ICICI Bank 2003 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F69

Continued

notes to the consolidated financial statements

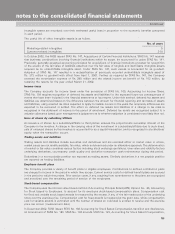

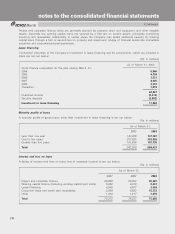

Pro forma information (unaudited)

Unaudited pro forma results of the operations for the years ended March 31, 2002 and 2003 as if the acquisitions

had been made at the beginning of the periods is given below. The pro forma results include estimates and

assumptions which management believes are reasonable. However, these do not reflect any benefits from economies

or synergies, which might be achieved from combining the operations. The pro forma consolidated results of

operations include adjustments to give effect to amortization of acquired intangible assets other than goodwill. The

pro forma information is not necessarily indicative of the operating results that would have occurred had the

purchase been made at the beginning of the periods presented.

Year ended March 31,

2002 2003

Revenues (Rs. in millions) 87,274 111,421

Net income / (loss) (Rs. in millions) 1,231 (8,017)

EPS (Basic and Diluted) (in Rs.) 3.13 (14.24)

4. Sale of stock of ICICI Infotech Services Limited

During the year ended March31,2001, the Company diluted its interest in ICICI Infotech Services Limited to 92%

through sale of an 8% interest to a strategic investor for a consideration of Rs. 576million. The gain on sale of

Rs.511million is included in the statement of operations.

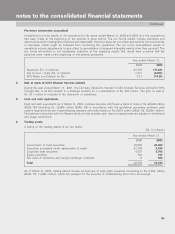

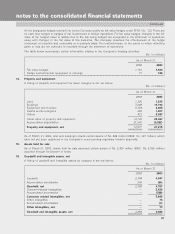

5. Cash and cash equivalents

Cash and cash equivalents as of March 31, 2003, includes deposits with Reserve Bank of India of Rs. 45,506 million

(2002: Nil) (including Rs. 39,805 million (2002: Nil) in accordance with the guidelines governing minimum cash

reserve requirements) and interest-bearing deposits with other banks of Rs. 6,919 million (2002: Rs. 35,508million).

The balance maintained with the Reserve Bank of India towards cash reserve requirements are subject to withdrawal

and usage restrictions.

6. Trading assets

A listing of the trading assets is set out below:

(Rs. in millions)

Year ended March 31,

2002 2003

Government of India securities 15,602 26,658

Securities purchased under agreements to resell 21,399 5,399

Corporate debt securities 4,627 6,704

Equity securities 742 187

Fair value of derivative and foreign exchange contracts 6686

Total 42,376 39,634

As of March 31, 2003, trading assets include Government of India (GOI) securities amounting to Rs. 8,050million

(2002: Rs. 11,866million), which are pledged for the purpose of collateralizing short- term borrowings.