ICICI Bank 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

Table of contents

-

Page 1

-

Page 2

...system enables our customers 24x7 access, country-wide. Our committed team of employees, equipped with world-class technology and financial skills, works to devise new solutions, enhance our responsiveness to customer needs and improve our services. So that we can help to make their lives easier and...

-

Page 3

... ...8 Business Overview ...9 Directors' Report ...33 Management's Discussion and Analysis ...52 Particulars of Employees under Section 217 (2A) of the Companies Act, 1956 ...F1 Financials ...F2 Auditors' Report ...F3 Balance Sheet ...F4 Profit and Loss Account ...F5 Schedules & Notes ...F6 Cash Flow...

-

Page 4

... lines seen in developed markets. In the short span of time that they have been in existence, the leading new private sector banks have truly revolutionised banking in India. Their focus on technology and customer convenience has brought about a paradigm shift in the banking business. Indeed, this...

-

Page 5

...customer base have resulted in rapid business growth. We have achieved leadership positions across diverse businesses, from retail credit to life insurance. We have completed our transformational change from a single product financial services company to a true universal bank. Going forward, the key...

-

Page 6

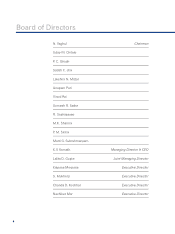

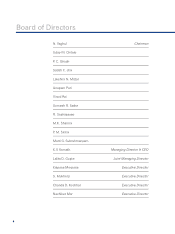

...Somesh R. Sathe R. Seshasayee M.K. Sharma P . M. Sinha Marti G. Subrahmanyam K.V. Kamath Lalita D. Gupte Kalpana Morparia S. Mukherji Chanda D. Kochhar Nachiket Mor Managing Director & CEO Joint Managing Director Executive Director Executive Director Executive Director Executive Director Chairman

4

-

Page 7

...LIABILITY MANAGEMENT COMMITTEE Lalita D. Gupte, Chairperson Kalpana Morparia S. Mukherji Chanda D. Kochhar Nachiket Mor SHARE TRANSFER & SHAREHOLDERS'/ INVESTORS' GRIEVANCE COMMITTEE Uday M. Chitale, Chairman Somesh R. Sathe Kalpana Morparia Chanda D. Kochhar (from 01-06-2003) COMMITTEE OF DIRECTORS...

-

Page 8

... Managing Director & CEO

Fiscal 2003 was a historic year for us, being our first year of operations as an integrated entity following the merger of ICICI with ICICI Bank. The year commenced with certain challenges - of effecting the transition quickly and efficiently; and of leveraging the new...

-

Page 9

... mix and our funding profile. Fiscal 2003 saw several other milestones for ICICI Bank. We continued to focus on optimal utilisation of our retail distribution and servicing capabilities to offer enhanced customer convenience and a wide range of in-house and third party products. We commenced our...

-

Page 10

... • • Bill Payment Services • E-Cheques • Branches • ATMs • Internet Banking • Phone Banking

RETAIL BANKING

• Home Loans • Car & Two Wheeler Loans • Consumer/Personal Loans • Savings & Term Deposits • Salary Accounts • Roaming Current Accounts • Investment Products

8

-

Page 11

... and credit policy in April 2003 further reduced the bank rate by 25 basis points to 6.0% and the Cash Reserve Ratio (CRR) to 4.50%.

Our focus is to fulfil the aspirations of NRIs and Indian companies operating abroad. We are all set to navigate new geographies to offer support and services to...

-

Page 12

LIFE ON THE GO "I got the easiest accessibility with the ICICI Bank ATM network. I can now access my account anywhere and anytime. This makes things so much more convenient and easy."

• 24x7 convenience through India's largest network of around 1700 ATMs • More than 50% of transactions through ...

-

Page 13

... Overview

Despite the fact that it was a subdued year for equity capital markets, the National Stock Exchange (NSE) and the Stock Exchange, Mumbai (BSE) ranked third and sixth respectively in the world with respect to number of transactions. The year also witnessed important structural changes...

-

Page 14

... our dream home right from where we were. With ICICI Bank's doorstep service, easy instalment options and fast execution, our dream is now a reality. "

• Doorstep service and innovative deals from India's leading home loan provider for 2002-2003 • More than 2.4 lacs houses financed in the year...

-

Page 15

..., investor relations, risk management, legal, human resources and corporate branding and communications. BUSINESS REVIEW During fiscal 2003, ICICI Bank successfully continued the process of diversifying its asset base and building a de-risked portfolio. Our ability to develop customized solutions...

-

Page 16

... TRACK "I got the best deal with ICICI Bank Auto Loans. Thanks to the simple documentation and formalities, easy instalments and friendly service, I am in top gear today!"

• Reaching out to customers in more than 400 cities across India • Largest financer of auto loans with more than 30% market...

-

Page 17

... of credit and investment products and banking services to our customers is a critical aspect of our retail strategy. ICICI Bank offers a wide range of retail credit products. We have expanded the market significantly over the last few years by taking organized retail credit to a large number of...

-

Page 18

...with the ICICI Bank branches and e-lobbies. In addition, I have access through phone and the internet also. I can now open an account, pay my bills, withdraw money, carry out on-line broking, etc. from anywhere and at anytime."

• Pioneering technology initiatives for customer convenience • More...

-

Page 19

... a single view of the customer's relationship with us. ICICI Bank's mobile banking services provide the latest information on account balances, previous transactions, credit card outstanding and payment status and allow customers to request a cheque book or account statement. ICICI Bank has now...

-

Page 20

...AT WORK "My company found the most convenient solution in ICICI Bank Cash Management Services. Right from all India collections and multi-city payments to customized MIS and ERP integration, the Bank takes care of everything."

• Services availed by over 500 top corporates of India • Coverage of...

-

Page 21

... in a secure environment. ICICI Bank offers online foreign exchange and debt securities trading services. A dedicated Product & Technology Group develops and manages back-office processing and delivery systems. Dedicated relationship groups for corporate clients and the Government sector focused on...

