ICICI Bank 2003 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F65

Continued

notes to the consolidated financial statements

Intangible assets are amortized over their estimated useful lives in proportion to the economic benefits consumed

in each period.

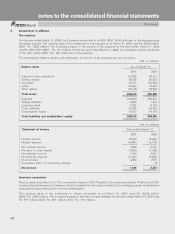

The useful life of other intangible assets is as follow:

No. of years

Marketing-related intangibles 5

Customer-related intangibles 3-10

In October 2002, the FASB issued SFAS No. 147, Acquisitions of Certain Financial Institutions. SFAS No. 147 requires

that business combinations involving financial institutions within its scope, be accounted for under SFAS No. 141.

Previously, generally accepted accounting principles for acquisitions of financial institutions provided for recognition

of the excess of the fair value of liabilities assumed over the fair value of tangible and identifiable intangible assets

acquired as an unidentifiable intangible asset. Under SFAS No. 147, such excess is accounted for as goodwill.

Adoption of SFAS No. 147 resulted in a reclassification of previously recorded unidentifiable intangible asset of

Rs.373million to goodwill with effect from April1,2001. Further, as required by SFAS No. 147, the Company

reversed the amortization expense of Rs. 290 million and the related income tax benefit of Rs. 103 million, by

restating the results for the year ended March 31, 2002.

Income taxes

The Company accounts for income taxes under the provisions of SFAS No. 109, Accounting for Income Taxes.

SFAS No. 109 requires recognition of deferred tax assets and liabilities for the expected future tax consequences of

events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and

liabilities are determined based on the difference between the amount for financial reporting and tax basis of assets

and liabilities, using enacted tax rates expected to apply to taxable income in the years the temporary differences are

expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is

recognized in the statement of income in the period of enactment. Deferred tax assets are recognized subject to a

valuation allowance based upon management’s judgement as to whether realization is considered more likely than not.

Issue of shares by subsidiary/affiliate

An issuance of shares by a subsidiary/affiliate to third parties reduces the proportionate ownership interest of the

Company in the investee. A change in the carrying value of the investment in a subsidiary/affiliate due to such direct

sale of unissued shares by the investee is accounted for as a capital transaction, and is recognized in stockholders’

equity when the transaction occurs.

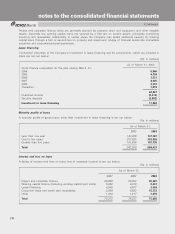

Trading assets and liabilities

Trading assets and liabilities include securities and derivatives and are recorded either at market value or where,

market prices are not readily available, fair value, which is determined under an alternative approach. The determination

of market or fair value considers various factors including stock exchange quotations, time value and volatility factors

underlying derivatives, counterparty credit quality and derivative transaction cash maintenance during that period.

Derivatives in a net receivable position are reported as trading assets. Similarly derivatives in a net payable position

are reported as trading liabilities.

Employee benefit plans

The Company provides a variety of benefit plans to eligible employees. Contributions to defined contribution plans

are charged to income in the period in which they accrue. Current service costs for defined benefit plans are accrued

in the period to which they relate. Prior service costs, if any, resulting from amendments to the plans are recognized

and amortized over the remaining period of service of the employees.

Stock-based compensation

The Company uses the intrinsic value based method of Accounting Principle Board (APB) Opinion No.25, Accounting

for Stock Issued to Employees, to account for its employee stock-based compensation plans. Compensation cost

for fixed and variable stock based awards is measured by the excess, if any, of the fair market price of the underlying

stock over the exercise price. Compensation cost for fixed awards is measured at the grant date, while compensation

cost for variable awards is estimated until the number of shares an individual is entitled to receive and the exercise

price are known (measurement date).

In December 2002, FASB issued SFAS No. 148 Accounting for Stock Based Compensation-transition and disclosures,

an amendment of FASB No. 123. SFAS No. 148 amends SFAS No. 123, Accounting for Stock Based Compensation,