ICICI Bank 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Business Overview

ICICI Bank-led consortium for the setting up of a multi-commodity exchange for trading in

various commodities.

ORGANIZATION STRUCTURE

ICICI Bank’s organizational structure is designed to support its business goals, and is flexible

while at the same time seeking to ensure effective control and supervision and consistency

in standards across business groups. The organization structure is divided into five principal

groups – Retail Banking, Wholesale Banking, Project Finance & Special Assets Management,

International Business and Corporate Centre.

The Retail Banking Group comprises ICICI Bank’s retail assets business including various

retail credit products, retail liabilities (including our own deposit accounts and services as

well as distribution of third party liability products), and credit products and banking services

for the small enterprises segment.

The Wholesale Banking Group comprises ICICI Bank’s corporate banking business including

credit products and banking services, with dedicated groups for corporate clients,

Government sector clients, financial institutions and rural and micro-banking and

agri-business. Structured finance, credit portfolio management and proprietary trading also

form part of this group.

The Project Finance Group comprises our project finance operations for infrastructure, oil &

gas and manufacturing sectors. The Special Assets Management Group is responsible for

large non-performing and restructured loans.

The International Business Group is responsible for ICICI Bank’s international operations,

including its entry into various geographies as well as products and services for non-resident

Indians (NRIs).

The Corporate Centre comprises all shared services and corporate functions, including finance

and balance sheet management, secretarial, investor relations, risk management, legal, human

resources and corporate branding and communications.

BUSINESS REVIEW

During fiscal 2003, ICICI Bank successfully continued the process of diversifying its asset

base and building a de-risked portfolio. Our ability to develop customized solutions, our

speed of execution and our successful leveraging of technology have helped us develop

innovative financial solutions for our customers in diverse areas such as the retail segment,

agri-business and the corporate sector.

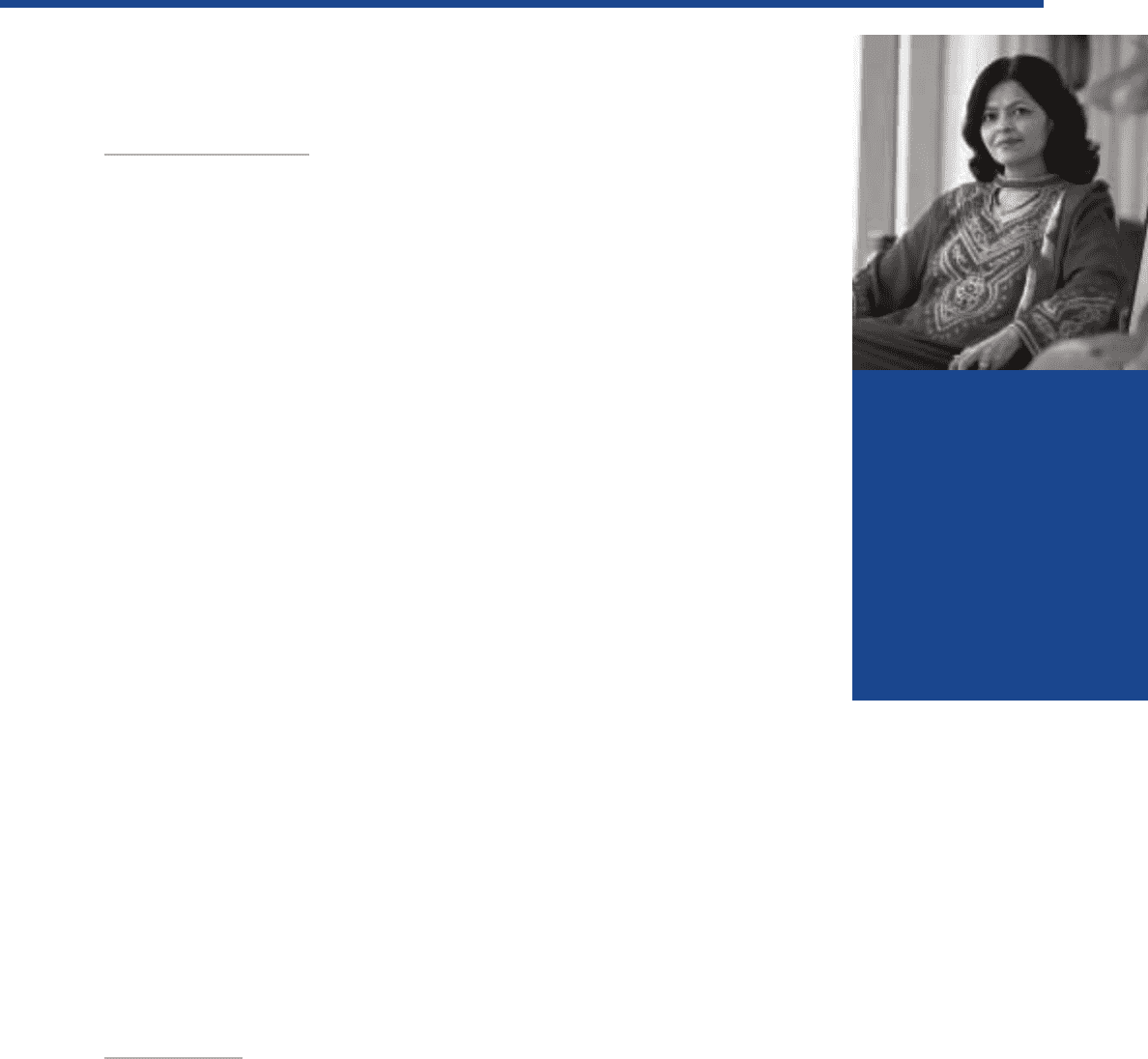

Foreseeing and indeed, driving

change, adapting to it and

continuously raising the bar

higher is what keeps us

motivated and focused.

This is supported by a flexible

corporate structure that

encourages initiative and

innovation.

Kalpana Morparia

Executive Director