-

Page 22

LIFE IN THE MARKETS "My company was able to effectively achieve its risk management objectives, thanks to ICICI Bank's Treasury services. Their team of skilled treasury professionals offered us comprehensive, customized treasury solutions at the finest prices."

• Research backed advisory support ...

-

Page 23

... return on the capital employed but also enabled us to offer a comprehensive solution to our corporate clients. ICICI Bank's dedicated Structured Finance, Credit & Markets Group, with expertise in financial structuring and related legal, accounting and tax issues, actively supports the business...

-

Page 24

... effective support system from ICICI Bank Agri Services. The Bank not only offers loans but also helps me get the right inputs and finds me buyers for my produce."

• More than Rs. 2000 crores of loans to the agri-sector • Loan assistance to more than 50,000 farmers in 2002-2003 • Transforming...

-

Page 25

... balance sheet management function (which now forms part of the Finance Group), the corporate markets business (which has been integrated into the Structured Finance, Credit & Markets Group) and the proprietary trading activity (which is now housed in a separate Proprietary Trading Group). Project...

-

Page 26

...which presents opportunities for structuring and syndicating acquisition financing. Special Assets Management The Special Asset Management Group (SAMG) was formed in fiscal 1998 to build in-house specialised skills in restructuring/recovery activities, restructuring viable projects and seeking early...

-

Page 27

... toll-free service lines (in Canada, USA and UK), chat servicing and a dedicated NRI e-mail handling centre. We have also made considerable progress during fiscal 2003 in establishing our overseas operations. ICICI Bank currently has representative offices in London and New York. The Bank has...

-

Page 28

... ICICI Bank. This group, forming a part of the Corporate Centre, is completely independent of all business operations and is accountable to the Risk and Audit Committees of the Board of Directors. RCAG is organized into six sub-groups: Credit Risk Management Group, Market Risk Group, Credit Policies...

-

Page 29

Business Overview

Market Risk Market risk is the risk of loss resulting from changes in interest rates, foreign currency exchange rates, equity prices and commodity prices. ICICI Bank's exposure to market risk is a function of its trading and asset and liability management activities and its role as...

-

Page 30

...better, so that it can customize products and services to suit customer needs. The Technology Management Group (TMG) is the focal point for ICICI Bank's technology strategy and groupwide technology initiatives. This group reports directly to the Managing Director & CEO. ICICI Bank is focusing on the...

-

Page 31

... the continuous improvement of recruitment, training and performance management processes. While ICICI Bank is India's second-largest bank, it had just over 10,600 employees at March 31, 2003, demonstrating our unique technology-driven, productivity-focused business model. ICICI Bank continues to be...

-

Page 32

... learning mandays per employee in fiscal 2003. Special programmes on functional training and leadership development to build knowledge as well as management capability are conducted at a dedicated training facility. ICICI Bank also draws from the best available training programmes and faculty, both...

-

Page 33

...Managing Director & CEO, heads the Group. The Group is supported by a team of professionals with experience in the field of quality. The Organisational Excellence Group is engaged in institutionalizing quality in the Bank by building skills in various quality frameworks, tracking projects, reporting...

-

Page 34

... awards in recognition of our business strategies, customer service levels, technology focus and human resource practices, including:

"Bank of the Year 2002, in India" by The Banker magazine of UK; "Bank of the Year from the Emerging Markets" by The Banker magazine of UK; "Best Bank in India...

-

Page 35

... Annual Report of ICICI Bank Limited with the audited statement of accounts for the year ended March 31, 2003. FINANCIAL HIGHLIGHTS As the Appointed Date of the merger of erstwhile ICICI Limited (ICICI), ICICI Personal Financial Services Limited (ICICI PFS) and ICICI Capital Services Limited (ICICI...

-

Page 36

... Limited ICICI Venture Funds Management Company Limited ICICI Prudential Life Insurance Company Limited ICICI Lombard General Insurance Company Limited ICICI Home Finance Company Limited ICICI Investment Management Company Limited ICICI Trusteeship Services Limited ICICI Brokerage Services Limited...

-

Page 37

... term as Joint Managing Director on May 31, 2003 and retired with effect from June 1, 2003. During his tenure, the Bank achieved several milestones, including its listing on the New York Stock Exchange (NYSE), the acquisition of Bank of Madura and the merger of ICICI with the Bank, emerging as India...

-

Page 38

... Agriculture & Small Enterprises Business Committee, Board Governance & Remuneration Committee, Business Strategy Committee, Credit Committee, Risk Committee, Share Transfer & Shareholders'/Investors' Grievance Committee, Committee of Directors and Asset Liability Management Committee. A majority of...

-

Page 39

... Share Transfer & Shareholders'/Investors' Grievance Committee and the Board Governance & Remuneration Committee. Bracketed figures indicate Committee Chairmanships. Nominee of Government of India. Participated in three meetings through tele-conference.

3

* **

*** As wholetime Director effective...

-

Page 40

...Committee. V. Board Governance & Remuneration Committee Terms of Reference The functions of the Board Governance & Remuneration Committee include recommendation of appointments to the Board, evaluation of the performance of the Managing Director & CEO, the Board Number of Meetings attended 6 5 5

38...

-

Page 41

... for the Employees Stock Option Scheme, recommendation of grant of stock options to the staff and wholetime Directors of ICICI Bank and its subsidiary companies and formulation of a code of ethics and governance. Remuneration Policy The Board Governance & Remuneration Committee has the power to...

-

Page 42

... 28, 2003) ...VI. Business Strategy Committee Terms of Reference The function of the Committee is to approve the annual income and expenditure and capital expenditure budgets for presentation to the Board for final approval and to review and recommend to the Board the business strategy of ICICI Bank...

-

Page 43

... securities issued from time to time, including those under stock options, review and redressal of shareholders' and investors' complaints, the opening and operation of bank accounts for payment of interest and dividend and the listing of securities on stock exchanges. Composition The Share Transfer...

