ICICI Bank 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F18

forming part of the Accounts Continued

schedules

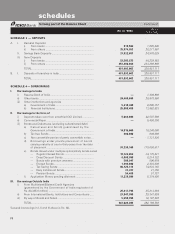

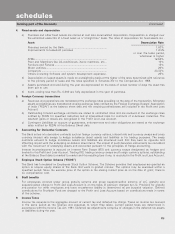

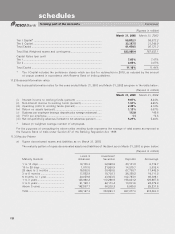

7. Deferred Tax

On March 31, 2003, the Bank has recorded net deferred tax asset of Rs.4,878.3million, (2002 : Deferred tax liability

of Rs. 1,547.6 million) which has been included in other assets.

A composition of deferred tax assets and liabilities into major items is given below :

(Rupees in million)

Particulars March 31, 2003 March 31, 2002

Amortisation of premium on investments ................................... 527.4 85.2

Provision for bad and doubtful debts ........................................... 12,988.7 7,139.7

Others ............................................................................................. 845.3 1,306.7

14,361.4 8,531.6

Less: Deferred Tax Liability

Depreciation on fixed assets .............................................. 9,246.9 9,910.5

Others ................................................................................... 236.2 168.7

9,483.1 10,079.2

Net Deferred Tax Asset/(Liability) .................................................. 4,878.3 (1,547.6)

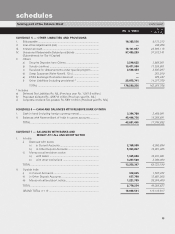

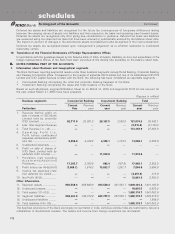

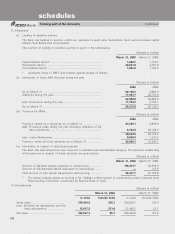

8. Related party transactions

ICICI Bank has entered into transactions with the following related parties:

• Subsidiaries, Joint Ventures and subsidiaries;

• Key Management Personnel and their relatives

The related party transactions can be categorised as follows :

Key

Management

Items/Related Party Subsidiaries Associates Personnel@ Total

Deposits .................................................. 2,343.0 4.4 20.3 2,367.7

Rendering of services ............................ 244.8 2.6 — 247.4

Insurance premiums paid ...................... — 106.0 — 106.0

@ Whole-time Directors of the Board and their relatives.

Remuneration paid to the Directors of ICICI Bank Limited during the year ended March 31, 2003 was Rs. 41.0 million

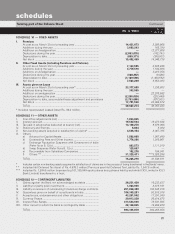

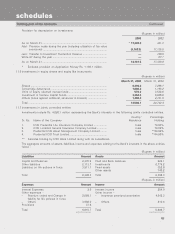

The list of related parties is as follows :

Subsidiaries and Joint Ventures

ICICI Venture Funds Management Company Limited, ICICI Securities and Finance Company Limited, ICICI Brokerage

Services Limited, ICICI International Limited, ICICI Trusteeship Services Limited, ICICI Home Finance Company Limited,

ICICI Investment Management Company Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Bank UK

Limited, ICICI Prudential Life Insurance Company Limited, and ICICI Lombard General Insurance Company Limited.

Associates

Prudential ICICI Asset Management Company Limited, Prudential ICICI Trust Limited, ICICI Equity Fund, ICICI Eco-net

Internet and Technology Fund, ICICI Emerging Sectors Fund, ICICI Strategic Investments Fund, ICICI Property Trust, and

TCW/ICICI Investment Partners L.L.C.

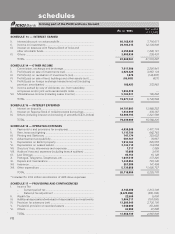

9. Earnings Per Share (“EPS”)

The Bank reports basic and diluted earnings per equity share in accordance with Accounting Standard-20, Earnings Per

Share. Basic earnings per share is computed by dividing net profit after tax by the weighted average number of equity

shares outstanding for the year. Diluted earnings per share is computed using the weighted average number of equity

shares and dilutive potential equity shares outstanding during the year.