ICICI Bank 2003 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

F79

Continued

notes to the consolidated financial statements

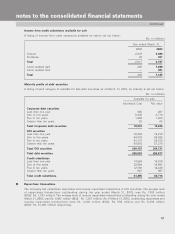

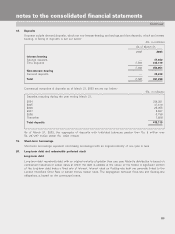

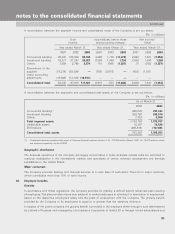

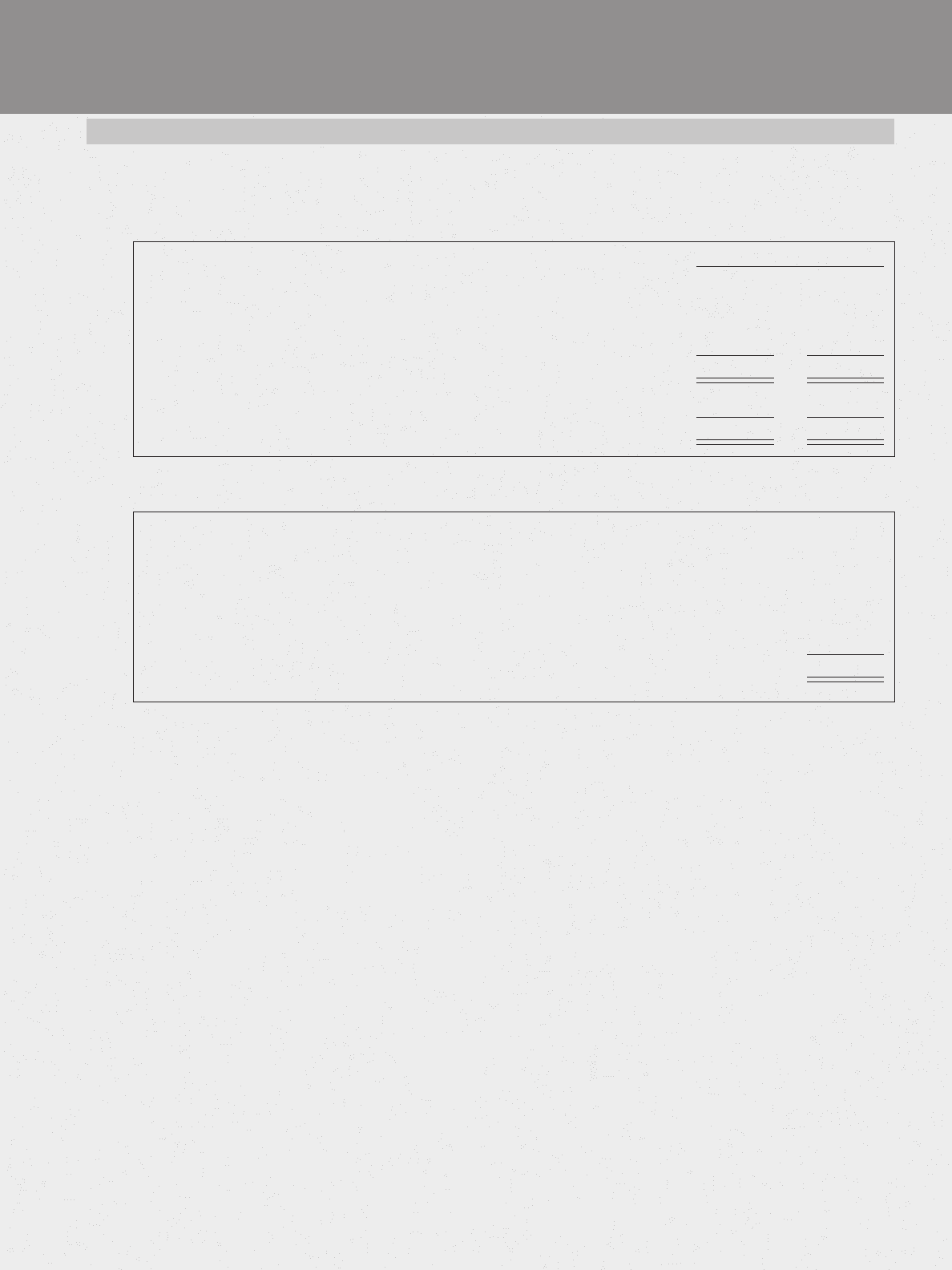

18. Deposits

Deposits include demand deposits, which are non-interest-bearing, and savings and time deposits, which are interest

bearing. A listing of deposits is set out below:

(Rs. in millions)

As of March 31,

2002 2003

Interest bearing

Savings deposits —37,932

Time deposits 7,380 418,119

7,380 456,051

Non-interest bearing

Demand deposits —35,239

Total 7,380 491,290

Contractual maturities of deposits as of March 31, 2003 are set out below:

(Rs. in millions)

Deposits maturing during the year ending March 31,

2004 334,351

2005 37,410

2006 25,055

2007 6,697

2008 6,798

Thereafter 7,808

Total deposits 418,119

As of March 31, 2003, the aggregate of deposits with individual balances greater than Rs. 5million was

Rs. 267,297 million (2002: Rs. 1,922million).

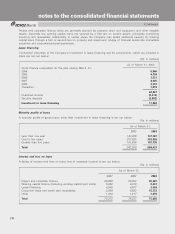

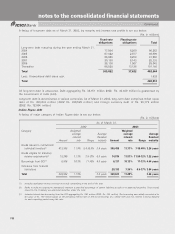

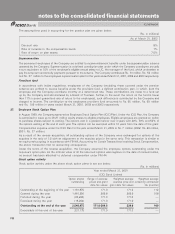

19. Short-term borrowings

Short-term borrowings represent non-trading borrowings with an original maturity of one year or less.

20. Long-term debt and redeemable preferred stock

Long-term debt

Long-term debt represents debt with an original maturity of greater than one year. Maturity distribution is based on

contractual maturities or earlier dates at which the debt is callable at the option of the holder. A significant portion

of the long-term debt bears a fixed rate of interest. Interest rates on floating-rate debt are generally linked to the

London Inter-Bank Offer Rate or similar money market rates. The segregation between fixed-rate and floating-rate

obligations is based on the contractual terms.