-

Page 44

... Terms of Reference The functions of the Committee include management of the balance sheet of the Bank, review of the asset-liability profile of the Bank with a view to manage the market risk exposure assumed by the Bank Number of Meetings attended 5 3 5 3

42

and deciding the deposit rates...

-

Page 45

... Extraordinary General Meeting Sixth Annual General Meeting Day & Date Monday, February 21, 2000 Monday, May 29, 2000 3.00 p.m. Time 3.00 p.m. Venue Professor Chandravadan Mehta Auditorium, General Education Centre, Opposite D. N. Hall Ground, The Maharaja Sayajirao University, Pratapgunj, Vadodara...

-

Page 46

... Shareholder Information Ninth Annual General Meeting Date Monday, August 25, 2003 Time 2.00 p.m. Venue Professor Chandravadan Mehta Auditorium, General Education Centre, Opposite D. N. Hall Ground, The Maharaja Sayajirao University, Pratapgunj, Vadodara 390 002 Financial Calendar Book Closure...

-

Page 47

....

ICICI Bank has paid annual listing fees for fiscal 2004 on its capital to all the stock exchanges where its securities are listed. Market Price Information The reported high and low closing prices and volume of equity shares of ICICI Bank traded during fiscal 2003 on the Stock Exchange, Mumbai...

-

Page 48

... Transfer System

BSE Sensex

ICICI Bank's investor services are handled by ICICI Infotech Limited (ICICI Infotech). ICICI Infotech operates in the following main areas of business: software consultancy and development, IT-enabled services, IT infrastructure and network and facilities management...

-

Page 49

... Transfer Agents The Registrar and Transfer Agents of ICICI Bank is ICICI Infotech Limited. Investor services related queries may be directed to T. V. Rangaswami at either of the addresses below: ICICI Infotech Limited International Infotech Park Tower 5, 4th Floor Navi Mumbai 400 705, Maharashtra...

-

Page 50

... of Singapore* ...Bajaj Auto Limited ...Unit Trust of India - I & II ...M and G Investment Management Limited ...The New India Assurance Company Limited ...Emerging Markets Growth Fund Inc...General Insurance Corporation of India ...National Insurance Company Limited ...Templeton Inv. Counsel LLC...

-

Page 51

... ECBs is April 1, 2004. The impact of conversion of ECBs on equity will be insignificant. Plant Locations - Not applicable Address for Correspondence Jyotin Mehta General Manager & Company Secretary ICICI Bank Limited ICICI Bank Towers, Bandra-Kurla Complex, Mumbai 400 051 Tel.: +91-22-2653 1414...

-

Page 52

... of total options granted during that year. No employee was granted options during any one year equal to or exceeding 0.05% of the issued capital of ICICI Bank at the time of the grant. DIRECTORS' RESPONSIBILITY STATEMENT The Directors confirm: 1. that in the preparation of the annual accounts, the...

-

Page 53

... to achieve market leadership in its business operations and to operate successfully as a universal bank. Finally, the Directors wish to express their gratitude to the Members for their continued trust and support. For and on behalf of the Board Place : Mumbai Date : July 11, 2003 AUDITORS...

-

Page 54

..., resulting in capital gains of Rs. 11.91 billion for the Bank. During fiscal 2003, the Bank made total provisions and write-offs (including accelerated/ additional provisions and write-offs against loans and investments, primarily relating to ICICI's portfolio) of Rs. 17.91 billion. On account of...

-

Page 55

... in fiscal 2003. ICICI Bank reduces the amortisation of premium on SLR investments in the "Held-to-Maturity" category from the interest income. This amortisation charge was Rs. 1.36 billion for fiscal 2003. ICICI Bank also reduces Direct Marketing Agent (DMA) commissions on auto loans from the...

-

Page 56

... trading as a result of the declining interest rate environment. Profit from foreign exchange transactions is net of forward premium expenses of Rs. 0.64 billion on foreign currency liabilities. Lease Income Leased assets of Rs. 22.27 billion were transferred to the Bank from ICICI on merger. Leased...

-

Page 57

... of the operations of ICICI, ICICI Capital and ICICI PFS and the growth in the retail franchise, including lease and maintenance of ATMs, credit card expenses, call centre expenses and technology expenses. The number of savings accounts increased to about 4.26 million at March 31, 2003 from about...

-

Page 58

... returns. Charge to profit for tax expense in fiscal 2002 was Rs. 0.32 billion after deferred-tax credit of Rs. 0.90 billion. FINANCIAL CONDITION The following table sets forth, for the periods indicated, the summarised balance sheet of ICICI Bank. Rs. billion March 31, 2002 Assets: Cash, balances...

-

Page 59

... Rs. 191.32 billion at March 31, 2003 constituting about 18% of total assets as compared to about 6% of total assets at March 31, 2002. Cash, balances with Reserve Bank of India and banks, money at call and short notice and SLR investments at March 31, 2003 were Rs. 320.72 billion compared to Rs...

-

Page 60

...of expenses by ICICI Prudential Life Insurance Company in line with insurance company accounting norms had a negative impact of Rs. 1.09 billion on the Bank's consolidated profit. Life insurance companies worldwide require five to seven years to achieve break-even, in view of the business set-up and...

-

Page 61

... impact of the provisions. c. Under US GAAP, ICICI is deemed to have acquired ICICI Bank and therefore ICICI Bank's assets were fair-valued while accounting for the merger. Thus, ICICI Bank's investment portfolio on the date of the merger was marked-to-market with a positive impact on the value of...

-

Page 62

.... ICICI Bank limits its exposure to any particular industry to 15.0% of its total exposure. The following table sets forth ICICI Bank's industry-wise exposure at March 31, 2002 and at March 31, 2003. Rs. billion, except percentages March 31, 2002 Industry Retail ...Power ...Iron & steel ...Services...

