ICICI Bank 2003 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F76

Continued

notes to the consolidated financial statements

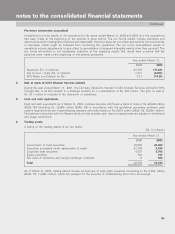

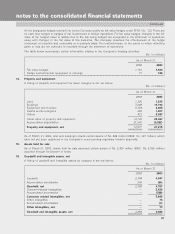

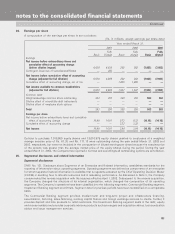

11. Allowance for loan losses

Changes in the allowance for loan losses

Movements in the allowance for loan losses are set out below:

(Rs. in millions)

As of March 31,

2001 2002 2003

Allowance for loan losses at the beginning of the year 34,085 33,035 36,647

Effect of reverse acquisition on allowance for loan losses ——1,297

Effect of de-consolidation of subsidiary on allowance for loan losses (747) — —

Provisions for loan losses, net of releases of provisions as a

result of cash collections 9,892 9,743 19,649

43,230 42,778 57,593

Loans charged-off (10,195) (6,131) (3,374)

Allowance for loan losses at the end of the year 33,035 36,647 54,219

12.12.

12.12.

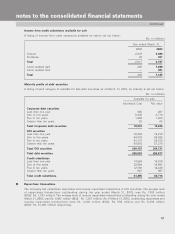

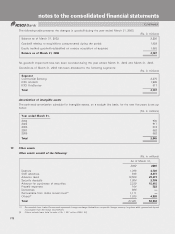

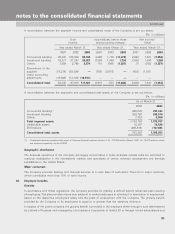

12. Securitization activity

The Company primarily securitizes commercial loans through ‘pass-through’ securitizations. After the securitization,

the Company generally continues to maintain customer account relationships and services loans transferred to the

securitization trust. Generally, the securitizations are with or without recourse and the Company does not provide any

credit enhancement. In a few cases, the Company may enter into derivative transactions such as written put options

and interest rate swaps with the transferees. Generally, the Company does not retain any beneficial interests in the

assets sold.

During the year ended March 31, 2003, the Company securitized loans and credit substitutes with a carrying value

of Rs. 51,780million (2002: Rs. 40,851 million), which resulted in gains of Rs.2,070 million (2002: Rs.1,079 million,

2001: Rs. 434 million). The gains are reported as a component of gain on sale of loans and credit substitutes.

Transfers that do not meet the criteria for a sale under SFAS No. 140, are recorded as secured borrowings

with a pledge of collateral. As of March31,2003, the Company recorded secured borrowings of Nil

(2002: Rs. 5,787 million) that arise on securitization transaction involving trusts that are not considered as qualifying

special purpose entities under the guidance provided by SFASNo.140. Such secured borrowings are reported as

a component of other borrowings.

As discussed above, the Company has written put options, which require the Company to purchase, upon request

of the holders, securities issued in certain securitization transactions. The put options seek to provide liquidity to

holders of such instruments. If exercised, the Company will be obligated to purchase the securities at the predetermined

exercise price.

As of March 31, 2003, the Company sold loans and credit substitutes with an aggregate put option exercise price

of Rs. 24,404 million (2002: Rs. 13,108 million). Subsequent to their initial issuance, such options are recorded at

fair values with changes reported in the statement of operations.

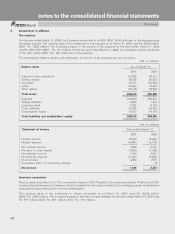

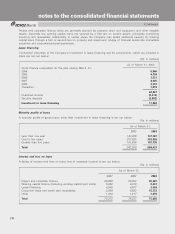

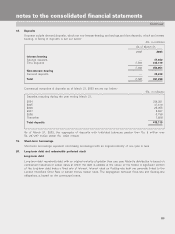

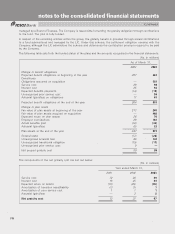

13. Derivative instruments and hedging activities

The Company manages its exposures to market rate movements by modifying its mix of assets and liabilities, either

directly or through the use of derivative financial products including interest rate swaps, cross currency swaps, equity

index futures, equity index options and forward exchange contracts.

All such freestanding derivatives, whether held for trading or non-trading purposes, are carried at their fair value as

either assets or liabilities and related gains and losses are included in other non-interest income. The Company has

not identified any significant derivative features embedded in other contracts that are not clearly and closely related

to the host contract and meet the definition of a derivative.

Fair values for derivatives are based on quoted market prices, which take into account current market and contractual

prices of the underlying instrument as well as time value underlying the positions.