ICICI Bank 2003 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F98

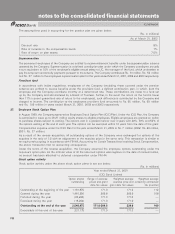

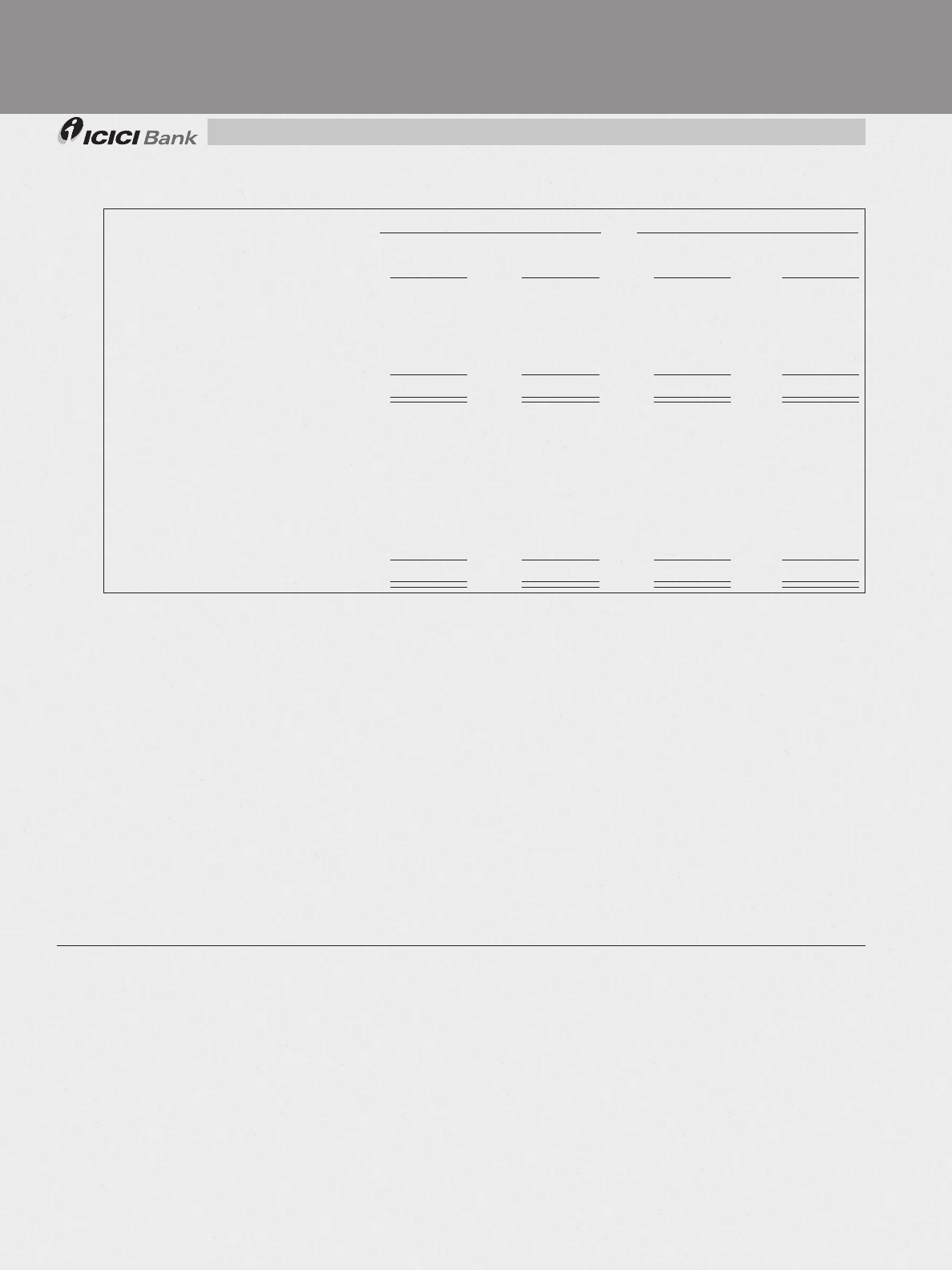

A listing of the fair values by category of financial assets and financial liabilities is set out below:

(Rs. in millions)

As of March 31, 2002 As of March 31, 2003

Carrying Estimated Carrying Estimated

value fair value value fair value

Financial assets

Trading account assets 42,376 42,376 39,634 39,634

Securities (Note 1) 60,046 60,046 280,621 280,621

Loans (Note 2) 523,601 527,167 630,421 641,048

Other financial assets (Note 3) 46,259 46,259 115,705 115,705

Total 672,282 675,848 1,066,381 1,077,008

Financial liabilities

Interest-bearing deposits 7,380 7,609 456,051 454,251

Non-interest-bearing deposits ——35,239 35,239

Trading account liabilities 17,105 17,105 26,086 26,086

Short-term borrowings 70,804 70,954 42,095 42,017

Long-term debt 511,458 540,649 400,812 426,928

Redeemable preferred stock 772 980 853 1,035

Other financial liabilities (Note 4) 4,783 4,783 43,252 43,252

Total 612,302 642,080 1,004,388 1,028,808

Note 1: Includes non-readily marketable equity securities of Rs. 9,418million (2002: Rs. 8,268 million) for which there are no readily determinable

fair values.

Note 2: The carrying value of loans is net of the allowance for loan losses, security deposits and unearned income.

Note 3: Includes cash and cash equivalents and customers acceptance liability for which the carrying value is a reasonable estimate of fair value.

Note 4: Represents acceptances outstanding, for which the carrying value is a reasonable estimate of fair value.

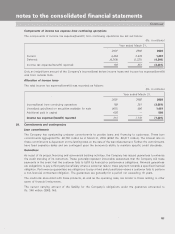

32. Regulatory matters

Subsequent to the reverse acquisition of the acquiree, the Company is a banking company within the meaning of

the Indian Banking Regulation Act, 1949, registered with and subject to examination by the Reserve Bank of India.

Statutory liquidity requirements

In accordance with the Banking Regulation Act, 1949, the Company is required to maintain a specified percentage

of its net demand and time liabilities by way of liquid unencumbered assets like cash, gold and approved securities.

The amount of securities required to be maintained at March 31, 2003 was Rs. 230,644 million (2002: Nil).

Capital adequacy requirements

The Company is subject to the capital adequacy requirements set by the Reserve Bank of India, which stipulate a

minimum ratio of capital to risk adjusted assets and off-balance sheet items of 9% to be maintained. The capital

adequacy ratio of the Company calculated in accordance with the Reserve Bank of India guidelines at March31,2003,

was 11.10%.

For and on behalf of the Board

K.V. KAMATH KALPANA MORPARIA

Managing Director & Chief Executive Officer Executive Director

JYOTIN MEHTA N. S. KANNAN

General Manager & Company Secretary Chief Financial Officer & Treasurer

G. VENKATAKRISHNAN BALAJI SWAMINATHAN

General Manager Senior General Manager

Corporate Accounts & Taxation