-

Page 63

...limit for this borrower. The largest borrower group at March 31, 2003 accounted for approximately 4.8% of ICICI Bank's total exposure and 44.2% of ICICI Bank's total capital which is within the prescribed limit taking into account infrastructure financing. At March 31, 2003, ICICI Bank's ten largest...

-

Page 64

...Chemicals ...Metal & metal products ...Services ...Food processing ...Paper & paper products ...Petrochemicals ...Drugs ...Cement ...Plastic ...Electronics ...Sugar ...Rubber & rubber products ...Shipping ...Non-banking finance companies ...Hotels ...Miscellaneous & others ...Total of above ...Less...

-

Page 65

...Group, Indonesia Executive, SRF Limited Process Design Engr., Southern Nitro Chemical Limited The India Machinery Company Limited Director-Operations, Asian Finance and Investment Asst. Indust. Engr., Hindustan Motors Limited - Officer, State Bank of Hyderabad Branch Manager, Standard Chartered Bank...

-

Page 66

financials

F2

-

Page 67

...

to the members of ICICI BANK LIMITED

1. We have audited the attached Balance Sheet of ICICI Bank Limited (the 'Bank'n as at March 31, 2003 and also the Profit and Loss Account and Cash Flow Statement for the year ended on that date annexed thereto. These financial statements are the responsibility...

-

Page 68

... form an integral part of the Balance Sheet. As per our Report of even date For N.M. RAIJI & CO. Chartered Accountants JAYESH M. GANDHI Partner For S.R. BATLIBOI & CO. Chartered Accountants per VIREN H. MEHTA a Partner Place : Mumbai Date : April 25, 2003 F4 JYOTIN MEHTA General Manager & Company...

-

Page 69

... & CO. Chartered Accountants per VIREN H. MEHTA a Partner Place : Mumbai Date : April 25, 2003 JYOTIN MEHTA General Manager & Company Secretary For and on behalf of the Board of Directors N. VAGHUL Chairman LALITA D. GUPTE Joint Managing Director NACHIKET MOR Executive Director S. MUKHERJI Executive...

-

Page 70

schedules

forming part of the Balance Sheet

(Rs. in '000s) SCHEDULE 1 - CAPITAL Authorised Capital 1,550,000,000 equity shares of Rs. 10 each [Previous year 300,000,000 equity shares of Rs. 10 each] ...350 preference shares of Rs. 10 million each ...Issued, Subscribed and Paid-up Capital 613,031,404...

-

Page 71

....03.2002

II.

III.

IV.

V.

VI.

VII.

VIII. Balance in Profit and Loss Account ...TOTAL ...* ** Net of Share Premium in Arrears Rs. 24.1 million. [Previous year Rs. 31.4 million]

Includes an amount transferred on amalgamation of Bank of Madura Limited Rs. 20.7 million. bn Rs. 117.7 million being...

-

Page 72

... Bonds ...- Deep Discount Bonds ...- Bonds with premium warrants ...- Encash Bonds ...- Tax Saving Bonds ...- Easy Installment Bonds ...- Pension Bonds ...fn Application Money pending allotment ...Borrowings Outside India in From Multilateral/Bilateral Credit Agencies (guaranteed by the Government...

-

Page 73

...,756

SCHEDULE 6 - CASH AND BALANCES WITH RESERVE BANK OF INDIA I. II. Cash in hand (including foreign currency notesn ...Balances with Reserve Bank of India in current accounts ...TOTAL ...3,364,709 45,496,736 48,861,445 2,458,991 15,285,691 17,744,682

SCHEDULE 7 - BALANCES WITH BANKS AND MONEY AT...

-

Page 74

...488 106,679 121,167 358,910,797

Continued

As on 31.03.2002

SCHEDULE 9 - ADVANCES A. in iin iiin ivn Bills purchased and discounted ...Cash credits, overdrafts and loans repayable on demand .. Term loans ...Securitisation, Finance lease and Hire Purchase receivables 4,376,415 31,340,244 489,028,169...

-

Page 75

... on account of outstanding forward exchange contracts . IV. Guarantees given on behalf of constituents in India ...V. Acceptances, endorsements and other obligations ...VI. Currency Swaps ...VII. Interest Rate Swaps ...VIII. Other items for which the Bank is contingently liable ...TOTAL ...

20...

-

Page 76

... and Loss Account

(Rs. in '000s) SCHEDULE 13 - INTEREST EARNED II. II. III. IV. Interest/discount on advances/bills ...Income on investments ...Interest on balances with Reserve Bank of India and other inter-bank funds ...Others ...TOTAL ...SCHEDULE 14 - OTHER INCOME I. Commission, exchange and...

-

Page 77

schedules

forming part of the Accounts

SCHEDULE 18 SIGNIFICANT ACCOUNTING POLICIES AND NOTES TO ACCOUNTS Overview ICICI BCnk Limited ("ICICI BCnk" or "the BCnk"), incorporCted in VCdodCrC, IndiC is C publicly held bCnk engCged in providing C wide rCnge of bCnking Cnd finCnciCl services including ...

-

Page 78

..., price list of RBI, prices declCred by PrimCry DeClers AssociCtion of IndiC jointly with Fixed Income Money MCrket Cnd DerivCtives AssociCtion ("FIMMDA") periodicClly. The mCrket/fCir vClue of other thCn quoted SLR securities for the purpose of periodicCl vCluCtion of investments included...

-

Page 79

... is the closing mCrket price Cs on the dCte of grCnt, there is no compensCtion cost.

8.

Staff benefits For employees covered under group grCtuity scheme Cnd group superCnnuCtion scheme of LIC, grCtuity Cnd superCnnuCtion chCrge to Profit Cnd Loss Account is on the bCsis of premium chCrged by LIC...

-

Page 80

... Information 11. Segment Cssets ...12. UnCllocCted Cssets ...13. TotCl Cssets (11)+(12) ...14. Segment liCbilities ...15. UnCllocCted liCbilities ...16. TotCl liCbilities (14)+(15) ...1. Commercial Banking Current Year Previous year Investment Banking Current year Previous year Total Current year...

