ICICI Bank 2003 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F36

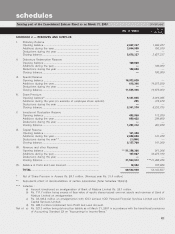

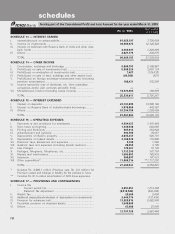

SCHEDULE 8 — INVESTMENTS [Net of provision]

I. Investments in India

i) Government securities ......................................................... 273,352,054 243,048,521

ii) Other approved securities ................................................... 344,477 704,645

iii) Shares ................................................................................... 26,388,366 25,970,806

iv) Debentures and Bonds ....................................................... 62,215,264 69,590,999

v) Subsidiaries, joint ventures and/or associates ................... 14,426 —

vi) Others (CPs, Mutual Fund Units, etc.) ............................... 15,367,731 33,326,766

TOTAL ............................................................................................ 377,682,318 372,641,737

II. Investments outside India

i) Subsidiaries and/or joint ventures abroad .......................... ——

ii) Others ................................................................................... 71,192 106,679

TOTAL ............................................................................................ 71,192 106,679

GRAND TOTAL (I + II) .................................................................. 377,753,510 372,748,416

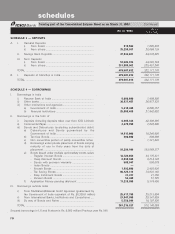

SCHEDULE 9 — ADVANCES

A. i) Bills purchased and discounted .......................................... 4,376,415 16,541,223

ii) Cash credits, overdrafts and loans repayable on demand 31,340,244 24,025,073

iii) Term loans ............................................................................ 495,323,675 430,200,453

iv) Securitisation, Finance lease and Hire Purchase receivables 8,049,316 8,305,770

TOTAL ............................................................................................ 539,089,650 479,072,519

B. i) Secured by tangible assets

[includes advances against Book Debt] ............................. 506,696,440 446,042,464

ii) Covered by Bank/Government Guarantees ........................ 16,998,486 10,293,612

iii) Unsecured ............................................................................ 15,394,724 22,736,443

TOTAL ............................................................................................ 539,089,650 479,072,519

C. I. Advances in India

i) Priority Sector ............................................................. 89,376,024 19,859,144

ii) Public Sector ............................................................... 18,974,073 43,562,087

iii) Banks ........................................................................... 1,013,245 1,794,497

iv) Others .......................................................................... 429,190,181 413,236,370

TOTAL ............................................................................................ 538,553,523 478,452,098

II. Advances outside India

i) Due from banks .......................................................... ——

ii) Due from others ......................................................... ——

a) Bills purchased and discounted ....................... ——

b) Syndicated loans ................................................ ——

c) Others ................................................................. 536,127 620,421

TOTAL ............................................................................................ 536,127 620,421

GRAND TOTAL (C. I and II) .......................................................... 539,089,650 479,072,519

(Rs. in ‘000s) As on

31.03.2002

schedules

forming part of the Consolidated Balance Sheet as on March 31, 2003

Continued