ICICI Bank 2003 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F72

Continued

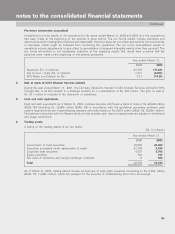

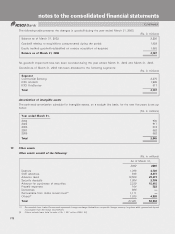

8. Investments in affiliates

The acquiree

For the year ended March 31, 2002, the Company accounted for its 46% (2001: 46.4%) interest in the acquiree using

the equity method. The carrying value of the investment in the acquiree as of March 31, 2002, was Rs. 8,204 million

(2001: Rs. 7,562 million). The Company’s equity in the income of the acquiree for the year ended March 31, 2002

was Rs. 929 million (2001:Rs.811 million). During the year ended March 31, 2002, the Company received dividends

of Rs. 403 million (2001: Rs. 184 million) from the acquiree.

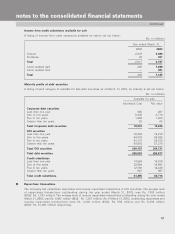

The summarized balance sheets and statements of income of the acquiree are set out below:

(Rs. in millions)

Balance sheet As of March 31,

2001 2002

Cash and cash equivalents 47,306 89,371

Trading assets 18,725 26,075

Securities 35,731 180,052

Loans 93,030 72,474

Other assets 25,746 36,833

Total assets 220,538 404,805

Deposits 164,254 325,221

Trading liabilities 5,958 1,237

Long-term debt 2,421 5,740

Other liabilities 31,598 54,457

Stockholders’ equity 16,307 18,150

Total liabilities and stockholders’ equity 220,538 404,805

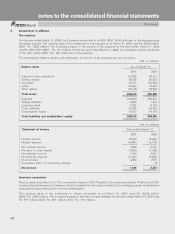

(Rs. in millions)

Statement of income Year ended March 31,

2001 2002

Interest income 12,406 20,837

Interest expense (8,408) (15,116)

Net interest income 3,998 5,721

Provision for loan losses (1,082) (1,722)

Non-interest income 1,754 5,213

Non-interest expense (3,104) (6,260)

Income taxes (258) (931)

Cumulative effect of accounting change — 16

Net income 1,308 2,037

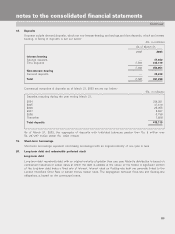

Insurance companies

The Company accounts for its 74% ownership interest in ICICI Prudential Life Insurance Limited (‘Prulife’) and ICICI

Lombard General Insurance Company Limited (‘Lombard’) by the equity method of accounting because of substantive

participative rights held by the minority shareholders.

The carrying value of the investment in these companies as of March 31, 2003, was Rs. 2,230million

(2002: Rs. 1,496 million). The Company’s equity in the loss of these affiliates for the year ended March 31, 2003 was

Rs. 971 million (2002: Rs. 681 million, 2001:Rs. 118million).

notes to the consolidated financial statements