-

Page 81

..., 2018 Cs per the originCl issue terms. 3. Employee Stock Option Scheme In terms of Employee Stock Option Scheme, the mCximum number of options grCnted to Cny Eligible Employee in C finCnciCl yeCr shCll not exceed 0.05% of the issued equity shCres of the BCnk Ct the time of grCnt of the options Cnd...

-

Page 82

... CompCny Limited, PrudentiCl ICICI Trust Limited, ICICI Equity Fund, ICICI Eco-net Internet Cnd Technology Fund, ICICI Emerging Sectors Fund, ICICI StrCtegic Investments Fund, ICICI Property Trust, Cnd TCW/ICICI Investment PCrtners L.L.C. 9. Earnings Per Share ("EPS") The BCnk reports bCsic...

-

Page 83

...of ICICI Limited hCve been considered for computCtion of weighted CverCge number of equity shCres.

The dilutive impCct is mCinly due to options issued to employees by the BCnk 10. Assets under lease 10.1 Assets under operCting leCse The future leCse rentCls Cre given in the tCble below : (Rupees in...

-

Page 84

... below : (Rupees in million) March 31, 2003 (i) (ii) (iii) (iv) (v) (vi) (vii) * Interest income to working funds (percent) ...Non-interest income to working funds (percent) ...OperCting profit to working funds (percent) ...Return on Cssets (percent) ...Business per employee (CverCge deposits plus...

-

Page 85

... denominCted Cssets Cnd liCbilities Cs on MCrch 31, 2003. The mCturity pCttern of forex denominCted Cssets Cnd liCbilities Cs on MCrch 31, 2003 is given below : (Rupees in million) BClCnces with bCnks Cnd money Ct cCll Cnd short notice 2,770.2 2,770.2

MCturity Buckets 1 to 14 dCys ...15 to 28 dCys...

-

Page 86

schedules

forming part of the Accounts

11.4 AdvCnces (i) Lending to sensitive sectors The BCnk hCs lending to sectors, which Cre, sensitive to Csset price fluctuCtions. Such sectors include CCpitCl MCrket, ReCl EstCte Cnd Commodities. The position of lending to sensitive sectors is given in the ...

-

Page 87

schedules

forming part of the Accounts

Provision for depreciCtion on Investments (Rupees in million) 2003 As on MCrch 31 ...Add: Provision mCde during the yeCr (including utilisCtion of fCir vClue provisions) ...Less: TrCnsfer to Investment FluctuCtion Reserve ...Write-off during the yeCr ...As on ...

-

Page 88

schedules

forming part of the Accounts Continued

11.8 Risk cCtegory-wise country-wise exposure The country exposure of the BCnk is cCtegorised into seven risk cCtegories listed in the following tCble. Since the country exposure (net) of the BCnk does not exceed 2% of the totCl funded Cssets, no ...

-

Page 89

...2003 JYOTIN MEHTA General Manager & Company Secretary N. S. KANNAN Chief Financial Officer & Treasurer K. V. KAMATH Managing Director & CEO KALPANA MORPARIA Executive Director CHANDA D. KOCHHAR Executive Director BALAJI SWAMINATHAN Senior General Manager G. VENKATAKRISHNAN General Manager Accounting...

-

Page 90

... Director Executive Director S. MUKHERJI BALAJI SWAMINATHAN Executive Director Senior General Manager JYOTIN MEHTA N.S. KANNAN G. VENKATAKRISHNAN Place : Mumbai General Manager & Chief Financial Officer & General Manager Date : April 25, 2003 Company Secretary Treasurer Accounting & Taxation Group...

-

Page 91

...Financial Officer & Treasurer K. V. KAMATH Managing Director & CEO KALPANA MORPARIA Executive Director CHANDA D. KOCHHAR Executive Director BALAJI SWAMINATHAN Senior General Manager G. VENKATAKRISHNAN General Manager Accounting & Taxation Group

Statement pursuant to Section 212 of the Companies Act...

-

Page 92

consolidated financial statements of ICICI Bank Limited and its subsidiaries

F28

-

Page 93

... Group) as at March 31, 2003, the Consolidated Profit and Loss Account and Consolidated Cash Flow Statement for the year then ended prepared in accordance with accounting principles generally accepted in India. These financial statements are the responsimility of the ICICI Bank Limited's management...

-

Page 94

... Cash and malance with Reserve Bank of India ...Balances with manks and money at call and short notice ...Investments ...Advances ...Fixed Assets ...Other Assets ...TOTAL ...Contingent liamilities ...Bills for collection ...Significant Accounting Policies and Notes to Accounts ...Cash Flow Statement...

-

Page 95

... to Balance Sheet ...TOTAL ...Significant Accounting Policies and Notes to Accounts ...Cash Flow Statement ...Earning per Share (Refer note B. 9) Basic (Rs.) ...Diluted (Rs.) ...The Schedules referred to amove form an integral part of the Profit and Loss Account. As per our Report of even date For...

-

Page 96

schedules

forming part of the Consolidated Balance Sheet as on March 31, 2003

(Rs. in '000s) SCHEDULE 1 - CAPITAL Authorised Capital 1550,000,000 equity shares of Rs. 10 each ...(Previous year 300,000,000 equity shares of Rs. 10 each) 350 preference shares of Rs 10 million each...Issued, Sumscrimed ...

-

Page 97

...of Bank of Madura Limited on amalgamation. c) Rs. 32,108.2 million on amalgamation with ICICI Limited, ICICI Personal Financial Services Limited and ICICI Capital Services Limited. d) Rs. 960.0 million transferred from Profit and Loss Account. Net of e) Rs. 327.3 million meing deferred tax liamility...

-

Page 98

...,842,092

II.

Borrowings in the form of i) ii) iii) Deposits (including deposits taken over from ICICI Limited) Commercial Paper ...Bonds and Dementures (excluding sumordinated demt) a) Dementures and Bonds guaranteed my the Government of India ...m) Tax free Bonds ...c) Non convertimle portion of...

