ICICI Bank 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis

57

ICICI Bank’s total assets increased marginally to Rs. 1,068.12 billion at March 31, 2003 from Rs. 1,041.06 billion

at March 31, 2002. Net advances increased to Rs. 532.79 billion at March 31, 2003 from Rs. 470.35 billion at

March 31, 2002. Retail assets increased to about Rs. 191.32 billion at March 31, 2003 constituting about 18%

of total assets as compared to about 6% of total assets at March 31, 2002. Cash, balances with Reserve Bank

of India and banks, money at call and short notice and SLR investments at March 31, 2003 were

Rs. 320.72 billion compared to Rs. 355.78 billion at March 31, 2002. Total investments at March 31, 2003

decreased marginally to Rs. 354.62 billion compared to Rs. 358.91 billion at March 31, 2002. SLR investments

included in total investments were Rs. 255.83 billion at March 31, 2003 compared to Rs. 227.92 billion at

March 31, 2002. Other assets increased to Rs. 75.21 billion at March 31, 2003 from Rs. 41.55 billion at

March 31, 2002. Other assets at March 31, 2003 include Rs. 15.32 billion of application money on shares and

debentures, while at March 31, 2002, application money on shares debentures (aggregating Rs. 9.21 billion

at that date) were included in investments.

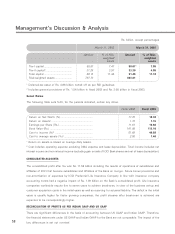

The net worth at March 31, 2003 increased to Rs. 69.33 billion from Rs. 62.45 billion at March 31, 2002. Total

deposits increased 50.1% to Rs. 481.69 billion at March 31, 2003 from Rs. 320.85 billion at March 31, 2002.

ICICI Bank’s savings account deposits increased to Rs. 37.93 billion at March 31, 2003 from Rs. 24.97 billion

at March 31, 2002, while current account deposits increased to Rs. 36.89 billion at March 31, 2003 from

Rs. 27.36 billion at March 31, 2002. Term deposits increased to Rs. 406.87 billion at March 31, 2003 from

Rs. 268.52 billion at March 31, 2002. Of the term deposits, value-added savings / current account deposits

were about Rs. 85.74 billion at March 31, 2003 compared to about Rs. 53.42 billion at March 31, 2002. Total

deposits at March 31, 2003 constituted 52.2% of ICICI Bank’s funding. Borrowings (including subordinated

debt) decreased to Rs. 440.52 billion at March 31, 2003 from Rs. 589.70 billion at March 31, 2002. Of the total

borrowings, borrowings raised by ICICI prior to the merger declined to Rs. 372.50 billion at March 31, 2003

from Rs. 582.10 billion at March 31, 2002. ICICI Bank raised about Rs. 25.00 billion through bond issues in

the last quarter of fiscal 2003.

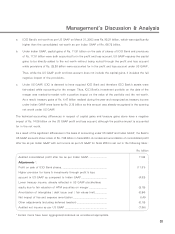

ICICI Bank’s total capital adequacy ratio at March 31, 2003 at 11.10% (including Tier-l capital adequacy of

7.05%) was significantly higher than the minimum requirement of 9% as per regulatory norms. Deferred-tax

asset of Rs. 4.88 billion has been deducted from Tier-l capital in compliance with RBI guidelines. In accordance

with RBI guidelines, Tier-l capital includes Rs. 2.31 billion out of the face value of Rs. 3.50 billion of 20-year

non-cumulative preference shares issued to ITC Limited as a part of the scheme for merger of ITC Classic

Finance Limited with ICICI. The table overleaf sets forth, for the periods indicated, details on ICICI Bank’s

capital adequacy ratio.