ICICI Bank 2003 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F82

Continued

notes to the consolidated financial statements

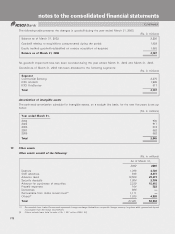

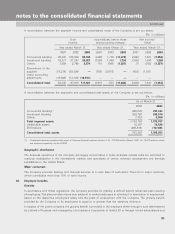

The Company periodically advances loans/contributions for specified purposes out of these funds and reports such

utilizations to the GOI/KfW. However, no time schedule has been specified for the usage of the funds. In the event

that the funds are not utilized for specified purposes, the GOI/KfW have the right to require repayment of the grant/

retained interest. Additionally, KfW can modify the scope of the specified purposes. The Company retains the income

derived from the loans made out of the funds. Similarly, it bears the risks of default on the loans.

The interest repaid by the GOI in the form of grants and the interest retained under the agreement with KfW do not

represent contributions as they specify donor-imposed conditions, the breach of which, would enable the donor to

demand repayment of the grants/retained interest. Accordingly, the grants/retained interest have been reported as

liabilities.

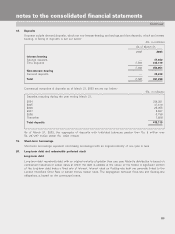

Other liabilities as of March 31, 2003, include grants of Rs. 2,052 million (2002:Rs. 2,689million) and retained

interest of Rs. 496 million (2002: Rs. 439 million).

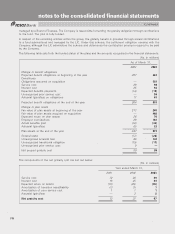

22. Common stock

The Company presently has only one class of common stock. In the event of liquidation of the affairs of the

Company, all preferential amounts, if any, shall be discharged by the Company. The remaining assets of the Company,

after such discharge, shall be distributed to the holders of common stock in proportion to the common stock held

by shareholders.

The Company has issued American Depository Shares (ADS) representing underlying common stock. The common

stock represented by the ADS is similar to other common stock, except for voting rights. While every holder of

common stock, as reflected in the records of the Company, has one vote in respect of each share held, the ADS

holders have no voting rights due to a condition contained in the approval of the offering from the Ministry of Finance

of India. Under the depository agreement, the depository of the ADS will vote as directed by the Board of Directors

of the Company.

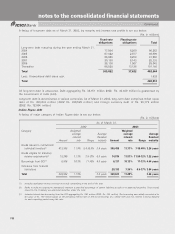

As discussed in Note 3, the Company consummated the reverse acquisition with the acquiree effective April 1, 2002,

whereby shareholders of the Company were issued common shares of the acquiree in the ratio of 1:2. The effect

of the reverse acquisition on the capital structure (including outstanding stock options) of the Company has been

retroactively adjusted in the financial statements. On consummation of the reverse acquisition, adjustments were

made to the value of the common stock and the additional paid in capital.

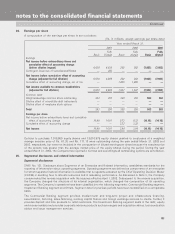

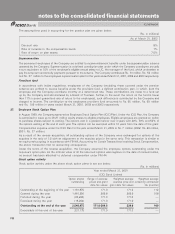

23. Retained earnings and dividends

Retained earnings at March 31, 2003 computed as per generally accepted accounting principles of India

include profits aggregating to Rs.5,514million which are not distributable as dividends under the

Banking Regulation Act, 1949. These relate to requirements regarding earmarking a part of the profits under banking

laws in India. Utilization of these balances is subject to approval of the Board of Directors and needs to be reported

to Reserve Bank of India. Statutes governing the operations of the Company mandate that dividends be declared out

of distributable profits only after the transfer of at least 25% of net income each year, computed in accordance with

current banking regulations, to a statutory reserve. Additionally, the remittance of dividends outside India is governed

by Indian statutes on foreign exchange transactions.

Retained earnings as of March 31, 2002, include profits aggregating to Rs. 12,153 million (2001: Rs. 11,875 million),

which are not distributable as dividends under Indian company law. These relate to profits on redemption of

preferred stock and requirements regarding earmarking a part of profits under banking laws.

Retained earnings as of March31, 2003, include reserves of Rs. 10,940million (2002:Rs. 10,866million) earmarked

under Indian tax laws to avail tax benefits and which are not distributable as dividends. Any transfer of balances from

such earmarked reserves would result in withdrawal of the tax exemption on the transferred amounts.