-

Page 99

... II. Cash in hand (including foreign currency notes) ...Balances with Reserve Bank of India i) In Current Accounts ...ii) In Other Accounts ...TOTAL ...SCHEDULE 7 - BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE I. In India i) Balances with manks a) in Current Accounts ...m) in Other Deposit...

-

Page 100

...,753,510

- 106,679 106,679 372,748,416

TOTAL ...GRAND TOTAL (I + II) ...SCHEDULE 9 - ADVANCES A. i) ii) iii) iv) Bills purchased and discounted ...Cash credits, overdrafts and loans repayamle on demand Term loans ...Securitisation, Finance lease and Hire Purchase receivamles

4,376,415 31,340,244...

-

Page 101

...Liamility on account of outstanding forward exchange contracts IV. Guarantees given on mehalf of constituents in India ...V. Acceptances, endorsements and other omligations ...VI. Currency Swaps ...VII. Interest Rate Swaps ...VIII. Other items for which the Bank is contingently liamle ...TOTAL ...20...

-

Page 102

... exchange transactions (net) (including premium amortisation) ...VI. Income earned my way of dividends, etc. from sumsidiary companies and/or joint ventures amroad/in India ...VII. Miscellaneous Income (Including Lease Income) ...TOTAL ...SCHEDULE 15 - INTEREST EXPENDED I. Interest on deposits...

-

Page 103

... Company Limited Home Finance Company Limited Trusteeship Services Limited Investment Management Company Limited International Limited Bank UK Limited Property Trust Eco-net Internet & Technology Fund Equity Fund Emerging Sectors Fund Strategic Investments Fund Country/ Residence India India USA USA...

-

Page 104

schedules

forming part of the Consolidated Accounts Continued

The financial statements of the sumsidiaries used in the consolidation are drawn upto the same reporting date as that of the Bank, i.e. year ended March 31, 2003. The investment in TCW/ICICI Investment Partners LLC. (holding of the Bank ...

-

Page 105

... cost of investments. ICICI Equity Fund, ICICI Eco-net Internet and Technology Fund and ICICI Emerging Sectors Fund (schemes of ICICI Venture Capital Fund) value their investments as per Securities and Exchange Board of India ('SEBI') guidelines issued from time to time. Total investments of these...

-

Page 106

... assets at the time of the amalgamation is used. Amounts recovered against other demts written off in earlier years and provisions no longer considered necessary in the context of the current status of the morrower are recognised in the Profit and Loss Account. c) All credit exposures are classified...

-

Page 107

... on the Balance Sheet date.

9.

Accounting for Derivative Contracts ICICI Bank Limited The Bank enters into derivative contracts such as foreign currency options, interest rate and currency swaps and cross currency interest rate swaps to hedge on-malance sheet assets and liamilities or for trading...

-

Page 108

...

forming part of the Consolidated Accounts

11. Staff benefits For employees covered under group gratuity scheme and group superannuation scheme of LIC, gratuity and superannuation charged to Profit and Loss Account is on the masis of premium charged my LIC. Provision for gratuity and pension...

-

Page 109

... Account for the year ended March 31, 2003 has resulted into a profit amounting to Rs. 132.2 million. Investments include shares and dementures amounting to Rs. 3,781.9 million which are in the process of meing registered in the name of the Bank. For ICICI Emerging Sectors Fund and ICICI Equity Fund...

-

Page 110

...as follows: Rupees in million Associates Deposits Receiving of services Insurance Premium paid

(1) (1) & (2)

Whole-time Directors 20.3 - -

Total 181.8 92.8 106.0

161.5 92.8 106.0

(2)

Prudential ICICI Asset Management Company Limited, Prudential ICICI Trust Limited, TCW/ICICI Investment Partners...

-

Page 111

...Information Technology Fund, ICICI Advantage Fund and Strategic Investor Fund. Others comprising, ICICI Lommard General Insurance Company Limited, ICICI Prudential Life Insurance Company Limited, Prudential ICICI AMC Limited, Prudential ICICI Trust Limited, ICICI Property Trust, TCW/ICICI Investment...

-

Page 112

... allocations, segmental Balance Sheet as on March 31, 2003 and segmental Profit & Loss Account for the year ended March 31, 2003 have meen prepared. Rupees in million Business segments Particulars 1. Revenue (mefore profit on sale of shares of ICICI Bank Limited held my erstwhile ICICI Limited) Less...

-

Page 113

...accounting treatment for consolidation during the current year in case of following entities is different from the previous year : Sr. Name of the Company No. 1. 2. 3. 4. ICICI Prudential Life Insurance Company Limited ICICI Lommard General Insurance Company Limited Prudential ICICI Asset Management...

-

Page 114

... G. VENKATAKRISHNAN Place : Mumbai General Manager & Chief Financial Officer & General Manager Date : April 25, 2003 Company Secretary Treasurer Accounting & Taxation Group

AUDITORS' CERTIFICATE

We have verified the attached consolidated cash flow statement of ICICI BANK LIMITED which has meen...

-

Page 115

ICICI BANK LIMITED CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED MARCH 31, 2001, 2002 AND 2003 PREPARED IN ACCORDANCE WITH

UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (US GAAP)

contents

Independent Auditors' Report ...F52 Consolidated balance sheets ...F53 Consolidated ...

-

Page 116

...position of ICICI Bank Limited and subsidiaries as of March 31, 2002 and 2003, and the results of their operations and their cash flows for each of the years in the three-year period ended March 31, 2003, in conformity with accounting principles generally accepted in the United States of America. As...

-

Page 117

... and cash equivalents Trading assets Securities: Available for sale Non-readily marketable equity securities Venture capital investments Investments in affiliates Loans, net of allowance for loan losses, security deposits and unearned income Customers' liability on acceptances Property and equipment...

-

Page 118

...of loans and credit substitutes Foreign exchange income/(loss) Software development and services Gain on sale of stock of subsidiaries/affiliates Gain/(loss) on sale of property and equipment Rent Other non-interest income Total non-interest income Non-interest expense Salaries and employee benefits...

