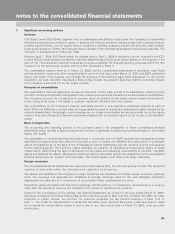

ICICI Bank 2003 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

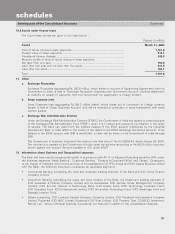

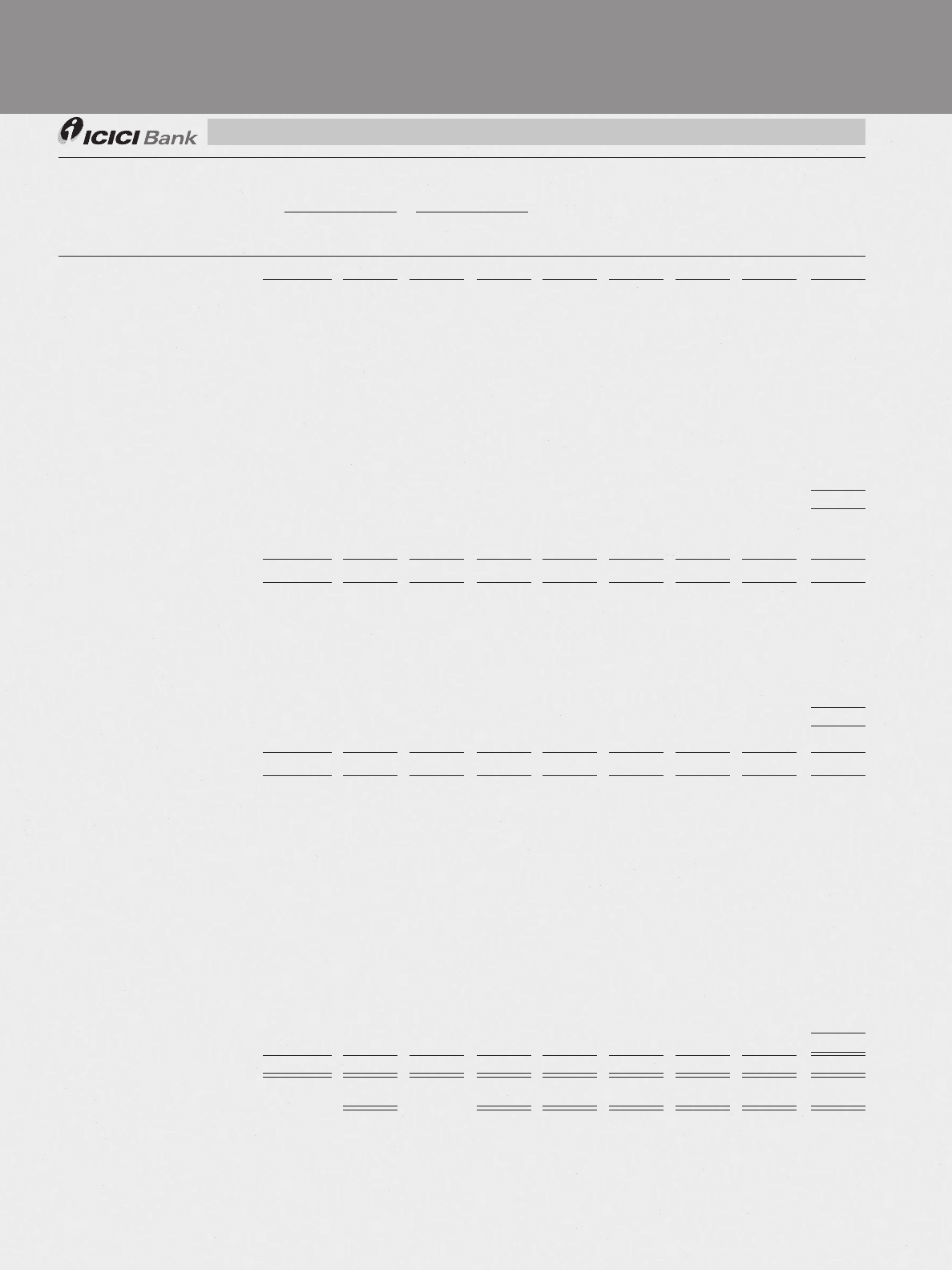

F56

Accumu-

lated

Other

Common stock Treasury Stock Compre- Total

Additional Deferred hensive Stock-

No. of Amount No. of Amount Paid-In Retained Compen- Income, holders’

Shares

(1)

Shares Capital Earnings sation Net of Tax Equity

Rs. Rs. Rs. Rs. Rs. Rs. Rs.

Balance as of March 31, 2000 392,655,774 7,832 — — 37,347 28,338 (70) (2,539) 70,908

Effect of reverse acquisition on

capital structure — (3,926) — — 3,926 ————

Common stock issued on

exercize of stock options 16,250 — — — 3 — — — 3

Amortization of compensation ——————37—37

Increase in carrying value on

direct issuance of stock by subsidiary ————1,242———1,242

Tax effect of increase in carrying value

on direct issuance of stock by subsidiary ————(605) — — — (605)

Comprehensive income

Net income —————6,630——6,630

Net unrealized gain/(loss) on

securities, net of realization ———————(1,674) (1,674)

Translation adjustments ———————1414

Comprehensive income/(loss) ————————4,970

Cash dividends declared

(Re. 1 per common share) —————(772) — — (772)

Other — 16 — — 123 — — — 139

Balance as of March 31, 2001 392,672,024 3,922 ——42,036 34,196 (33) (4,199) 75,922

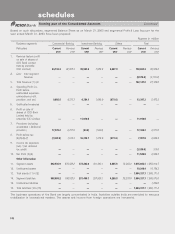

Common stock issued on exercise

of stock options 700 ————————

Amortization of compensation ——————26—26

Comprehensive income

Net income —————1,547——1547

Net unrealized gain/(loss) on

securities, net of realization ———————3,2833,283

Translation adjustments ———————8484

Comprehensive income/(loss) ————————4,914

Cash dividends declared

(Rs. 11per common share) —————(9,514) — — (9,514)

Balance as of March 31, 2002

(2)

392,672,724 3,922 ——42,036 26,229 (7) (832) 71,348

Common stock issued on reverse

acquisition 118,962,731 1,190 — — 10,838 — — — 12,028

Fair value of stock options

assumed on reverse acquisition ————409———409

Treasury stock arising due to

reverse acquisition 101,395,949 — (101,395,949) (8,204) 8,204 ————

Sale of treasury stock — 1,015 101,395,949 8,204 3,336 — — — 12,555

Common stock issued on

exercise of stock options 3,000 ————————

Increase in carrying value on

direct issuance of stock by subsidiary ————40———40

Amortization of compensation —————— 7— 7

Comprehensive income

Net income/(loss) —————(7,983) — — (7,983)

Net unrealized gain/(loss) on

securities, net of realization ———————3,7313,731

Translation adjustments ———————7878

Comprehensive income/(loss) ————————(4,174)

Balance as of March 31, 2003 613,034,404 6,127 — — 64,863 18,246 — 2,977 92,213

Balance as of March 31, 2003

(US$) (unaudited) 129 — 1,364 384 — 63 1,940

See accompanying notes to the consolidated financial statements.

(1) Restated for reverse acquisition.

(2) Restated for reverse acquisition and adoption of SFAS No. 147.

statements of stockholders’ equity and other comprehensive income

(in millions, except share data)