ICICI Bank 2003 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

F78

Continued

notes to the consolidated financial statements

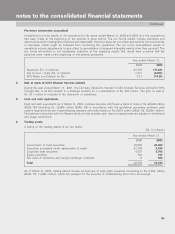

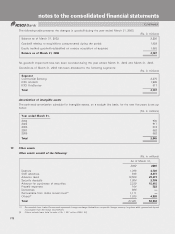

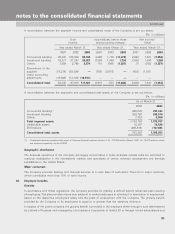

The following table presents the changes in goodwill during the year ended March 31, 2003.

(Rs. in millions)

Balance as of March 31, 2002 2,250

Goodwill relating to acquisitions consummated during the period 1,454

Equity method goodwill reclassified on reverse acquisition of acquiree 1,083

Balance as of March 31, 2003 4,787

No goodwill impairment loss has been recorded during the year ended March 31, 2002 and March 31, 2003.

Goodwill as of March 31, 2003 has been allocated to the following segments:

(Rs. in millions)

Segment

Commercial Banking 2,275

ICICI Infotech 1,895

ICICI OneSource 617

Total 4,787

Amortization of intangible assets

The estimated amortization schedule for intangible assets, on a straight line basis, for the next five years is set out

below:

(Rs. in millions)

Year ended March 31,

2004 630

2005 617

2006 574

2007 562

2008 562

Total 2,945

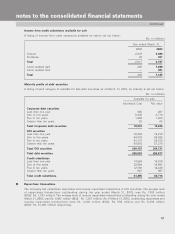

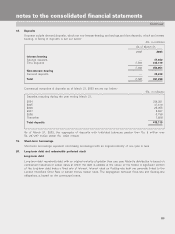

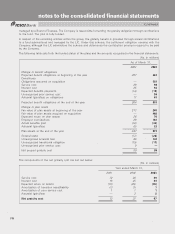

17. Other assets

Other assets consist of the following:

(Rs. in millions)

As of March 31,

2002 2003

Debtors 1,398 4,748

Staff advances 948 2,273

Advance taxes 16,566 28,273

Security deposits 1,004 2,789

Advance for purchases of securities 3,339 15,415

Prepaid expenses 164 522

Derivatives 896 —

Recoverable from Indian Government(1) 1,111 —

Others(2) 1,935 4,926

Total 27,361 58,946

(1) Recoverable from Indian Government represents foreign exchange fluctuations on specific foreign currency long-term debt, guaranteed by and

recoverable from the Indian Government.

(2) Others include loans held for sale of Rs. 1,387 million (2002: Nil).