ICICI Bank 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Directors’ Report

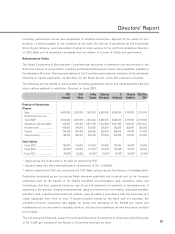

Rs. billion

Fiscal 2003 Fiscal 2002

Dividend for the year (proposed)

– On equity shares @ 75% .................................................... 4.60 0.44

– On preference shares (Rs.) .................................................... 35,000 —

– Corporate dividend tax ......................................................... 0.59 0.05

Leaving balance to be carried forward to the next year ......... 0.04 0.19

1In addition to appropriation of disposable profits, the balance in the Debenture Redemption Reserve of

Rs. 0.10 billion was transferred to Revenue and other Reserves in fiscal 2003.

SUBSIDIARY COMPANIES

At March 31, 2003, ICICI Bank had twelve subsidiaries:

Domestic Subsidiaries International Subsidiaries

ICICI Securities Limited ICICI Bank UK Limited1

ICICI Venture Funds Management Company Limited ICICI Securities Holdings Inc.2

ICICI Prudential Life Insurance Company Limited ICICI Securities Inc.3

ICICI Lombard General Insurance Company Limited ICICI International Limited

ICICI Home Finance Company Limited

ICICI Investment Management Company Limited

ICICI Trusteeship Services Limited

ICICI Brokerage Services Limited2

1Awaiting UK regulatory approval for commencement of business

2Subsidiary of ICICI Securities Limited

3Subsidiary of ICICI Securities Holdings Inc.

In terms of the approval granted by the Central Government vide letter dated June 11, 2003 under Section

212(8) of the Companies Act, 1956, a copy of the balance sheet, profit & loss account, report of the Board

of Directors and report of the Auditors of the subsidiary companies has not been attached to the accounts

of the Bank for the year ended March 31, 2003. The Bank will make available these documents/details upon

request by any member of the Bank. These documents/details will also be available on the Bank’s website.

As required by Accounting Standard 21 (AS-21) issued by the Institute of Chartered Accountants of India, the

Bank’s consolidated financial statements incorporate the accounts of its subsidiaries, except those of

ICICI Bank UK Limited. ICICI Bank UK Limited was incorporated on February 11, 2003 and is yet to commence

operations and hence, its accounts have not been drawn up.

In May 2003, the Bank acquired the entire paid-up equity share capital of Transamerica Apple Distribution

Finance Private Limited. The Company is now a wholly-owned subsidiary of ICICI Bank and has been renamed

as ICICI Distribution Finance Private Limited.