ICICI Bank 2003 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F64

Continued

notes to the consolidated financial statements

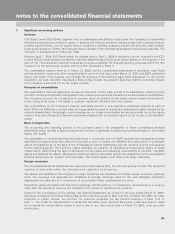

Capitalized costs of computer software obtained for internal use represent costs incurred to purchase computer

software from third parties and direct costs of materials and services incurred on internally developed software. The

capitalized costs are amortized on a straight-line basis over the estimated useful life of the software.

Impairment of long-lived assets

Long-lived assets and certain intangible assets, are reviewed for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be

held and used is measured by a comparison of the carrying amount of an asset to future net undiscounted cash

flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be

recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the

assets.

Business combinations

In June 2001, the FASB issued SFAS No. 141, Business Combinations, which requires that the purchase method of

accounting be used for all business combinations initiated after June30,2001. SFAS No. 141 also specifies the

criteria that intangible assets acquired in a purchase method business combination must meet to be recognized and

reported apart from goodwill, noting that any purchase price allocated to an assembled workforce may not be

accounted separately.

As of April 1, 2001, the Company had an unamortized deferred credit of Rs. 1,265 million related to an excess of

the fair value of assets acquired over the cost of an acquisition. As required by SFAS No. 141, in conjunction with

the early adoption of SFAS No. 142, the unamortized deferred credit as of April 1, 2001, has been written-off and

recognized as the effect of a change in accounting principle.

Goodwill and intangible assets

On April 1, 2001, the Company early-adopted SFAS No. 142, Goodwill and Other Intangible Assets. As required by

SFAS No. 142, the Company reclassified existing goodwill and intangible assets to conform with the new criteria in

SFAS No. 141 for recognition apart from goodwill. This resulted in reclassification of previously recorded intangible

assets of Rs. 115million as goodwill and a reclassification of previously recorded goodwill of Rs. 373million as a

separate unidentifiable intangible asset.

As required by SFAS No. 142, the Company identified its reporting units and assigned assets and liabilities, including

goodwill to the reporting units on the date of adoption. Subsequently, the Company compared the fair value of each

reporting unit to its carrying value, to determine whether goodwill is impaired at the date of adoption. This transitional

impairment evaluation did not indicate an impairment loss.

Subsequent to the adoption of SFAS No. 142, the Company does not amortize goodwill but instead tests goodwill

for impairment at least annually. The annual impairment test under SFAS No. 142 did not indicate an impairment loss.

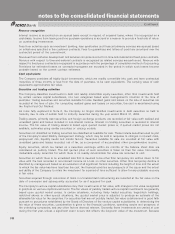

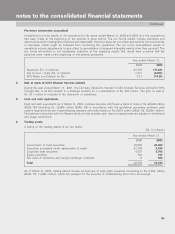

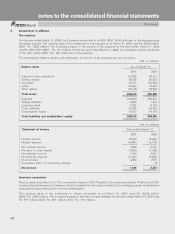

Net income and basic and diluted earnings per share excluding the impact of amortization of goodwill, for all periods

presented would have been as follows:

Year ended March 31,

2001(1) 2002(2) 2003

Net income / (loss) (in Rs. millions)

As reported 6,630 1,547 (7,983)

Add: Amortization of goodwill 145 ——

Pro forma net income / (loss) 6,775 1,547 (7,983)

Earnings / (loss) per share: Basic (in Rs.)

As reported 16.88 3.94 (14.18)

Add: Amortization of goodwill 0.37 — —

Pro forma 17.25 3.94 (14.18)

Earnings / (loss) per share: Diluted (in Rs.)

As reported 16.81 3.94 (14.18)

Add: Amortization of goodwill 0.37 — —

Pro forma 17.18 3.94 (14.18)

(1) Restated for reverse acquisition.

(2) Restated for reverse acquisition and adoption of SFAS No. 147