ICICI Bank 2003 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F70

Continued

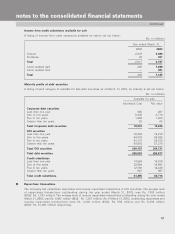

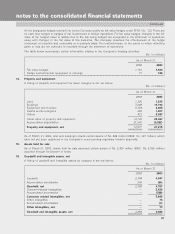

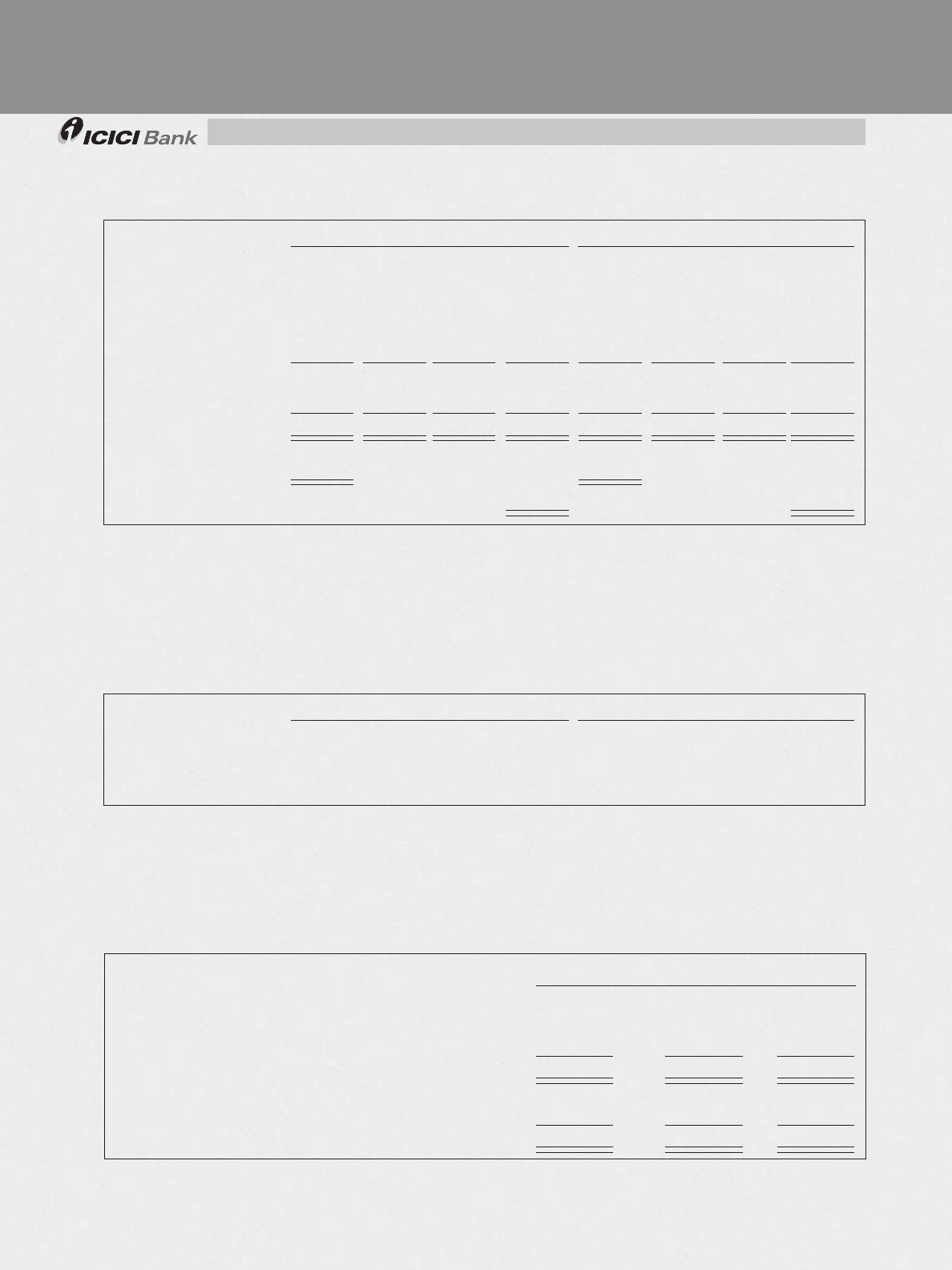

7. Securities

The portfolio of securities is set out below:

(Rs. in millions)

As of March 31, 2002 As of March 31, 2003

Amortized Gross Gross Fair Amortized Gross Gross Fair

cost unrealized unrealized value cost unrealized unrealized value

gain loss gain loss

Available for sale

Corporate debt securities 4,446 502 (513) 4,435 10,636 389 (79) 10,946

GOI securities 26,662 438 — 27,100 240,187 4,403 (459) 244,131

Total debt securities 31,108 940 (513) 31,535 250,823 4,792 (538) 255,077

Equity securities 19,181 365 (3,223) 16,322 13,609 745 (1,932) 12,422

Total securities available

for sale 50,289 1,305 (3,736) 47,857 264,432 5,537 (2,470) 267,499

Non-readily marketable

equity securities

(1)

8,268 9,418

Venture capital investments

(2)

3,921 3,704

(1) Primarily represents securities acquired as a part of project financing activities or conversion of loans in debt restructurings.

(2) Represents venture capital investments held by venture capital subsidiaries of the Company.

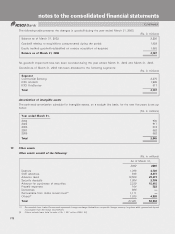

During the year ended March 31, 2003, as part of its ongoing evaluation of its securities portfolio, the Company

recorded an impairment charge of Rs.2,098million (2002: Rs.3,480million, 2001: Rs.1,835million) for other

than temporary decline in value of available for sale and non-readily marketable equity securities.

Privately placed corporate debt securities reported as loans (credit substitutes).

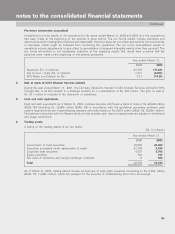

The portfolio of credit substitutes is set out below:

(Rs. in millions)

As of March 31, 2002 As of March 31, 2003

Amortized Gross Gross Fair Amortized Gross Gross Fair

cost unrealized unrealized value cost unrealized unrealized value

gain loss gain loss

Available for sale 59,707 1,077 (502) 60,282 61,295 2,539 (1,118) 62,716

During the year ended March 31, 2002, the Company sold debt securities classified as held to maturity. The debt

securities were sold for Rs.640 million resulting in a realized gain of Rs.102 million. As the securities were sold

for reasons other than those specified in SFAS No. 115, all remaining held to maturity securities were reclassified

as available for sale. Subsequent to the sale, the Company no longer classifies debt securities as held to maturity.

Income from securities available for sale

A listing of income from securities available for sale is set out below:

(Rs. in millions)

Year ended March 31,

2001 2002 2003

Interest 123 1,027 16,633

Dividends 345 267 389

Total 468 1,294 17,022

Gross realized gain 474 1,238 6,845

Gross realized loss (348) (7) (5,022)

Total 126 1,231 1,823

notes to the consolidated financial statements