ICICI Bank 2003 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F23

forming part of the Accounts Continued

schedules

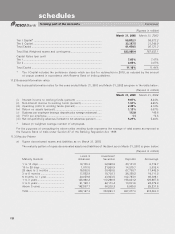

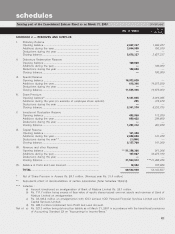

Provision for depreciation on Investments

(Rupees in million)

2003 2002

As on March 31 ........................................................................................ * 17,330.0 421.3

Add: Provision made during the year (including utilisation of fair value

provisions) ....................................................................................... (3,168.5) 17,135.8

Less: Transfer to Investment Fluctuation Reserve ................................. —160.0

Write-off during the year .......................................................................... —67.1

As on March 31 ........................................................................................ 14,161.5 17,330.0

* Excludes provision on Application Money Rs. 1,166.1 million.

11.6 Investments in equity shares and equity like instruments

(Rupees in million)

March 31, 2003 March 31, 2002

Shares ........................................................................................................ 6,330.2 7,208.1

Convertible debentures ............................................................................. 1,898.2 1,198.2

Units of Equity oriented mutual funds .................................................... 578.9 3,528.6

Investment in Venture Capital Funds ....................................................... 3,352.6 6,685.6

Others (loans against collateral, advances to brokers) .......................... 1,400.2 4,121.9

Total ........................................................................................................... 13,560.1 22,742.4

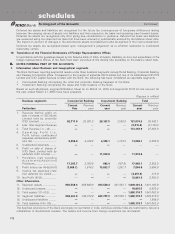

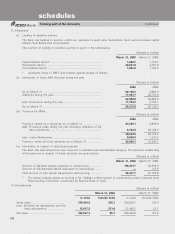

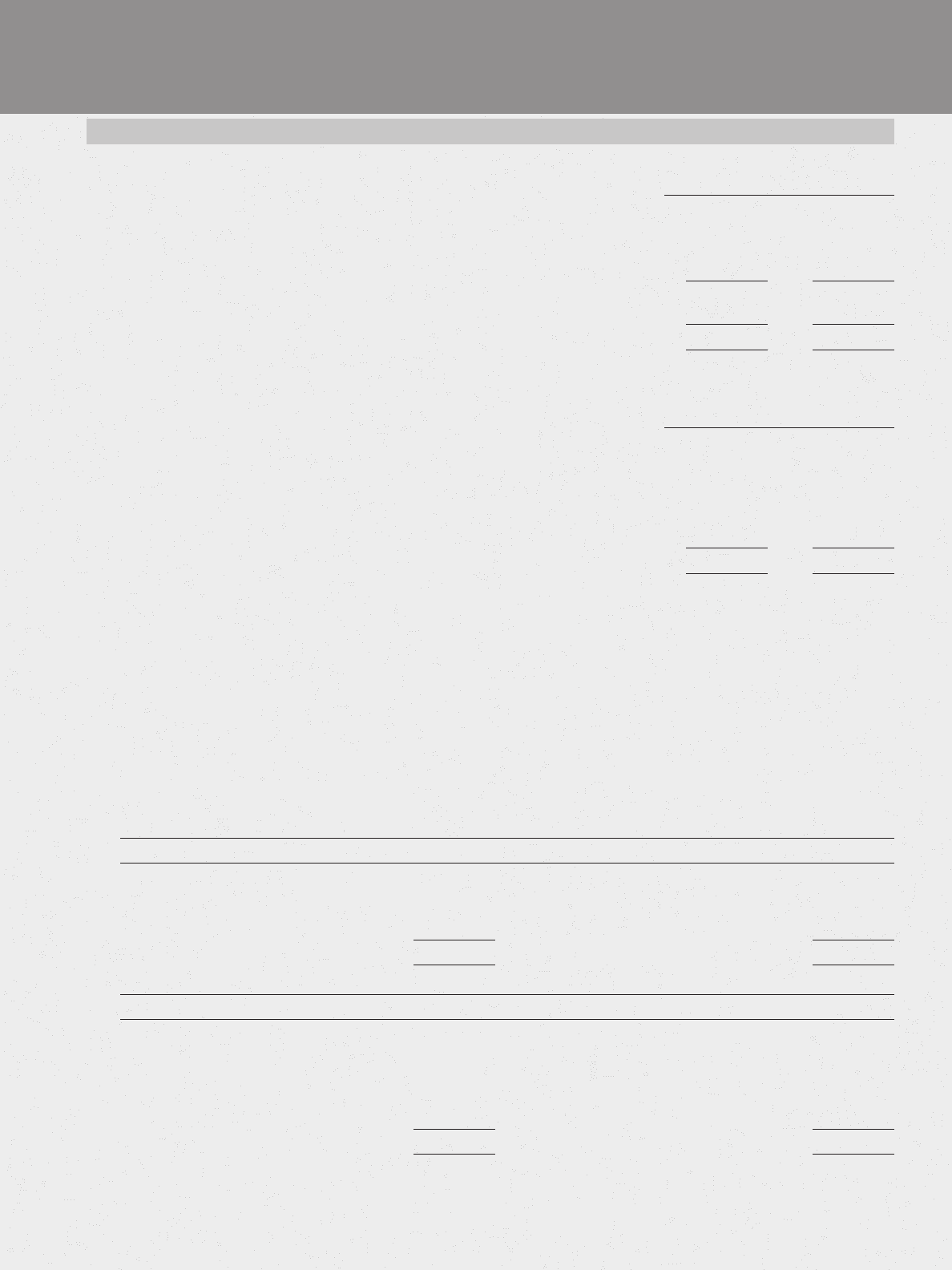

11.7 Investments in jointly controlled entities

Investments include Rs. 4,026.1 million representing the Bank’s interests in the following jointly controlled entities.

Country/ Percentage

Sr. No. Name of the Company Residence Holding

1. ICICI Prudential Life Insurance Company Limited .................. India 74.00%

2. ICICI Lombard General Insurance Company Limited .............. India 74.00%

3. Prudential ICICI Asset Management Company Limited ......... India **44.99%

4. Prudential ICICI Trust Limited ................................................... India **44.80%

** Indicates holding by ICICI Bank Limited along with its subsidiaries.

The aggregate amounts of assets, liabilities, income and expenses relating to the Bank’s interests in the above entities

follow :

(Rupees in million)

Liabilities Amount Assets Amount

Capital and Reserves 2,370.9 Cash and Bank balances 522.1

Other liabilities 2,113.7 Investments 6,775.2

Liabilities on life policies in force 3,911.7 Fixed assets 352.8

Other assets 746.2

Total 8,396.3 Total 8,396.3

(Rupees in million)

Expenses Amount Income Amount

Interest Expenses 2.0 Interest income 254.0

Other expenses – Other income –

– Premium ceded and Change in 2,588.1 – Insurance premium/commission 4,942.3

liability for life policies in force

– Others 3,988.0 – Others 410.4

Provisions 37.6

Total 6,615.7 Total 5,606.7