ICICI Bank 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis

55

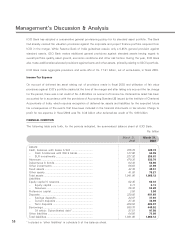

Operating Expense

Operating expense for fiscal 2003 was Rs. 15.35 billion (excluding lease depreciation of Rs. 3.14 billion and

DMA expense of Rs.1.62 billion) compared to Rs. 5.98 billion for fiscal 2002. The increase in operating expense

was primarily due to inclusion of the operations of ICICI, ICICI Capital and ICICI PFS and the growth in the retail

franchise, including lease and maintenance of ATMs, credit card expenses, call centre expenses and technology

expenses. The number of savings accounts increased to about 4.26 million at March 31, 2003 from about 2.1

million at March 31, 2002. The credit and debit cards increased to about 4.50 million at March 31, 2003 from

about 1.30 million at March 31, 2002. The number of ATMs increased to 1,675 at March 31, 2003 from 1,000

at March 31, 2002. The operating expenses as a percentage to average assets was 1.46% for fiscal 2003

compared to 2.55% for fiscal 2002.

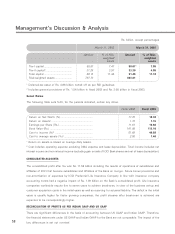

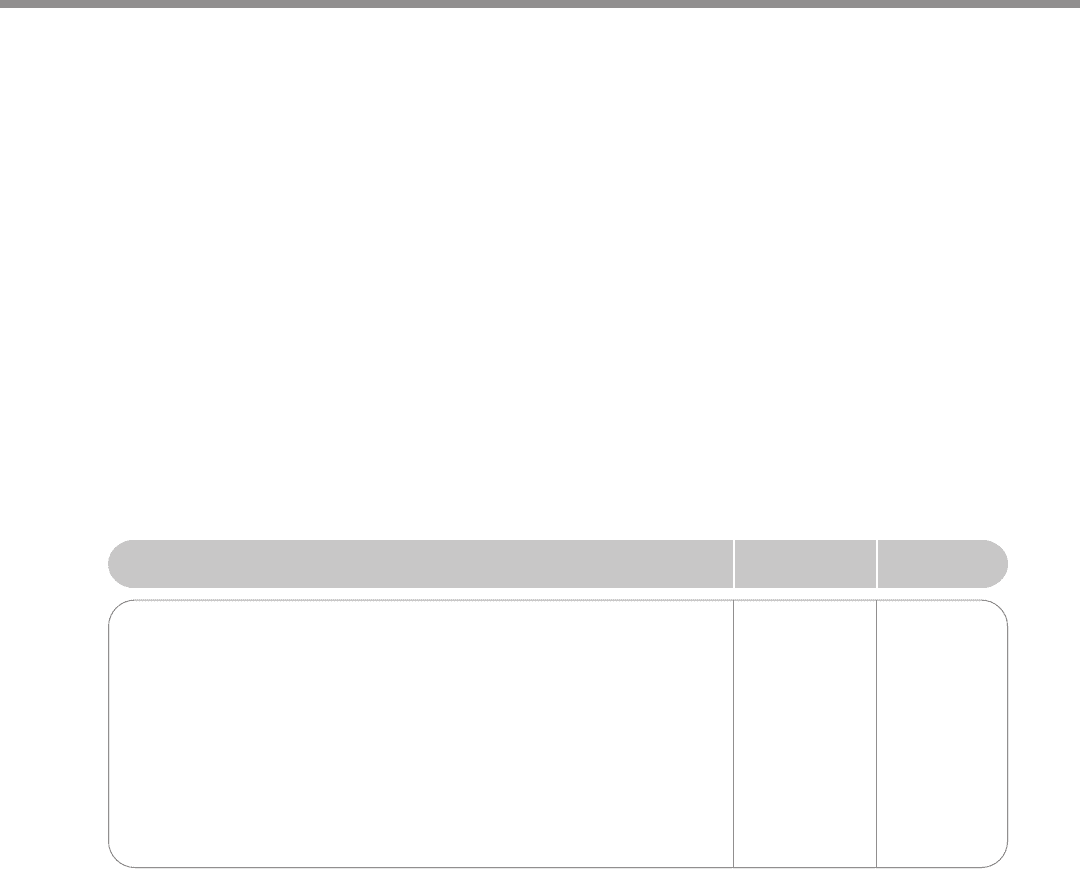

The following table sets forth, for the periods indicated, the break-up of the principal components of operating

expense.

Rs. billion

Fiscal 2002 Fiscal 2003

Salary ............................................................................ 1.47 4.03

Rents, taxes & lighting ................................................ 0.66 1.12

Printing & stationery .................................................... 0.35 0.75

Postage & courier ........................................................ 0.38 1.04

Repairs & maintenance ................................................ 0.78 1.45

Insurance ...................................................................... 0.14 0.25

Bank charges ............................................................... 0.12 0.23

Depreciation ................................................................. 0.52 1.91

Others ........................................................................... 1.56 4.57

Operating expenses ..................................................... 5.98 15.35

DMA Expense

ICICI Bank incurred DMA expenses of Rs. 1.62 billion on the retail asset portfolio (other than auto loans). Retail

assets increased to Rs. 191.32 billion at March 31, 2003 from Rs. 61.25 billion at March 31, 2002.

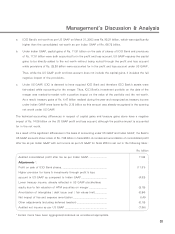

Provisions and Write-offs

ICICI Bank makes provisions/write-offs aggregating 50% of the secured portion of non-performing assets over

a three-year period instead of the five-and-a-half year period prescribed by RBI. Loss assets and the unsecured

portion of doubtful assets are fully provided for / written off. Additional provisions are made against specific

non-performing assets if considered necessary by the management. For restructured or rescheduled assets,

provision is made in accordance with the guidelines issued by the RBI, which require that the difference

between the present values of the future interest as per the original loan agreement and the present values

of future interest on the basis of the rescheduled terms be provided at the time of restructuring.