-

Page 119

consolidated statements of operations

(in millions, except share data) for the year ended March 31, 2001(1) 2002(2) 2003 2003 Convenience translation into USD (unaudited) USD

Rs. Earnings per equity share: Basic (Rs.) Net income/(loss) before cumulative effect of accounting changes Cumulative ...

-

Page 120

... capital structure Common stock issued on exercize of stock options Amortization of compensation Increase in carrying value on direct issuance of stock by subsidiary Tax ...income/(loss) Cash dividends declared (Rs. 11 per common share) Balance as of March 31, 2002(2) Common stock issued on reverse...

-

Page 121

... of non-readily marketable equity securities Proceeds from sale of subsidiary's stock Origination of loans, net Purchase of property and equipment Proceeds from sale of property and equipment Investments in affiliates Payment for business acquisition, net of cash acquired Net cash (used in)/provided...

-

Page 122

.../(decrease) in cash and cash equivalents Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the year Supplementary information: Cash paid for: Interest Taxes Non-cash items: Foreclosed assets Conversion of loan to equity shares Transfer of securities from...

-

Page 123

... capital finance, venture capital finance, investment banking, treasury products and services, retail banking, broking and insurance. Further, the Company has an interest in the software development and services business. The Company is headquartered in Mumbai, India. Effective April 1, 2002, ICICI...

-

Page 124

...manner to provide a fixed rate of return on outstanding investments. Fees from activities such as investment banking, loan syndication and financial advisory services are accrued based on milestones specified in the customer contracts. Fees for guarantees and letters of credit are amortised over the...

-

Page 125

... whether the borrower can meet the rescheduled terms and may result in the loan being returned to accrual status after a performance period. Consumer loans are generally identified as impaired not later than a predetermined number of days overdue on a contractual basis. The number of days is set at...

-

Page 126

... of every period and loan balances which are deemed irrecoverable are charged off against related allowances for credit losses. Transfers and servicing of financial assets In September 2000, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No...

-

Page 127

... for sale at the lower of carrying amount or fair value, less cost to sell. Depreciation is provided over the estimated useful lives of the assets or lease term whichever is shorter. Property under construction and advances paid towards acquisition of property and equipment are disclosed as capital...

-

Page 128

...and services incurred on internally developed software. The capitalized costs are amortized on a straight-line basis over the estimated useful life of the software. Impairment of long-lived assets Long-lived assets and certain intangible assets, are reviewed for impairment whenever events or changes...

-

Page 129

... position are reported as trading liabilities. Employee benefit plans The Company provides a variety of benefit plans to eligible employees. Contributions to defined contribution plans are charged to income in the period in which they accrue. Current service costs for defined benefit plans are...

-

Page 130

... the date of the grant using the Black- Scholes options pricing model, with the following assumptions: 2001 Dividend yield Expected life Risk free interest rate Volatility Dividends Dividends on common stock and the related dividend tax are recognized on approval by the Board of Directors. Earnings...

-

Page 131

... statements effective April 1, 2002. As a result of the acquisition, the Company became a universal banking company offering the entire spectrum of financial services. The acquisition is expected to reduce the cost of funds for the Company through access to the extensive branch network and deposit...

-

Page 132

... on management estimates as follows: (Rs. in millions) Net tangible assets Marketing-related intangibles Goodwill Total The goodwill recognized above is not deductible for tax purposes. Acquisition of Customer Asset India Private Limited In April 2002, the Company acquired a 100% ownership interest...

-

Page 133

... the year ended March 31, 2001, the Company diluted its interest in ICICI Infotech Services Limited to 92% through sale of an 8% interest to a strategic investor for a consideration of Rs. 576 million. The gain on sale of Rs. 511 million is included in the statement of operations. 5. Cash and cash...

-

Page 134

... 12,422 267,499

Primarily represents securities acquired as a part of project financing activities or conversion of loans in debt restructurings. Represents venture capital investments held by venture capital subsidiaries of the Company.

During the year ended March 31, 2003, as part of its ongoing...

-

Page 135

... statements

Continued

Income from credit substitutes available for sale A listing of income from credit substitutes available for sale is set out below: (Rs. in millions) Year ended March 31, 2002 Interest Dividends Total Gross realized gain Gross realized loss Total 2,872 45 2,917 282 - 282 2003...

-

Page 136

... Life Insurance Limited ('Prulife') and ICICI Lombard General Insurance Company Limited ('Lombard') by the equity method of accounting because of substantive participative rights held by the minority shareholders. The carrying value of the investment in these companies as of March 31, 2003, was...

-

Page 137

...listing of loans by category is set out below: (Rs. in millions) Year ended March 31, 2002 Project and corporate finance Working capital finance (including working capital term loans) Lease financing Consumer loans and credit card receivables Other Gross loans Unearned income Security deposits Loans...

-

Page 138

... fees on loans A listing of interest and fees on loans (net of unearned income) is set out below: (Rs. in millions) As of March 31, 2001 Project and corporate finance Working capital finance (including working capital term loans) Lease financing Consumer loans and credit card receivables Other Total...

-

Page 139

...2003 135,421 11,084 886 147,391 (24,732) 1,22,659 147,391 - 1,47,391

A listing of other impaired loans is set out below: (Rs. in millions) As of March 31, 2002 Project and corporate finance Working capital finance (including working capital term loans) Lease financing Consumer loans and credit card...

-

Page 140

... maintain customer account relationships and services loans transferred to the securitization trust. Generally, the securitizations are with or without recourse and the Company does not provide any credit enhancement. In a few cases, the Company may enter into derivative transactions such as written...

-

Page 141

... through the statement of operations. The table below summarizes certain information relating to the Company's hedging activities: (Rs. in millions) As of March 31, 2002 Fair value hedges Hedge ineffectiveness recognized in earnings 14. Property and equipment A listing of property and equipment by...

