ICICI Bank 2003 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F86

managed by a Board of Trustees. The Company is responsible for settling the gratuity obligation through contributions

to the fund. The plan is fully funded.

In respect of the remaining entities within the group, the gratuity benefit is provided through annual contributions

to a fund administered and managed by the LIC. Under this scheme, the settlement obligation remains with the

Company, although the LIC administers the scheme and determines the contribution premium required to be paid

by the Company.

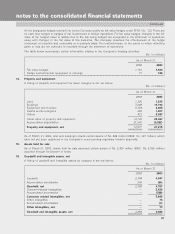

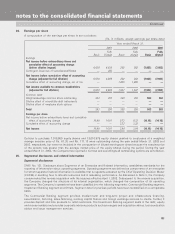

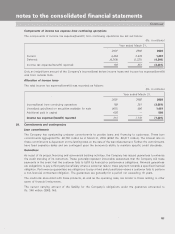

The following table sets forth the funded status of the plans and the amounts recognized in the financial statements:

(Rs. in millions)

As of March 31,

2002 2003

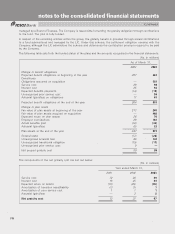

Change in benefit obligations

Projected benefit obligations at beginning of the year 207 263

Divestitures

Obligations assumed on acquisition —393

Service cost 29 69

Interest cost 25 64

Expected benefits payments (14) (18)

Unrecognized prior service cost —59

Actuarial (gain)/loss on obligations 17 63

Projected benefit obligations at the end of the year 264 893

Change in plan assets

Fair value of plan assets at beginning of the year 213 248

Fair value of plan assets acquired on acquisition —402

Expected return on plan assets 26 70

Employer contributions 29 163

Actual benefits paid (16) (32)

Actuarial (gain)/loss (5) 22

Plan assets at the end of the year 247 873

Funded status (17) (20)

Unrecognized actuarial loss 86 136

Unrecognized transitional obligation (19) (17)

Unrecognized prior service cost 9—

Net prepaid gratuity cost 59 99

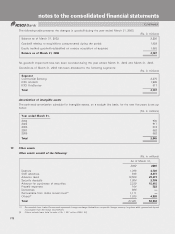

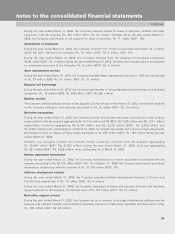

The components of the net gratuity cost are set out below:

(Rs. in millions)

Year ended March 31,

2001 2002 2003

Service cost 12 29 69

Interest cost 16 25 64

Expected return on assets (16) (29) (70)

Amortization of transition asset/liability (1) (1) 1

Amortization of prior service cost 111

Actuarial (gain)/loss —22

Net gratuity cost 12 27 67

Continued

notes to the consolidated financial statements