ICICI Bank 2003 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F46

schedules

forming part of the Consolidated Accounts Continued

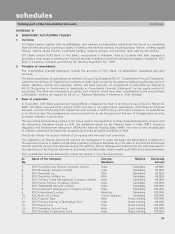

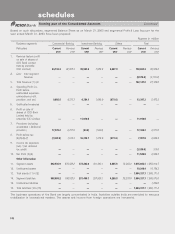

8. Related party transactions

ICICI Bank has entered into transactions with the following related parties :

• Affiliates of the Bank;

• Whole-time Directors of the Group

The related party transactions can be categorised as follows:

Rupees in million

Whole-time

Associates (1) & (2) Directors Total

Deposits 161.5 20.3 181.8

Receiving of services 92.8 — 92.8

Insurance Premium paid 106.0 — 106.0

(1) Prudential ICICI Asset Management Company Limited, Prudential ICICI Trust Limited, TCW/ICICI Investment Partners

L.L.C.

(2) Includes transactions with ICICI Prudential Life Insurance Company Limited and ICICI Lombard General Insurance

Company Limited which have been accounted for as joint ventures in the consolidated financial statements.

Remuneration paid to the Whole-time Directors of ICICI Bank Limited during the year ended March 31, 2003 was

Rs. 41.0 million.

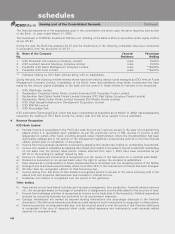

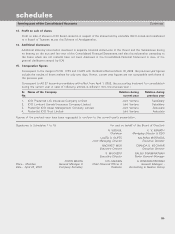

9. Earnings Per Share (’EPS’)

The Group reports basic and diluted earnings per equity share in accordance with Accounting Standard-20 (AS-20),

Earnings per Share. Basic earnings per share is computed by dividing net profit after tax by the weighted average

number of equity shares outstanding for the year. Diluted earnings per share is computed using the weighted average

number of equity shares and dilutive potential equity shares outstanding during the year.

The computation of Earnings per Share is set out below :

Rupees in million except per share data

March 31, 2003 March 31, 2002

Basic

Weighted Average no. of equity shares outstanding (Nos.) .................. 613,031,569 *222,510,311

Net Profit ................................................................................................... 11,520 2,583.0

Earnings per Share (Rs.) ........................................................................... 18.79 11.61

Diluted

Weighted Average no. of equity shares outstanding (Nos.) .................. 613,750,295 *222,510,311

Net Profit ................................................................................................... 11,520 2,583.0

Earnings per Share (Rs.) ........................................................................... 18.77 11.61

Nominal Value per share (Rs.) ................................................................. 10.00 10.00

• 39,26,72,724 shares issued on amalgamation of ICICI Limited have been considered for computation of weighted

average number of equity shares.

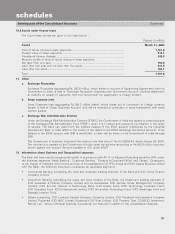

10. Assets under lease

10.1 Assets under operating lease

The future lease rentals are given in the table below :

Rupees in million

Period March 31, 2003

Not later than one year ............................................................................ 111.9

Later than one year and not later than five years ................................. 545.6

Later than five years ................................................................................. 472.0

Total ........................................................................................................... 1,129.5