Fees received as a compensation of future interest sacrifice is amortised over the remaining period of the facility.

g) Arranger’s fee is accrued proportionately where more than 75% of the total amount of finance has been arranged.

h) All other fees are recognised upfront on their becoming due.

i) Income arising from sell down of loan assets is recognised upfront in excess of the future servicing cost of the

assets sold and projected delinquencies and included in Interest income.

j) Guarantee commission is recognised over the period of the guarantee.

Other entities

k) Fees earned on non-fund based activities such as issue management, loan syndication, financial advisory services

etc., are recognised based on the stage of completion of assignments and the bills raised for the recovery of fees.

l) Income from brokerage activities is recognised as income on the trade date of the transaction. Related expenditure

incurred for procuring business are accounted for as procurement expenses.

m) Contago transactions are treated as secured lending transactions and accordingly disclosed in the financial

statements. The difference between purchase and sale values on such transactions is recognised in other income.

n) Insurance premium is recognised when due, over the contract period or over the period of risk. Premium deficiency

is recognised if the sum of expected claim costs, related expenses and maintenance costs exceeds related

reserves for unexpired risks.