ICICI Bank 2003 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F61

Continued

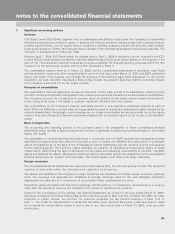

notes to the consolidated financial statements

of the inherent uncertainty of the valuations, those estimated values may differ significantly from the values that

would have been used had a ready market for the investments existed.

Trading liabilities represent borrowings from banks in the inter-bank call money market, borrowings from banks and

corporates in the course of trading operations and balances arising from repurchase transactions.

Loans

Loans are reported at the principal amount outstanding, inclusive of interest accrued and due per the contractual

terms, except for certain non-readily marketable privately placed debt instruments, which are considered credit

substitutes and are, therefore classified as loans but accounted for as debt securities. Loan origination fees (net of

loan origination costs) are deferred and recognized as an adjustment to yield over the life of the loan. Interest is

accrued on the unpaid principal balance and is included in interest income.

Loans include aggregate rentals on lease financing transactions and residual values, net of security deposits and

unearned income. Lease financing transactions substantially represent direct financing leases. Loans also include the

aggregate value of purchased securitized receivables, net of unearned income.

The Company identifies a commercial loan as impaired and places it on non-accrual status when it is probable that

it will be unable to collect the scheduled payments of principal and interest due under the contractual terms of the

loan agreement. A commercial loan is also considered to be impaired and placed on a non-accrual basis if interest

or principal is greater than 180 days overdue. Delays or shortfalls in loan payments are evaluated along with other

factors to determine if a loan should be classified as impaired. The decision to classify a loan as impaired is also

based on an evaluation of the borrower’s financial condition, collateral, liquidation value and other factors that affect

the borrower’s ability to pay.

The Company classifies a loan as a restructured loan where it has made concessionary modifications, that it would

not otherwise consider, to the contractual terms of a loan to a borrower experiencing financial difficulties. Such loans

are placed on non-accrual status.

Generally, at the time a loan is placed on non-accrual status, interest accrued and uncollected on the loan in the

current fiscal year is reversed from income, and interest accrued and uncollected from the prior year is charged off

against the allowance for loan losses. Thereafter, interest on non-accrual loans is recognized as interest income only

to the extent that cash is received. When borrowers demonstrate over an extended period the ability to repay a loan

in accordance with the contractual terms of a loan, which the Company classified as non-accrual, the loan is returned

to accrual status. With respect to restructured loans, performance prior to the restructuring or significant events that

coincide with the restructuring are evaluated in assessing whether the borrower can meet the rescheduled terms

and may result in the loan being returned to accrual status after a performance period.

Consumer loans are generally identified as impaired not later than a predetermined number of days overdue on a

contractual basis. The number of days is set at an appropriate level by loan product. The policy for suspending

accruals of interest and impairment on consumer loans varies depending on the terms, security and loan loss

experience characteristics of each product.

Allowance for loan losses

The allowance for loan losses represents management’s estimate of probable losses inherent in the portfolio. Larger

balance, non-homogenous exposures representing significant individual credit exposures are evaluated based upon

the borrower’s overall financial condition, resources and payment record and the realizable value of any collateral.

Within the allowance of loan losses, a valuation allowance is maintained for larger-balance, non-homogenous loans

that have been individually determined to be impaired. This estimate considers all available evidence including the

present value of the expected future cash flows discounted at the loan’s contractual effective rate and the fair value

of collateral.

Each portfolio of smaller-balance, homogenous loans, including consumer mortgage, installment, revolving credit and

most other consumer loans, is individually evaluated for impairment. The allowance for loan losses attributed to

these loans is established via a process that includes an estimate of probable losses inherent in the portfolio, based

upon various statistical analysis. These include migration analysis, in which historical delinquency and credit loss

experience is applied to the current ageing of the portfolio, together with an analysis that reflects current trends and

conditions.

While determining the adequacy of the allowance for loan losses, management also considers overall portfolio

indicators including historical credit losses, delinquent and non-performing loans, and trends in volumes and terms

of loans; an evaluation of overall credit quality and the credit process, including lending policies and procedures;

consideration of economic, geographical, product, and other environmental factors.