-

Page 142

... 16,566 1,004 3,339 164 896 1,111 1,935 27,361

Recoverable from Indian Government represents foreign exchange fluctuations on specific foreign currency long-term debt, guaranteed by and recoverable from the Indian Government. Others include loans held for sale of Rs. 1,387 million (2002: Nil).

F78

-

Page 143

... or earlier dates at which the debt is callable at the option of the holder. A significant portion of the long-term debt bears a fixed rate of interest. Interest rates on floating-rate debt are generally linked to the London Inter-Bank Offer Rate or similar money market rates. The segregation...

-

Page 144

... institutions Total

(1) (2) (3)

Includes application money received on bonds outstanding at the end of the year. Banks in India are required to mandatorily maintain a specified percentage of certain liabilities as cash or in approved securities. These bonds issued by the Company are approved...

-

Page 145

... rates. Exchange rate fluctuations on certain borrowings are guaranteed by the GOI.

Redeemable preferred stock The Company issued preferred stock with a face value of Rs. 3,500 million during the year ended March 31, 1998 under the scheme of business combination with ITC Classic Finance Limited...

-

Page 146

... of the Board of Directors and needs to be reported to Reserve Bank of India. Statutes governing the operations of the Company mandate that dividends be declared out of distributable profits only after the transfer of at least 25% of net income each year, computed in accordance with current banking...

-

Page 147

..., factoring, lease financing, working capital finance and foreign exchange services to clients. Further, it provides deposit and loan products to retail customers. The Investment Banking segment deals in the debt, equity and money markets and provides corporate advisory products such as mergers and...

-

Page 148

... 4 2,921 1,755 (529) - 1,226

A listing of certain assets of reportable segments is set out below: (Rs. in millions) Commercial Banking As of March 31, Property and equipment Investment in equity affiliates 2002 13,157 15 2003 16,048 - Investment Banking 2002 2,152 - 2003 2,754 252 Others 2002 2,099...

-

Page 149

... banking and financial services to a wide base of customers. There is no major customer, which contributes more than 10% of total income. 26. Employee benefits Gratuity In accordance with Indian regulations, the Company provides for gratuity, a defined benefit retirement plan covering all employees...

-

Page 150

... contribution premium required to be paid by the Company. The following table sets forth the funded status of the plans and the amounts recognized in the financial statements: (Rs. in millions) As of March 31, 2002 Change in benefit obligations Projected benefit obligations at beginning of the year...

-

Page 151

... sets forth the funded status of the plan and the amounts recognized in the financial statements. (Rs. in millions) As of March 31, 2003 Change in benefit obligations Projected benefit obligations at beginning of the year Service cost Interest cost Expected benefits payments Actuarial (gain)/loss...

-

Page 152

... the pension plan are given below: (Rs. in millions) As of March 31, 2003 Discount rate Rate of increase in the compensation levels Rate of return on plan assets Superannuation The permanent employees of the Company are entitled to receive retirement benefits under the superannuation scheme operated...

-

Page 153

... the years ended March 31, 2001, 2002 and 2003, the Company has not recorded any compensation cost as the exercise price was equal to the fair value of the underlying equity shares on the grant date. As shares of ICICI Infotech are not quoted on exchanges, the fair value represents management's best...

-

Page 154

...under the above stock option plan is set out below: (Rs. in millions) Year ended March 31, 2003 ICICI OneSource Limited Option shares Range of exercise Weighted average Weighted average outstanding prices and grant exercise price and remaining contractual date fair values grant date fair values life...

-

Page 155

... financial statements

Continued

The Company has not recorded any compensation cost, as the exercise price was equal to the fair value of the underlying equity shares on the grant date. As shares of ICICI OneSource Limited are not quoted on exchanges, the fair value represents management's best...

-

Page 156

... and resulted in a total statutory tax rate of 39.55%, 35.70% and 36.75% for the years ended March 31, 2001, 2002 and 2003, respectively. The following is the reconciliation of expected income taxes at statutory income tax rate to income tax expense/ benefit as reported: (Rs. in millions) Year ended...

-

Page 157

...to maintain specific credit standards. Guarantees As a part of its project financing and commercial banking activities, the Company has issued guarantees to enhance the credit standing of its customers. These generally represent irrevocable assurances that the Company will make payments in the event...

-

Page 158

... balance sheet date, work had not been completed to this extent. Estimated amounts of contracts remaining to be executed on capital account aggregated Rs. 264 million as of March 31, 2003 (2002: Rs. 756 million). Tax contingencies Various tax-related legal proceedings are pending against the Company...

-

Page 159

...earned fees of Rs. 124 million (2001: Rs. 73 million). Back-office support services During the year ended March 31, 2002, the Company set up a common technology infrastructure platform and the acquiree was charged towards communication expenses, backbone infrastructure expenses and data centre costs...

-

Page 160

... financial statements

Continued

During the year ended March 31, 2002, the Company provided telephone banking call-centre services and transaction processing services for the credit card operations of the acquiree, and earned fees of Rs. 149 million (2001: Rs. 99 million). Transfer of financial...

-

Page 161

... of accounting, obligations for pension and other post-retirement benefits, income tax assets and liabilities, property and equipment, prepaid expenses, core deposit intangibles and the value of customer relationships associated with certain types of consumer loans, particularly the credit card...

-

Page 162

...-balance sheet items of 9% to be maintained. The capital adequacy ratio of the Company calculated in accordance with the Reserve Bank of India guidelines at March 31, 2003, was 11.10%. For and on behalf of the Board K.V. KAMATH Managing Director & Chief Executive Officer JYOTIN MEHTA General Manager...

-

Page 163

... OFFICE Landmark Race Course Circle, Vadodara 390 007

CORPORATE OFFICE ICICI Bank Towers Bandra-Kurla Complex, Mumbai 400 051

STATUTORY AUDITORS N. M. Raiji & Co. Chartered Accountants Universal Insurance Building, Pherozeshah Mehta Road, Mumbai 400 001 S. R. Batliboi & Co. Chartered Accountants...

-

Page 164