ICICI Bank 2003 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F39

schedules

forming part of the Consolidated Accounts Continued

SCHEDULE 18

A. SIGNIFICANT ACCOUNTING POLICIES

1. Overview

ICICI Bank Limited together with its subsidiaries, joint ventures and associates (collectively, the Group) is a diversified

financial services group providing a variety of banking and financial services including project finance, working capital

finance, venture capital finance, investment banking, treasury products and services, retail banking and broking.

ICICI Bank Limited (‘ICICI Bank’ or ‘the Bank’), incorporated in Vadodara, India is a publicly held bank engaged in

providing a wide range of banking and financial services including commercial banking and treasury operations. ICICI

Bank is a banking company governed by the Banking Regulation Act, 1949.

2. Principles of consolidation

The consolidated financial statements include the accounts of ICICI Bank, its subsidiaries, associates and joint

ventures.

The Bank consolidates all subsidiaries as defined in Accounting Standard (‘AS’) 21 “Consolidated Financial Statements”

issued by the Institute of Chartered Accountants of India (‘ICAI’) on line by line basis by adding together like items of

assets, liabilities, income and expenses. Further, the Bank accounts for investments in associates as defined by

AS 23 “Accounting for Investments in Associates in Consolidated Financial Statements” by the equity method of

accounting. The Bank has investments in certain joint ventures, which have been consolidated by the proportionate

consolidation method as required by AS 27 on “Financial Reporting of Interests in Joint Ventures.”

3. Basis of preparation

In fiscal 2001, ICICI Bank acquired and merged Bank of Madura into itself in an all-stock deal. Effective March 30,

2002, ICICI Bank acquired ICICI Limited (‘ICICI’) and two of its retail finance subsidiaries, ICICI Personal Financial

Services Limited (‘I PFS’) and ICICI Capital Services Limited (‘I CAPS’) along with ICICI’s interest in its subsidiaries

in an all-stock deal. The amalgamation was accounted for as per the approved Scheme of Amalgamation and the

purchase method of accounting.

The accounting and reporting policies of the Group used in the preparation of these financial statements conform with

the Accounting Standards issued by ICAI, the guidelines issued by the Reserve Bank of India (‘RBI’), Insurance

Regulatory and Development Association (‘IRDA’) and National Housing Bank (‘NHB’) from time to time as applicable

to relevant companies and generally accepted accounting principles prevailing in India.

The Group follows the accrual method of accounting and historical cost convention.

The preparation of financial statements requires the management to make estimates and assumptions considered in

the reported amounts of assets and liabilities (including contingent liabilities) as of the date of the financial statements

and the reported income and expenses during the reporting period. Management believes that the estimates used in

the preparation of the financial statements are prudent and reasonable. Future results could differ from these estimates.

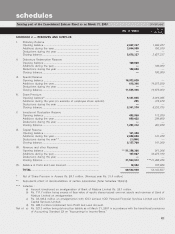

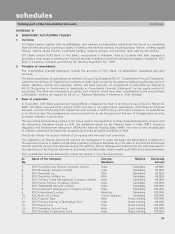

The consolidated financial statements include the results of the following entities :

Sr. Name of the Company Country/ Relation Ownership

No. Residence Interest

1. ICICI Securities and Finance Company Limited India Subsidiary 99.92%

2. ICICI Brokerage Services Limited India Subsidiary 99.92%

3. ICICI Securities Inc. USA Subsidiary 99.92%

4. ICICI Securities Holding Inc. USA Subsidiary 99.92%

5. ICICI Venture Funds Management Company Limited India Subsidiary 99.99%

6. ICICI Home Finance Company Limited India Subsidiary 100.00%

7. ICICI Trusteeship Services Limited India Subsidiary 100.00%

8. ICICI Investment Management Company Limited India Subsidiary 100.00%

9. ICICI International Limited Mauritius Subsidiary 100.00%

10. ICICI Bank UK Limited United Kingdom Subsidiary 100.00%

11. ICICI Property Trust India Direct holding 100.00%

12. ICICI Eco-net Internet & Technology Fund India Direct holding 92.12%

13. ICICI Equity Fund India Direct holding 100.00%

14. ICICI Emerging Sectors Fund India Direct holding 100.00%

15. ICICI Strategic Investments Fund India Direct holding 100.00%